Higher production helps offset chronic overhead increases

The 19th annual Dental Economics/Levin Group Annual Practice Survey unsurprisingly showed us that high overhead is not going away any time soon. And it also clearly demonstrated how a focus on production can offset those overhead increases, resulting in higher profit and an improved financial picture for many practices. Generally speaking, this year’s survey reflects a positive dental practice landscape, one that is no longer suffering any ill effects from the pandemic. It appears we have entered the new normal.

In addition to the useful and interesting data provided by this year’s respondents, we will again provide practical suggestions and specific recommendations to help you apply this information to your practice and your career.

Demographic background

The survey was conducted in early January 2025, and by design, surveyed only general dentists in private practice. Ninety-one percent of respondents are owners or partners in an independent practice and 3% are associates. Only about 6% of our respondents are employed by DSOs or extremely large groups.

Interestingly, there has been little shift in the number of respondents who practice alone. Fifty-three percent of our respondents are solo practitioners, which correlates closely with previous surveys and comparative data provided by other organizations such as the ADA.

And finally, the average age of the respondents in this survey is 54 years. The average age of dentists in the United States is approximately 49 years, so this is a representative sample of dentists at the midpoint of their careers.1 This year, again, the profile of respondents allows us to provide very representative information.

It’s really all about production

The survey this year provided some very positive data. The average production per doctor, including hygiene production as a component, was $1,004,178, which is notably higher than in 2023. We’ll discuss that more in just a moment.

If we apply the generally accepted assumption that the average practice generates 75% of production from doctors and 25% from hygiene, this suggests that the average private practice dentist is directly producing approximately $750,000 per year.

Seventy-three percent of practices reported higher doctor production in 2024, about the same as in 2023. Importantly though, 16% reported their increase was greater than 25%, four times the number in last year’s survey. The number of practices experiencing large jumps in production increased significantly.

More good news

The average change in total production reported individually by practices was +10.7%. This is one of the highest average year increases reported by dentists in 19 years of this survey.

Frequent readers of my articles, or those who have heard me lecture, may recall that Levin Group models project that the average private practice has the potential to increase production by at least 30% over a three-year period. This year’s survey clearly supports that premise.

The average change in profit reported by individual practices was +7.3%. This is a significant increase over the previous few years, which have had their own unique dynamics.

In 2020, most practices declined in profit due to prolonged pandemic shutdowns. In 2021 and 2022, production increased slightly and profit decreased significantly due to a rapid rise in overhead. The increased expenses ate up any increase in profit plus some.

This happened again in 2023, but by a much lower amount. This year’s data appears to indicate that practice teams are learning to control costs while focusing more on increasing production.

Levin Group recommendations

Production can be increased by large amounts when the right practice management systems and approaches are put in place. Even with this year’s increase, too many practices are hovering in the $1,000,000 production per doctor range, not realizing the significant opportunity to easily increase production further.

Overhead has been on the increase since 2020 and will not be reversing. There are many strategies to counteract those higher costs through increased production, such as scheduling 97% of all active patients, reducing no-shows, adding a new service or new technology, etc.

Practices should choose the strategies that are appropriate for them and then rigorously implement them to release the production potential inherent in every practice.

Higher overhead won’t go away

Sixty-five percent of practices reported higher overhead in 2024. Only 14% stated that their overhead declined, and 21% reported that overhead was the same.

When asked “how much higher?” a third reported an overhead increase of more than 10%. Overall, the increase in overhead in 2024 was 5.1%, less than half a point higher than in 2023. Overhead seems to now be rising at about 5% per year, and this may be the new normal.

Not surprisingly, 62% of dentists selected rising overhead as “their biggest challenge” out of the eight challenges that we asked them to rank.

Levin Group recommendations

Overhead is a practice killer if it gets higher than the industry standards. For every dollar that overhead is reduced, profit increases by the same amount.

An $800,000 per year practice that reduces overhead by 4% will increase annual profit and income by $32,000. This is significant and can contribute heavily over the years to help doctors pay off debt and more easily reach financial independence.

What are the challenges?

When asked about their revenue expectations for 2025, 92% of dentists were optimistically expecting to have the same or better revenue than in 2024. Most of them stated that they expect their total revenue to increase by 5% or more, which is the most optimistic point of view that we have seen in several years.

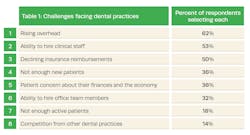

But none of this comes without challenges. Each year we ask the respondents to identify and prioritize the biggest challenges facing their practice (table 1). Note that respondents could select all that applied.

- The top challenge for the third year running is rising overhead, selected by 62%, slightly down from last year.

- Fifty-three percent stated that the ability to hire clinical staff was their second biggest challenge. This was also slightly down from last year.

- A challenge that private practice dentists have faced for an exceedingly long time is declining insurance reimbursements, selected by 50%. This was down 10% from the previous year.

- Not enough new patients was the fourth most selected challenge, chosen by 36% of the respondents. This has moved up three places in terms of ranking from last year, which would indicate a new trend and possible serious concern.

- The next in line of dentists’ concerns is that patients are more worried about their personal finances and the economy. Selected by 36%, this is significantly up from the previous year where it barely made the list.

