Variable annuities: Look before you leap

by Marvin Appel, PhD, and Brian Hufford, CPA, CFP

Variable annuities are insurance policies that offer investment flexibility and tax deferral. They are subject to fewer government regulations than retirement plan accounts, and, in some situations, may represent the best solution to estate planning problems. However, caveat emptor! They are, as a rule, far more expensive than most other investment options available to the individual investor. If you're not careful, surrender charges could lock you into an inferior investment for up to eight years. In this article we will review some of the important issues you need to consider before deciding to invest in a variable annuity.

What is a variable annuity?

You can invest in mutual funds through a variable annuity, much like a retirement plan. Each annuity comes with its own menu of investment options. Most include a choice of income-generating investments and various stock funds (such as S&P 500, small-cap stocks, and international stocks). You can customize your portfolio using the available mutual funds and make periodic changes (subject to any restrictions the annuity may impose).

Unlike IRAs, however, annuity mutual funds are distinct from mutual funds that you might buy with taxable assets. The daily price changes of many different annuity accounts may be listed in a separate part of the financial section of your newspaper.

The fund families available within annuities have familiar names: American Century, Invesco, Janus, etc. However, even if a regular mutual fund has the same name and manager as its annuity "clone," there is no guarantee that the two investments will perform the same.

Defer taxes indefinitely

Once you invest in an annuity, you do not owe income taxes on any investment gains until you withdraw the assets. Unlike retirement accounts or IRAs, the government does not require you to begin withdrawing at age 70 - or require any minimum rate of withdrawal.

You can add to a variable annuity at any time. However, as with retirement accounts, withdrawals before age 59 - will generally incur a 10 percent tax penalty in addition to the regular taxes due.

Life insurance feature

A variable annuity has life insurance included. So, if someone invested $100,000, lost money in his investments, and passed away before recouping the losses, the beneficiary of the policy would receive the original $100,000.

Of course, if your investments in an annuity are very successful, life insurance on the original amount invested no longer means very much because you would have to give back all those gains before that death benefit became applicable. Many annuities include a "step-up" provision to address this concern. Every six years (for example), your annuity contract would be valuated and the death benefit improved to reflect accrued investment gains during the previous six years.

So, if you wanted to be sure of leaving at least the initial investment in your estate under any circumstance, but also wanted to try to achieve investment growth, the right variable annuity could meet your needs. (Remember that as with any insurance, the quality of the guarantee is only as good as the financial condition of the insurance company backing it up.)

Cost are a negative

Annuities carry two levels of costs, whereas regular mutual funds have only one. Each mutual fund manager within the annuity imposes his/her own expense ratio. In addition, the sponsoring insurance company adds an "administrative and mortality benefit expense" to the expense of each individual mutual fund. Although the more economical variable annuities tack on 0.65 percent or less per year for the insurance overhead, the industry average is about 1.3 percent per year.

When the burden of the investment manager expense for the separate mutual funds and the overhead are combined, you could easily end up paying some 2.5-3 percent annually on your assets. It is therefore imperative that you select your program carefully.

On top of that, if a commissioned salesperson opens a variable annuity account for you, you may have to surrender up to 8 percent of your investment if you change your mind and decide to move it elsewhere within a year. Surrender charges phase out gradually, usually over a period of seven to eight years. Fortunately, no-load policies are available without surrender charges, some of which we mention later.

In contrast, when you open an IRA in a regular mutual fund, you pay only that fund's expense ratio. For no-load U.S. equity mutual funds, you can easily keep the expense ratio below 1 percent. The difference between paying 1 percent and more than 2 percent per year overhead may not sound like much, but it can add up to a significant amount.

In fact, the expenses of variable annuities matter enough to justify this recommendation: You should not consider investing in a variable annuity until you have maximized your use of retirement plans (SEP IRAs, 401K, IRA, Roth IRA, pension plans, etc.) You should not put an IRA account within an annuity because such a move greatly increases your investment expenses without adding any tax benefit.

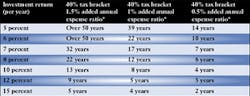

In an era of high investment returns, the extra 1 percent or so that a variable annuity costs might be small compared to the value of the tax benefits. However, in an era of more modest returns, the impact of that extra 1 percent can be significant. As a general rule, the higher your current tax bracket, the higher the investment return. The longer you leave your funds in the annuity, the greater the benefit of the tax deferral.

Table 1 shows how many years you need to invest in a variable annuity before the benefit of the tax deferral outweighs the impact of the added cost. By comparing the right side of the table with the left, you can see that even a seemingly small increase in expenses dramatically increases the time required to recoup your costs through the tax benefits.

Become a well-informed investor

Only two programs (that we are aware of) have total expenses (insurance overhead plus individual fund expense ratios) under 1 percent per year: TIAA-CREF Personal Annuity Select and Vanguard Variable Annuity. These programs have fewer investment selections than most, but should be the first place to look since they do offer options such as S&P 500 Index funds or diversified international stock funds.

Other relatively economical programs (with insurance overhead of 0.65 percent) include the Aegon/Peoples Benefit Life Advisor's Edge Annuity and the T.D. Waterhouse Annuity. With the expenses of the underlying mutual funds combined, these annuities carry a total expense ratio of 1.5 to 2 percent per year. None of the specific programs mentioned here has a surrender charge.

If you are already investing as much as possible in all employment-related tax-deferred retirement plans and have disposable income available for long-term savings, a variable annuity might make sense for you. You may need to consult a tax or with an estate-planning expert before making any final decisions.

Remember, if you do seek outside advice, be aware that many financial advisors make their living from commissions on the products they sell you. As a result, they may not be able to recommend the most economical alternative. Variable annuities can be valuable tools, but only if you take the time to understand them thoroughly and ensure that you are getting the most economical product before you invest.