Tax advantages of purchasing new equipment for your dental office

By Allen M. Schiff, CPA, CFE

The end of 2013 is quickly approaching. This year seemed to go by more quickly than others! If you are thinking of purchasing new equipment for your dental practice, now is a good time to do so as well as start your end of 2013 tax planning.

Acquisition of new equipment has many advantages. Yes, of course there are tax advantages that we will explore in detail later within this article.

First, there are psychological benefits for you as the dentist, as well as your patients and your team. For example, if your reception area furniture is "stale" and the color scheme is out of the 1970s, this is the time to give it a "facelift." This is the first thing your patients see when they enter your office. Just think how new furniture will make you and your patients feel when come into your office for the very first time. A new look certainly says a lot for you, your team, and your practice's image. The same can be said for the dental equipment in your operatories. A properly equipped operatory with state-of-the-art equipment says, "Yes, Mr./Mrs. Patient, I care enough about you to assure you I have the most up-to-date dental equipment to deliver my oral health-care services at an optimum level."

A properly equipped dental operatory will also assist in case presentation and may help increase overall case acceptance. The bottom line here is, your office décor, including the condition of your operatories, must be conducive to your marketing strategies. This is very important, because you do not want to convey to the patient a mixed message when receiving your marketing collateral as it relates to the actual patient experience within your dental office.

So, the next logical question is, "What are the tax advantages from the purchase of new dental equipment?"

First, in order to get any benefit, the equipment must be placed in service by Dec. 31, 2013. That means the equipment must be delivered, installed, and ready to be used in your dental practice by that date. Since most dental practices operate on the cash basis of accounting, the equipment invoice must be paid -- either with a check or financing dated Dec. 31, 2013, or earlier, or a credit card charge which, once again, must be dated Dec. 31, 2013, or earlier.

There are three different ways to recover the cost of your new equipment using tax depreciation:

- Section 179 expensing

- 50% additional first-year depreciation

- Regular depreciation

Each method has its own advantages and disadvantages. Let's explore them together.

The Section 179 expense allows you to write off (depreciate) as much as the entire cost of equipment in the year of purchase. For 2013 the maximum expense write-off is $500,000. To the extent that your purchase of Section 179 eligible property exceeds $2,000,000 in 2013, the maximum expense is reduced "dollar for dollar" in excess of $2,000,000. For example, if you were to purchase $2,100,000 in equipment, you have exceeded that cap by $100,000 ($2,100,000 to $2,000,000). This would reduce your maximum Section 179 deduction by $100,000, giving you a maximum expense of $400,000. With Section 179, you can "cherry pick" which item(s) you wish to expense and you may also use only a portion of the purchase price. You do not have to use all of the $500,000 Section 179 depreciation. The Section 179 expense cannot produce or increase a loss. Any unused Section 179 expense may be carried forward and used in the future. Barring action by Congress, for tax years beginning in 2014 the maximum Section 179 expense is $25,000 and the maximum equipment cost is $200,000. Section 179 expense may be claimed on both new and used equipment.

The 50% additional first-year depreciation (also called bonus depreciation) is the default -- unless your dental CPA elects out of it, you must take it on all eligible acquisitions during 2013. The election out of bonus depreciation is filed as part of your income tax return filing. Unlike Section 179, bonus depreciation is "all or nothing" based upon the recovery year class (typically three, five, or seven years). Current tax regulations require you to take it, or elect out of it, for all assets in a recovery year class. For instance, if you have both five-year and seven-year class acquisitions, you could take it on the five-year assets (dental equipment) and elect out of it on the seven-year assets (reception area furniture). With 50% bonus depreciation in the year of acquisition, you depreciate 50% of the cost plus the regular depreciation expense on the other 50% remaining balance. The balance is depreciated over the remaining class life. Bonus depreciation may create or increase a tax loss. There is no limitation on the amount of bonus depreciation you may claim. Barring extension, bonus depreciation expires December 31, 2013. (Equipment purchased on or before Dec. 31, 2013 qualifies. Equipment purchased subsequent to Dec. 31, 2013, does not qualify.) Bonus depreciation is available only for new equipment and not used equipment. This is because Congress was looking for a way to stimulate the economy by encouraging the purchase of new equipment.

The third and final method is regular depreciation, which spreads the depreciation deduction over the life of the asset. Five-year assets are depreciated over five years. Seven-year assets are depreciated over seven years. Unlike Section 179 and the 50% bonus depreciation, there is no large deduction in the year of acquisition. However, you do receive a full deduction in each year until the equipment is fully depreciated (five or seven years). Like 50% bonus depreciation, regular depreciation may create or add to a tax loss. By spreading the depreciation deduction over the life of the related asset, you are spreading the tax savings over the life of the asset. Should you have debt in your dental practice, this will help provide a "shelter" to your cash flow for the period you are servicing the principal portion of the debt. Regular depreciation may be used with both new and used equipment.

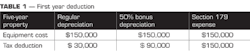

Table 1 is an example of all three methodologies, assuming you have acquired $150,000 in dental equipment during 2013.

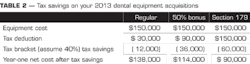

As you can see, depreciation is not "one size fits all." You could actually write off as much as $150,000 of the $150,000 cost if you were to maximize all of your choices. Depending upon what depreciation method is used, your results can vary greatly. Nevertheless, once you choose the depreciation methodology with your dental CPA's assistance, please determine which income tax bracket (both federal and state) you fall into during 2013 to determine your overall tax savings. Please be careful when choosing the depreciation method. Most states do not completely follow federal tax depreciation policies, so your depreciation deduction at the state level may vary from the federal depreciation deduction.

To compute your tax savings on your 2013 dental equipment acquisitions, please use table 2 to assist you:

I have outlined three major methods of addressing tax depreciation for acquisition of dental equipment during 2013 in your dental practice, along with the approximate income tax savings. For more information on depreciation or other accounting, tax, and practice management consulting issues you may have, please contact your dental CPA or you may visit the Academy of Dental CPAs' website at www.adcpa.org.

Allen M. Schiff, CPA, CFE, is a founding member of the Academy of Dental CPAs (www.adcpa.org). This group of very knowledgeable dental CPA firms across the nation specializes in practice management services to the dental industry. Mr. Schiff serves on the ADCPA Executive Committee and is the chairperson of the ADCPA Marketing Committee. You may reach him at (410) 321-7707 or by email at [email protected].

Past DE Articles