Retirement: How much is enough?

Robert J. Mallin, DDS, CFP

In my formative years, I was attending a workshop given by my friend, the late, great Dr. F. Harold Wirth. During the workshop, he posed the question: "How much is enough?" From the back of the room, I answered: "Just a little bit more."

Well, he never let me forget my quip, and he wove my story into his lectures and workshops for years and years.

There is some truth to my quip, especially among dentists - most of whom come from modest economic backgrounds and have difficulty in becoming comfortable with money. There never is "enough."

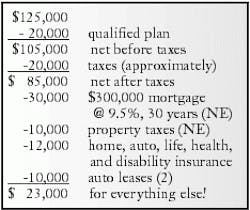

For years, I've asserted that the average dentist (according to ADA statistics), who nets about $125,000 before taxes, can hardly afford to live a reasonable lifestyle and fund an adequate retirement.

Let me tell you what I mean.

What do you need to retire in reasonable comfort? In my opinion, $2 million in a qualified plan.

Is this the absolute minimum? No, of course not! It depends on your personal circumstances, objectives, and temperament.

But, for a reasonably comfortable retirement - at least in this millenium - I believe this is a realistic number.

How do you get it?

You'll need to invest about $20,000 a year for 30 years at 8 percent interest in a qualified plan (or you can have a rich uncle die or win the lottery). That's not easy with an income of $125,000.

Here's why:

Adjust the numbers for your personal status and see where you are.

Now, why $2 million?

Statistically, we know we can draw out 4 percent per year and never deplete the entire amount. That leaves us $80,000 a year - before taxes - in retirement. Not terrible - but not great.

If we draw out 6 percent per year, we're drawing out $120,000 - which is about what the average dentist earned at the height of his/her career.

But what about depletion?

There are no guarantees. But you should have a portfolio of sound equities, and follow these simple rules:

1. In year one, spend up to 6 percent of the value of your retirement account.

2. In subsequent years:

a. If the principal is higher at the beginning of the next year, take 6 percent;

b. If the principal is lower than the previous year, take only what you took the previous year (but never more than 12 percent).

Yes, inflation is not factored into this equation.

Yes, if the market goes south by 50 percent, you'll face some hardships. But won't we all?

Yes, a depression will create problems - but at least your living costs will be lower.

In a performance table created from S&P 500 data, supplied by Ibbotson Associates, it was shown that following this process from 1969 to 1999 would have caused your original nest egg to go up six times (and still be intact!) after drawing out money annually as per the formula.

This article is not the place to discuss all of the possible ramifications of asset allocation and withdrawal possibilities. It is intended to be food for thought - especially for our younger colleagues, who may not even have meager Social Security benefits to anticipate.

Robert J. Mallin, DDS, CFP, is both a dentist and a Certified Financial Planner. He has authored many articles and lectured extensively on financial and practice-transition matters. He owns PPC of NJ, Inc., a dental practice-broker/financial-planning firm. Dr. Mallin is a member of American Dental Sales (ADS). See the ADS classified ads in Dental Economics for names and phone numbers of ADS members in your area.