ROI: Crossing the street blindfolded?

No matter where I lecture around the country, I find that one question keeps coming up from dentists in all quarters, whether they’re buying a practice or equipment, hiring staff, or even enrolling in comprehensive CE. That question is, “How do I know the value of this investment, and will I get a return on it?”

We often embark on new investments as though we were blindfolded. If we purchase new equipment for $80,000, we may be tempted to say to ourselves, “I think I’ll eventually generate $80,000 in production from it, so I’ll recoup my investment someday ... maybe.” That’s not a sound business principle. When we don’t know how to properly measure a return on an investment, we feel out of control. It’s time to take off the blindfold and open our eyes.

A common investment is the purchase of a new computer system. Here’s how to calculate the ROI:

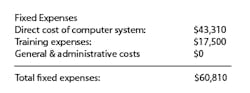

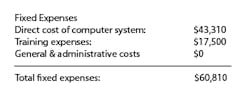

Determine your fixed expenses

Fixed expenses include the direct cost of the purchase, plus the cost of any training, as well as general and administrative costs involved in implementing the new system in your office. In our example, let’s assume we have new equipment and training costs, indicated below, and negligible general and administrative costs, for a total fixed expense of $60,810.

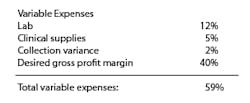

Determine your variable expenses

Above and beyond the fixed expenses are variable expenses associated with increased production needed to generate a return. These include the following:

The collection variance assumes the cost for not collecting 100 percent of production. In our example, we assume you are collecting at our range norm of 98 percent, so the loss of 2 percent is a variable expense. We also advise dentists to include a gross profit margin, minimally of 25 to 40 percent. If you don’t expect a gross profit margin, there will be no return.

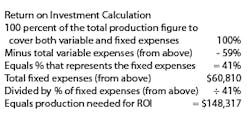

Determine your ROI

Now that you know the expenses associated with your computer purchase, it’s time to calculate the ROI:

To have a return on your initial investment of $60,810, you will need to generate $148,317 in additional production. Now that you have a statistical interpretation of success, you can analyze your investment. Ask yourself:

1Is this $148,317 in additional production feasible to accomplish in one year? Two years? Ever? Not every investment brings a monetary return. Some may simply enhance your practice environment. This is fine, but still calculate the ROI to make an informed decision.

2How will the new investment support the increase in production? Will the investment directly increase production? Your new computer system may increase production through efficient scheduling, time-saving digital X-rays, faster information-recording, improved relationship with patients, treatment acceptance, and clinical efficiency.

3 What systems or behavior changes need to occur to reach the ROI? It’s people who make results happen and reap rewards, not the purchase by itself. Prioritize with your staff the changes which need to be implemented to ultimately get a return on investment.

Amy Morgan is chief executive officer and lead trainer of Pride Institute, a national dental-management company which provides consulting services, educational seminars, patient charting, and staff training materials. To ask Amy a question for this column, visit “Ask Pride” at www.prideinstitute.com or call Pride Institute toll-free at (800) 925-2600.