A Wall Street View of the Dental Industry - Fall 2006 Dental Office Survey

As many of you already know, it’s a great time to be a dentist. What you may not realize is that it’s also a great time to be a dental investor. According to the Robert W. Baird Dental Index, a dental stock index we calculate using market-cap weighted returns from companies including Henry Schein, Patterson Companies, Dentsply, Sirona/Schick Technologies, Align Technologies, Young Innovations, Biolase Technology, and (prior to their acquisition by Danaher) Sybron Dental Specialties, the dental industry nicely outperformed the S&P 500 through the first nine months of 2006, rising 11 percent vs. the S&P’s 7 percent. Even more impressive is the performance of the Robert W. Baird Dental Index the past five years (ending Sept. 2006), during which time it returned nearly five times the market.

So what has driven this healthy stock performance over the past five years? Part of the answer has to do with volatility in other parts of the stock market. With the tech bubble bursting in 2001 and many health care areas - big cap pharma, cardiology, orthopedics - facing growing reimbursement pressures, the defensive nature of the dental industry has provided a safe haven for many investors.

More importantly, however, we believe much of the strength in dental stocks has been driven by growing recognition from investors that the dental industry is healthy and - dare we say? - exciting. Patient flow is solid, demand for high-priced/high-margin esthetic treatments continues to grow, and interest in advanced technology products (think digital X-ray, practice-management software, etc.) is increasing. And with a number of favorable industry dynamics driving demand for dental services, including aging Baby Boomers, international rising levels of dental care, a growing link between oral health and overall health, expanding insurance coverage, and increasing demand for specialty treatments, investors have reason to believe the dental market can remain exciting.

In an attempt to quantify these healthy industry trends for Dental Economics® readers, we recently conducted a survey of 735 DE® subscribers during September and October. Survey questions asked dental practitioners about their purchasing intent regarding basic equipment, chairside CAD/CAM systems, and digital radiography. Practitioners were also asked about recent patient flow trends (and expectations for future demand), their attitude toward offshore lab services, and how they select distributors.

In these pages, we provide a summary of key findings. Thanks to all of you who took the time to help with this research initiative!

Basic Dental Operatory EquipmentDemand Expected to Moderate fromUnsustainable Levels, but Remain Healthy

A key focus of the survey was to assess dentists’ demand for basic operatory equipment (for example, chairs, lights, cabinetry). As Wall Street analysts who help institutional investors look at the industry from an investing standpoint, this question has been in the forefront with the heightened levels of basic equipment sales we have seen. Specifically, we have questioned the source of these heightened levels of basic equipment sales and whether this accelerated demand may have pulled forward sales from future years.

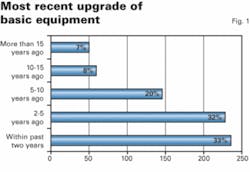

As shown in the first graph, survey results demonstrate the high level of investment in operatory equipment in recent years, as the majority of respondents (nearly two-thirds) indicated they updated their basic operatory equipment within the past five years, and one-third indicated they had done so within the past two years.

A number of factors are believed to have driven this heightened level of investment. First, many believe that strong equipment demand in recent years is related to a changing equipment purchasing paradigm; that dentists have increasingly invested in their offices in order to attract patients and employees, as well as increase the value of their practices. In the past, we believe equipment investments were primarily driven by replacement needs. Second, favorable tax depreciation incentives enacted by Congress for small business owners that were marketed by a number of distributors are believed to have helped equipment sales. Finally, we believe a strong new product cycle, including increasing integration of technology among basic equipment lines, has helped spur demand in recent years.

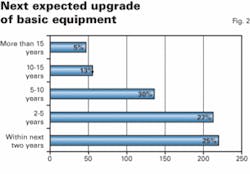

The second chart demonstrates that demand for basic operatory equipment is expected to moderate somewhat near-term. Only 25 percent of respondents indicated interest in updating their basic operatory equipment within the next two years, and nearly 60 percent indicated that their time horizon for updating is more like two to 10 years.

That said, near-term demand for basic operatory equipment was better than expected and demonstrates what we believe is a changed equipment purchasing paradigm and a contracting upgrade cycle. (Dental office investment cycles have historically been 10 to 15 years, but have been contracting in recent years). In our opinion, these survey results suggest a soft landing instead of a sharp fall-off in demand for basic equipment. This is the likely scenario after unsustainably high dental equipment growth in recent years, a situation that would be favorable for those invested in the industry.

Basic Equipment Investment Priorities

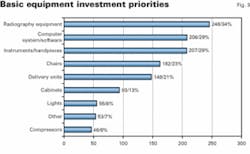

Survey participants were asked which type of operatory equipment was their highest priority for updating. As shown in Figure 3, demand for operatory equipment is fairly broad-based. However, interest is highest for the more advanced technology lines of equipment, including radiography (likely reflective of the conversion from film to digital), instruments/handpieces (likely the conversion from air-powered handpieces to electric and also likely reflective of a number of innovative new product launches), and computer systems/software (likely upgrades as nearly all dental offices currently use some type of dental practice management system).

Interest in Chairside CAD/CAMRestoration Systems

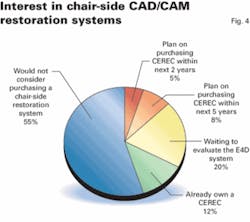

Results from the survey indicate that long-term demand for expensive CAD/CAM technology is fairly healthy. As shown in the chart below, more than 30 percent of respondents are considering the purchase of a chair side CAD/CAM system. Interestingly, two-thirds of those considering the system (~20 percent of all respondents) reported they are waiting to evaluate the E4D system before deciding to purchase a CEREC. The CEREC system is manufactured by Sirona (SIRO) and exclusively distributed in North America by the Patterson Companies (PDCO), while the E4D system is manufactured by privately-held D4D Technologies and will be distributed by Sullivan-Schein (HSIC).

