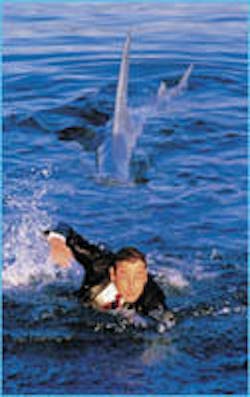

Swimming with the SHARKS

How to better deal with patient insurance plans

by Dr. James R. Pride, and Amy Tuttle-Morgan

A common lament we hear from dentists is: "How can I control the insurance companies? ... How can I get my staff to control them? ... If I raise my fees, will it fly with insurance? ... How do I get my patients to rise above insurance concerns?" The mere mention of the "I-word" can throw a dentist's digestion out of kilter. First, a dentist chooses to swim with the sharks — insurance companies — and then is surprised when they bite. How do you swim with sharks? You don't. You choose to swim only in a safe harbor, where the water is clear and the currents are calm.

As with every issue in the dental practice, insurance represents a choice. There is no one pat answer for all practices on matters such as how flexible financial arrangements should be, how many days a week the dentist should work, how to market effectively, how to identify the ideal patient — or how to define the proper role of insurance. Practices may make sound decisions to be cash only, to accept indemnity insurance, to participate to some degree in PPOs, or to support managed-care completely. For one practice, embracing insurance may be tantamount to water ballet; for another, it may be like a shark attack. How can you decide what is right for your practice?

How do you make sound decisions regarding insurance? By referencing your vision. If a pathway gets you closer to your vision, then it is good; if not, it should be avoided. Because decisions about insurance — and about every aspect of your practice — can be properly made only by referencing your vision, let us first discuss this wider issue.

The big pictureWhen we feel as if we're swimming with sharks, it is symptomatic of a larger problem. We're feeling out of control because our decision-making process is flawed. When we lack a coherent, defined, long-range direction, it reduces our decisions to spur-of-the-moment ones. We tend to view every issue in isolation and get pulled by the latest currents, be they managed care, OSHA, or whatever. Should you try to go paperless? Should you take on an associate? Should you accept insurance? The real "shark" we must guard against is a fragmented, spur-of-the-moment decision-making process that fails to relate every issue to long-term goals.For example, Dr. A. had just completed a lengthy, postgraduate program of clinical training. His vision was to develop a high-end cosmetic practice. Then, he proceeded to join all of the PPOs in town. When we questioned him about this, we found that he simply felt pressured to join the plans to obtain new patients. He obviously did not relate his decision about insurance to his vision!

In another case, Dr. B. established a practice in an area populated by industrial workers. Her vision was to capture these patients. Nevertheless, she refused to join their insurance plan or even to accept assignment of benefits. She admired a colleague who had an insurance-free practice, yet that colleague's office was not located in a blue-collar town. Dr. B. needed to make a decision that made sense in her context with her vision (or change her vision, if she so chooses).

In Dr. A.'s case, accepting insurance was detrimental to the practice vision; however, with Dr. B, not accepting insurance was the problem. These are examples of how participation in dental benefit plans must be viewed in a wider context, and how the misalignment of short-term actions with long-term goals is bound to be problematic.

Defining your visionThe first step in determining the role of insurance in your practice is to identify the nature of your practice now and what you would like it to be in one, five, and 20 years. Do you want to be a high-tech dentist or not? What are your personal and professional goals for the next one, five, and 20 years? What services do you want to provide? What kind of patients would appreciate those services? How do you find such patients? What would you want your employees to say about you as a leader? Start with the longest time frame, and then define more immediate goals. Only after you've answered these questions and arrived at a clear, compelling vision can you then properly assess the role of insurance in your practice.The role of insuranceImplementation brings you to the next phase in your journey: ensuring that your practice statistics align with your vision. For example, if your production and collection figures indicate revenues of $400,000, and your vision is to produce $600,000, there is a misalignment. The practice needs to change in order to achieve your goal. This means you will need to re-examine your systems. In evaluating your systems, you will need to assess the role of insurance. Are your policies regarding insurance an asset or a liability in reaching your vision?Drop insurance?Many dentists get fed up with insurance paperwork and slow payments, so, in a fit of pique, they decide to drop their plans. This can be very dangerous. First, doctors must confirm that insurance really is causing a problem in the practice. This must be established through the practice statistics, not through the dentist's anger. Doctors who are thinking about dropping insurance plans need to be able to answer these questions:- What is your active patient base?