- Not as serious a problem as hiring clinical staff, but 32% did identify challenges in hiring front office staff.

Levin Group recommendations

It would be an especially useful practice management exercise to review this list of challenges with your team and place them in priority order for your individual practices. Develop a list of actions and a plan for each of the top challenges your practice faces. For example, hiring new team members may necessitate excellent step-by-step systems for faster training. Rising overhead, as explained above, can be offset by increasing practice production. Economic concerns by patients, which seem to be a much bigger factor than in the past, can be addressed by offering interest-free financing.

On to dental insurance

Thirty-two percent of respondents reported that one or more of the plans in which their practice participates lowered reimbursements. While still significant, this was an improvement over 2023, when over 50% of practices noted insurance companies reducing reimbursements. Could this be the start of a welcome trend toward insurance companies easing up on years of lower reimbursements? Nonetheless, 20% of practices reported a decrease in total reimbursement levels from insurance companies.

A question we receive regularly at Levin Group was asked on the survey: “Should I go all fee-for-service?” According to our survey, only 12% of practices have zero insurance participation. Many other doctors seem to be frustrated with their reliance on insurance as almost four in 10 (38%) stated that in 2025 they do plan to drop at least one plan—significantly higher than the year before.

The typical payer mix of practices was 54% insurance and 46% fee-for-service. This quickly explains why most practices cannot easily or painlessly convert to all fee-for-service. Additionally, almost two-thirds (64%) of practices reported that more than half of their revenue was insurance reimbursements.

Levin Group recommendations

Our recommendation is to proceed cautiously in all participation decisions. Whether you are pro or con working with insurance companies, it is important to first analyze your practice before making any specific decisions. We always recommend analyzing the practice’s collective position with insurance plans, revenue from plans, number of patients in each plan, and other factors. These decisions should not be emotional. There are methods to reduce the dependence on insurance, but the first step is to analyze the practice’s model and position and understand the potential downsides of specific changes.

Staffing

Staffing continues to be a significant challenge. In the last few years, it has alternated with overhead for first or second place of the biggest challenges reported by dentists. Again, this year, more than 91% of dentists reported that they believe there’s a shortage of dental staff. This is more than a shortage. It is a crisis. Here’s why.

- Fifty-seven percent state that they are currently seeking to hire a staff member. This is remarkably similar to last year’s survey.

- Fifty-three percent of practices have at least one open position to fill right now, which means that they are not adding additional team members but replacing someone who left.

- Only 29% of practices had no staffing turnover in the survey.

- Approximately 16% of practices lost three or more team members, creating a significant void in practice labor.

See Table 2 for what strategies practices said they were doing to address the current staffing challenge.

Levin Group recommendations

Many textbooks could easily be written on recommendations for staffing. Signing bonuses, longevity bonuses, changing the practice culture to be more positive and energized, surprises for the team such as gift certificates, lunches, filling the refrigerator with snacks, and out-of-office activities are all part of the equation. Perhaps the most important thing is applying a new leadership model where the doctor and office manager take time to compliment, inspire, and recognize people, thereby creating an ultradesirable work environment. The best way to build a long-term team is to create an environment where people feel important, appreciated, and enjoy coming to work.

Two miscellaneous facts

First, 14% of practices reported seeing an increase in the amount of third-party financing that is being utilized to pay for treatment. Given concerns about the economy, this gives patients an easy way to access debt for recommended dental care.

Second, 41% of practices reported having patients enrolled in an in-house dental membership plan. This is a relatively new phenomenon that helps to retain patients and increase case acceptance, and helps patients develop a sense of loyalty to the practice.

Summary

This year’s survey provided more positive news than any of the last three years. Production increased sufficiently to offset overhead increases, allowing for an increase in practice profit. Although these reports are excellent, there are concerns about the economy and the changing geopolitical landscape. However, it is wonderful to see dental practices returning to higher production and profitability, despite the challenges of increased overhead and staffing shortages.

Levin Group recommendations

To reiterate, the most important factor in the success of dental practices today is to increase practice production every year and by an amount that offsets overhead. We have entered a new normal where the higher overhead will remain but hopefully grow only at a predictable amount of about 3-5% per year. Increasing production is easier than most practices recognize. Dentists should read, watch, or listen to production-oriented education to gain ideas on how to grow their own practice, which will lead to an enjoyable, successful, and satisfying career.

Editor's note: This article appeared in the May 2025 print edition of Dental Economics magazine. Dentists in North America are eligible for a complimentary print subscription. Sign up here.

Reference

- U.S. Dentist retirement and career span trends. American Dental Association. https://www.ada.org/resources/research/health-policy-institute/dentist-workforce/dentist-retirement-trends

About the Author

Roger P. Levin, DDS, CEO and Founder of Levin Group

Roger has worked with more than 30,000 practices to increase production. A recognized expert on dental practice management and marketing, he has written 67 books and more than 4,000 articles, and regularly presents seminars in the US and around the world. To contact Dr. Levin or to join the 40,000 dental professionals who receive his Practice Production Tip of the Day, visit levingroup.com or email [email protected].