The 12 percent of survey respondents who indicated they already own a CEREC points to a modest self-selection bias and a more technically adept DE reader base, as current U.S. penetration of CEREC is estimated by the Patterson Companies and Sirona Dental Systems to be 5 to 6 percent. Furthermore, survey results may be somewhat misleading as multiple answers were accepted and 44 respondents (out of 703) selected more than one answer. A final note on the CAD/CAM results: the 55 percent of respondents who have no interest in chairside CAD/CAM is not surprising, in our opinion, as this technology may not be cost-effective for all dental practices and specialties.

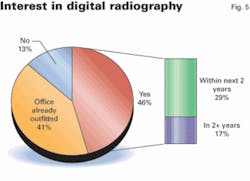

Interest in Digital Radiography

Survey results demonstrate that digital radiography remains one of the most highly sought after technologies in dentistry, and is one of the best investments, in our opinion. While most people in the industry appreciate the high level of interest in such technology, we believe the following chart helps illustrate the extent to which dentists are interested in this technology.

As shown, 29 percent of respondents reported plans to outfit their practice within the next two years, while 17 percent reported plans to outfit their practice but planned a longer time horizon. Given this popularity in digital radiography, we believe it should continue to be a strong driver of the industry’s equipment growth. Again, the survey does show a modest self-selection bias as current market penetration of digital radiography is estimated to be in the 25 percent range, while 41 percent of survey respondents currently utilize digital radiography per the survey.

Not Surprisingly, Dentists Have Healthy/Stable Outlook for Patient Traffic Flow

With most dentists carrying modest inventories and relying on regular shipments of consumable supplies from their distributors, sales of dental consumables tend to closely reflect the flow of patient traffic. Healthy and stable patient traffic flow in dental offices therefore becomes a very important metric for dental investors (consumable supplies account for roughly 70 percent of the $6 billion North American dental distribution market). We also believe a healthy outlook for patient traffic flow is an important metric for gauging expected demand for dental equipment as the more optimistic the dentist is regarding current/future trends, the more likely he/she will be to invest in his/her practice.

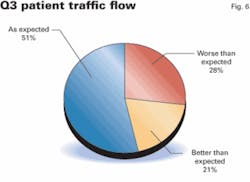

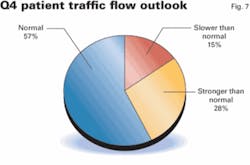

In the survey, we asked dentists to characterize their practice’s patient traffic flow during the past three months, and to provide their expectation for patient traffic flow over the coming three months (both relative to normal seasonality). Not unexpectedly, dental patient traffic remained healthy in Q3-06, with 72 percent of respondents reporting either “As Expected” or “Better Than Expected” patient traffic flow. Dentists generally have a healthy outlook for patient traffic flow in Q4-06, with 57 percent of respondents expecting a relatively normal level of patient traffic flow and 28 percent of respondents expecting “Stronger Than Normal” flow. Interestingly, nearly twice as many dental practitioners surveyed expect patient traffic flow to be “Stronger Than Normal” rather than “Slower Than Normal.”

Distribution Preferences and AttitudesTowards Offshore Lab Services

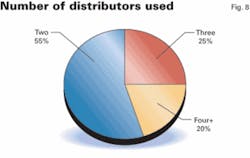

Dentists indicated using fewer distributors than we anticipated. We anticipated that the majority of respondents would use three, four, or more distributors, instead of just two. In Wall Street’s view, however, a more consolidated list of distributors among dental practitioners bodes well for full-service distributors that offer full product line-ups.

We also polled respondents to assess what characteristics dentists use to choose their distributors. As shown in the table below, customer service, reputation, and price were the most important characteristics, while customer loyalty programs were not a key factor.

On what basis do you choose your distributor? Please rank with 1 being the most important factor.

Our final question asked dentists whether they use an offshore dental lab service. As a background, offshore dental labs have grown in recent years and have taken some business from U.S. dental labs (primarily lower-tech, labor-intensive processes). Although most dentists indicated that they do not use an offshore dental lab service, which would be good for dental manufacturers, many dentists may not realize that part of their restorations may be manufactured at offshore labs as some dental labs outsource a portion of their production process to overseas labs.

Overall, we believe these survey results reflect what continues to be a healthy dental market and an attractive sector for investors. While a large number of dentists have invested heavily in equipment in recent years, we believe survey results demonstrate the potential for further growth in equipment sales as dentists increasingly invest in new equipment in order to improve the appeal of their office and incorporate advanced technology equipment systems that can potentially improve office efficiency/productivity. Furthermore, with dentists generally having a positive view on patient traffic, we believe both consumables and equipment purchases are likely to remain healthy.Suey Wong is the senior research analyst covering medical technology at Robert W. Baird & Co. He was named among the “Best on the Street” in The Wall Street Journal’s annual analyst survey for two consecutive years, ranking among the top five analysts in the medical products category. StarMine has rated Suey the second highest among analysts in the medical technology sector and has ranked him No. 1 for his stock-picking skills. Suey received a bachelor’s degree from the University of Wisconsin-Madison and an MBA from the University of Chicago.