AMT: The flat tax is here!

Careful what you wish for! We all seem to be clamoring for a national sales tax, value-added tax, flat tax, or any kind of tax that is different from what we have now. The fact is, we already have a flat tax of sorts, and you are not going to like it. It is known as the Alternative Minimum Tax, or AMT. It has been around since 1969.

The AMT was originally designed to make sure that fat cats with clever tax attorneys paid at least some taxes. Congress got incensed when they learned that a handful of individuals who made more than $1 million did not pay any income tax due to clever tax shelters, use of accelerated depreciation, and other loopholes. So, an alternative tax scheme was enacted that applied a flat tax percentage to a taxpayer’s “alternative” income. This alternative income essentially disallowed most normal deductions (i.e., “simplification”) and gave you a $45,000 “standard deduction” instead. You then calculated the alternative minimum tax at 26 percent of this simplified income figure. You then paid the greater of your normal taxes or the AMT. For the vast majority of taxpayers, their regular tax was the higher figure and they could ignore the AMT.

However, there was a major time bomb lurking in the AMT system: whether on purpose or not, Congress failed to index the AMT exemption amount for inflation. In the regular tax system, for instance, you may have noticed that the amount of your exemption for each dependent goes up each year, as does the standard deduction and even the tax table brackets themselves. So, as income rose over time, the regular tax did not increase proportionately, when measured in inflation-adjusted or “real” dollars. However, since the AMT exemption has not increased with inflation, the amount of the AMT tax has steadily - and quietly - increased. In fact, most of our readers have already been drawn into the AMT, although you may not have noticed it.

This “stealth tax” has begun to exceed the regular tax for more and more people each year. Some 3.5 million taxpayers will be affected in 2005, and estimates are that 31 million will be caught up in the AMT by the year 2010! By that time, 93 percent of taxpayers in the $200,000-$500,000 income range will pay AMT as their primary tax.

Congress is well aware of this rising problem, but they can’t afford to give up the trillions of dollars in taxes it generates. By 2007, the Treasury will receive more in AMT taxes than in regular taxes!

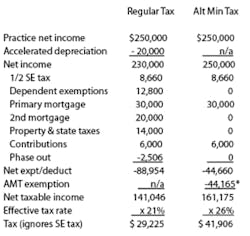

It is almost impossible to plan around the AMT because, by definition, it is fairly “simple.” All of your personal exemptions are thrown out. Likewise, most itemized deductions are disallowed, other than your initial principal mortgage. Excess depreciation also is disallowed. What follows is an example:

null

*The AMT married-joint exemption amount for 2005 is normally $58,000. But, to add insult to injury, the exemption is reduced by 25 percent of the amount that income exceeds $150,000. It is totally phased out when income reaches $382,000. Unless Congress acts, the $58,000 figure reverts to $45,000 in 2006 (back to the 2000 level).

You pay the greater of the two taxes, or $41,906. Although you would normally think a tax rate of 26 percent sounds pretty good, it really hurts when you lose most of your deductions and other “tax preference” items, such as excess depreciation. Other than having a large amount of itemized deductions, there is nothing unusual or aggressive about this tax situation, yet the AMT has caused an extra, possibly unexpected tax of about $12,000. Plan carefully with your tax advisor, as the AMT appears here to stay.

Raymond “Rick” Willeford, MBA, CPA, CFP®, is president of Willeford Haile & Associates, CPA, PC, and Willeford CPA Wealth Advisors, LLC. As a fee-only advisor, he has specialized in providing financial, tax, and transition strategies for dentists since 1975. Willeford is the president of the Academy of Dental CPAs, a consultant member of AADPA, and is available as a speaker nationwide. Contact him by phone at (770) 552-8500, or by e-mail at [email protected].