- What percentage of that patient base is enrolled in the insurance plan you're thinking of dropping?

- What percentage of your production stems from utilization of the plan you're thinking of dropping?

One dentist (typical of others we encounter) could not answer these questions, yet he was ready to drop his insurance plans. When we calculated the actual numbers, we found that there really was no problem with insurance, because the plans encompassed less than 30 percent of his patient base and utilization. In cases like this, dentists are overly focused on insurance carried by a small number of patients. They should instead direct their efforts to the vast majority of patients who fit their ideal profile and gain referrals of like patients from this group.

Who is preoccupied?Many times it is the dentist and team who are overly focused on insurance and are stoking the fires of insurance-mindedness within the patient. Ask yourself: In your practice, who mentions insurance first — the patient, or you and your team? Our research shows that it is the dental office that overemphasizes the importance of insurance. Also ask yourself: When the subject of insurance comes up, how do you and your team behave? Even if your words are unobjectionable, is your body language telling the patient that you're worried? A sudden tenseness in the shoulders, eyes drooping, nervousness in the voice, etc., conveys to patients that they have hit an obstacle. The solution to the patient's preoccupation with insurance is to first cure the dentist and staff from the condition.We recommend broaching the issue at the end of a 15- to 20-minute preclinical interview with the new patient, as well as in a status exam with patients of record. Then, explain the role that insurance plays in treatment. That role may be limited to paying for some, but not all, of the care that a patient may need.

You may be the kind of dentist who considers the patient's long-term oral health, not insurance maximums, when diagnosing and recommending treatment. If so, tell the patient in a direct and positive way what your standards are, without criticizing the insurance plan. This approach instills a new attitude about insurance in the patient who values quality care.

If more than 50 percent of your patient base is utilizing reduced-fee plans that prevent you from realizing your vision, then ending participation may be your best option. If this is the decision, it must be executed in a deliberate method so as not to lose patients. The steps involved include:

- Giving the quality of care that warrants the higher fees you want to charge.

- Educating patients about your standards of care and the role insurance plays in delivery of that care.

- Analyzing your patient base so that the doctor and team know how many patients are in alignment with the practice vision and how many are at risk of leaving.

The very last step involves dropping the plan and notifying your patients through a combination of written and verbal communication. Doctors who drop their plans as a first and sudden step can lose patients and precipitate a cash-flow crisis in the practice.

Remember, too, that with the advent of e-claims and the much faster claim processing now available, many practices that drop participation in reduced-fee plans do not have to banish insurance entirely. They can continue to offer patients the service of accepting assignment of insurance benefits if they use a good e-claims system.

These steps for dropping insurance are a basic guideline and vary according to the individual practice. However, what we can say for certain is if it is your decision to drop the insurance programs, then understand what you are doing.

Develop a plan for the phase-out, rather than act blindly. If you walk across a street blindfolded, you may or may not be hit by a car. But doesn't it make much more sense to open your eyes to ensure that you will reach the other side safely?

Where are the sharks?The solution to swimming with the sharks is to dance to your own tune, draw your line in the sand, have the courage to dream, identify your vision, and achieve it. Insurance is not the enemy, but short-sighted and rash decisions are. We must make long-range decisions that bring us closer to our goals.Like the great sea captains of the past who dared to venture to exotic new shores, today's successful entrepreneur is impassioned with a clear-cut vision to steer the ship and stay the course. So, too, is today's successful dentist.

MistakesWhen defining your vision, avoid these common mistakes:- Striving to do what is socially acceptable. Some dentists find that serving the high-income patient is rewarding, yet they still have time to serve the poor. Your practice is yours to mold as you wish.

- Not dreaming "big". Dentists are too often "small" dreamers. Because dentists are excellent technically — and perfectionists — many may hesitate to raise the bar too high for fear of not clearing it. Thus, they understate their vision and consequently create a climate of underperformance for themselves and their teams. Money isn't everything; however, this attitude can also reflect a passivity that holds dentists in their comfort zone and stops them from realizing their true potential.

- Not changing the vision. For example, sometimes dentists achieve their vision, but fail to set another. One young dentist's dream was to reach a production level of $400,000, and that dream was realized. Then it was time to set another vision, which the dentist failed to do. Without new goals, the motivation of the dentist and team waned, and the practice regressed.

Having a vision means daring to draw your line in the sand. It takes courage to say, "This is the kind of dentistry I want to do and the income I want to make." Your staff, patients, and even colleagues may not hold the same standards. You need courage not only to set the vision, but also to implement it.