Fee Fights and How to Forget Them!

by Dale E. Wagman, DDS

If you've been in practice longer than a minute, you've heard the little man on your right shoulder whisper, "Hey, costs are going up. We gotta raise the fees!"

You've heard the guy on the other shoulder reply, "Wait. If we raise the fees, the patients are going to get angry and go somewhere else."

Then, "Yeah, but if we don't raise 'em, we'll go out of business."

"OK, but how much are we going to raise them?"

"I don't know — the usual or the same amount everybody else is raising theirs ... or whatever ... the CPI or something like that."

If you listen to these two guys long enough, they'll drive you nuts! And, the worst part is that they are both correct.

Despite what they tell us about the economy as a whole, inflation is not dead in the dental business. Expenses are going up; wages, supply bills, equipment costs, rents, the entire lot.

Fortunately, so is the production in the average dental practice. You may indeed have to raise your fees, but the questions are: When do you do it? How much? And which individual fees do you raise? It might not be necessary to raise them all, thereby setting off the "high-price alarm bells" ringing in your patients' heads.

Needs-based fee raising

Many dentists have a magical number in their heads that they use to calculate a fee raise — 10 percent or the CPI or some other number that may or may not have any significance to their particular situation. That's no way to run a business! In this tight market, you need to be more specific.

Luckily, you can stop the two guys from fighting, decide whether or not you do need to increase your fees, get an exact number for just how much, which is both justifiable and defensible, and get a pretty good feeling for exactly which fees you need to raise, all with one simple formula: a/b=x/y.

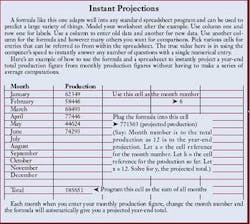

Many readers will recognize this formula as the proporportionality or ratio formula. (Hint: When you read it say, a is to b as x is to y.) Once you learn to use it, you will find this formula to be one of the most useful business tools you will ever have. Let's learn how to use it to raise fees.

Suppose that in the year 2001, your net collections were $750,249 and your expenses were $564,000. Say that in 2002 your expenses jumped to $575,228. On first glance, you might assume that your expenses had jumped up by 4.7 percent. But what if your net collections had risen to $775,347? Laboratory bills, supply bills, and many salary expenses are directly related to how much business you do. Unless you have a means of comparing, you wouldn't know if the increase in expenses was the result of an actual increase in costs or a result of your increased revenue. This formula is the answer.

Let's plug in the numbers:

Let a = $750,249 (your 2001 collections).

Let b = $564,000 (your 2001 expenses).

Let x = $775,347 (your 2002 collections).

Let y = the projected expenses for 2002.

The equation now looks like this:

750249 divided by 564000 = 775347 divided by y

To solve for y, cross-multiply: 750249y = 43729570800

Then divide: a43729570800/750249

y = 582867

The equation shows us that your projected expenses should have been $582,867. So, even though it might seem like expenses have gone up, because you're writing a bigger check, in this example they were actually $7,639 less than they should have been based on the increase in business. Your expenses actually went down by 1.3 percent. Should you raise your fees in this case?

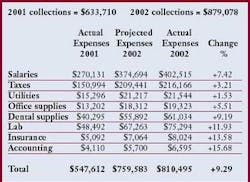

Take a look at the more detailed example below. Set up a form like this one and plug in the numbers from your own office. Use the formula to compute the projected expenses, and then subtract the projected expenses from the actual expenses for the new year. Compute either the positive or negative percent changes in the last column. The percentage is how much more or how much less you actually spent, compared to what you would have expected to spend, given any change in revenue you may have had. If all of the numbers are positive, like in the example, it might indeed be time for a fee increase.

In this example, which is just a sampling of some of the costs associated with running a dental office, we see that, overall, expenses have increased 9.29 percent above what would have been expected given the increase in collections. Certainly, this would point toward a need to increase fees in 2003 to compensate.

You could use the 9.3 figure as a blanket number for a raise, or you could use the formula to be more specific, and raise individual fees by an amount that more accurately represents the costs actually associated with those procedures. A 1.53 percent increase in utility costs, for example, gets distributed over every procedure you perform. An 11.93 percent increase in laboratory costs over what would have been expected is directly associated with only those procedures that carry a lab expense, like crown and bridge or prosthetics. You might want to raise your crown fees more than you do your exam fees, thereby satisfying both of the little men fighting in your head.

This form will give you a handy tool to examine other aspects of your business as well. For example, why did the insurance rates jump up so much? Why were your accounting fees so much higher than what would have been predicted? Those numbers should have remained the same. At the very least, they should have risen no more than you would have predicted given the increase in revenue. It might be time to make a couple of phone calls and ask for explanations. While you're at it, take a close look at your laboratory bills. Did you do more laboratory-related procedures to get the increase in collections? That might be a good number to start tracking. It will help you to get a handle on the nature of your practice and allow you to monitor the cost of dealing with one laboratory over another. Keep an eye on the supply bills too. Sometimes costs rise subtly over time, without you noticing. If your actual costs jump a significant amount above your projected costs, you might want to re-examine your relationship with your supplier as well.

Dentists are constantly under attack from the business world: "You guys are great clinicians, but you make lousy businessmen," they say.

Stick a weapon like this formula in your holster, and they'll at least have to smile the next time they say that!