Entity choice: Opportunities and traps

This is the first of a two-part article that discusses entity choice and maintenance for the practice and real estate entities. The first part deals with liability protection, entity formation, entity maintenance, and dissolution.

There are five entities, plus some hybrids, for practice and related entity operation. They are sole proprietorships, C corporations, S corporations, limited or professional limited liability companies (LLCs), and general partnerships (partnerships).

Liability protection

While a sole proprietorship is the simplest entity form, it offers no liability protection, absent insurance. A partnership also offers no liability protection absent insurance. If two or more dentists practice together without forming any other entity, they are a partnership by default and partners are jointly and severally liable for the acts of other partners. Thus, because LLCs can elect to be taxed as either a partnership or other entity, it makes sense to maintain the liability protection afforded to an LLC rather than a partnership, except in those few states where dentists are not permitted to practice through LLCs.

How can operating as a sole proprietorship or partnership insulate a dentist against liability? The dentist should consider carrying an umbrella insurance policy that effectively insures the dentist and practice against what the dentist wants to insure. In addition, the dentist should consider carrying an employment practices liability insurance policy.

Most of all, the dentist, with the practice as the plan sponsor, should consider adopting and funding a tax-qualified retirement plan, (e.g., a safe harbor 401(k) profit-sharing plan for younger doctors) or a defined benefit or cash balance plan for older doctors who have not saved to contribute more. Unlike SIMPLE plans and IRAs, tax-qualified plans are absolutely creditor proof, except for child support orders and federal tax liens, provided that the owner is not the only participant in the plan.

S corporations, LLCs, and C corporations do offer liability protection, except for alleged or actual malpractice. The decision to form an S corporation, LLC, or C corporation versus a sole proprietorship or partnership should be based on two criteria. First, the greater the number of employees in the practice or other entity, the greater the need to consider an entity that provides liability protection. Second, if there is more than one dentist in the practice, it is essential to consider operating in an entity that provides liability protection. While a dentist is always liable for his or her own acts, an entity that provides liability protection protects the practice owners from the acts of other partners and dentists and, hopefully, from claims of practice employees against the practice owners.

However, practicing through or forming a C corporation is a bad choice because of the double tax on distributions on the sale of the practice. Even though the C corporation tax rate is reduced from 35% to 20%,1 it is still better to practice as an S corporation rather than pay 20% plus the ordinary income rate. Sale of practice proceeds are taxed twice, unless the practice can successfully show and prove2 that the largest portion of the practice sale—goodwill—is personal and taxed at one level.3 If the practice is organized as a C corporation and the owner plans to practice at least 10 more years, consider converting to an S corporation. The 10-year period treats the newly elected S corporation as a C corporation.4Entity formation

In forming an S or C corporation for the practice, articles of incorporation are prepared and filed with the secretary of state. Each state has different filing requirements. Simultaneous with filing the articles, the shareholder makes an initial capital contribution into a bank account,(e.g., $500 or $1,000). The corporation will also be required to name a statutory or registered agent. After the entity formation is approved by the state, proceedings of the incorporator and a code of regulations (or policies that follow state law regarding the corporation’s operations) are prepared. In addition, shareholder and director minutes and a share journal and share ledger are prepared. Finally, share certificates are issued to each of the shareholders.

In forming an LLC, articles of organization are prepared and filed with the secretary of state, and the initial capital contribution is made, along with naming the statutory or registered agent. Thereafter, a single or multimember operating agreement is prepared. Membership certificates are issued evidencing ownership. For multimember LLCs, it is preferred they prepare and maintain a company record book. While LLCs have been touted as having the liability protection afforded to corporations without maintaining corporate formalities, oftentimes membership interests are sold or gifted, (particularly where real estate is involved e.g., gifts to children). In such cases, maintaining up-to-date records of ownership is imperative.

Entity maintenance

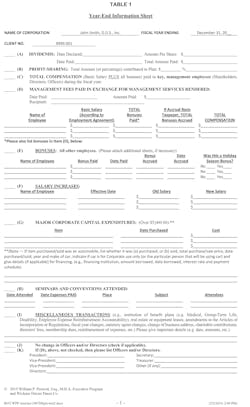

It is not enough to form an S or C corporation. In all states, the corporate entity must “look and act” like a corporation to ensure liability protection is present. Corporate formalities are maintained through preparation of annual shareholder and director minutes. The minutes provide that the shareholders elect directors and the directors elect officers. Minutes delineating the significant corporate activities that the S or C corporation takes each year are included in the corporation’s record book. The record book is usually retained and maintained by the client’s law firm so that minutes are up-to-date. A year-end information sheet should be sent to each client and his or her respective CPA ahead of the taxable year-end for completion. Table 1 is an example of a year-end information sheet.

Entity dissolution

Once the practice is sold in a complete sale, the practice is eventually dissolved. For example, if a practice is sold and accounts receivable are collected for some period of time following closing and, after all outstanding payables are paid, the retirement plan is terminated with assets being rolled into an IRA, and the corporation or LLC is formally dissolved under the applicable state law. If there is a surviving or remaining owner where there is more than one owner, the practice entity continues under the same tax identification number.

Summary

While I have encountered many very successful sole proprietors as practice owners through the years, my recommendation is to practice as a separate entity that provides liability protection, not for alleged or actual malpractice, but for acts of third parties, (e.g., employees).

References

1. 2017 Tax Cuts and Jobs Act. Pub.L. 115–97.

2. Kennedy v. Commissioner, T.C. Memo. 2010-206.

3. Prescott WP. The current status of personal goodwill. Dent Econ. 2016;106(10):54,56.

4. Internal Revenue Code Section 1374.

WILLIAM P. PRESCOTT, ESQ., MBA, of Wickens Herzer Panza in Avon, Ohio, is a practice transition and tax attorney and former dental equipment and supply general manager and representative. His most recent book is titled Joining And Leaving the Dental Practice, third edition, available through the ADA Center for Professional Success. ADA members can download the e-book for free at success.ada.org/en/practice-management/ joining-and-leaving-the-dental-practice. For this and Mr. Prescott’s other publications, see prescottdentalLaw.com. Mr. Prescott can be contacted at (440) 6958067 or wp[email protected].