How billing to medical can protect your practice from inflation and decreased dental reimbursements

The overhead of a dental practice is approximately 60%–70% and rising, while dental reimbursements have decreased. Dentistry is paid poorly compared to other medical specialties, while the overhead for other medical providers is lower. When you visit your MD, typically they have minimal supplies in their offices: a table for you to lie on, a chair for you to sit on, and a computer with very few additional supplies. Following the COVID-19 pandemic, I was hoping that dental practices would finally be seen as surgery centers and closer to being viewed and reimbursed as a medical specialty. But the opposite has happened.

Dental insurance carriers have decreased reimbursements for claims. Our operatories are called that for a reason; we are performing invasive procedures every day, all day, even if that procedure is “cutting into a tooth.”

Overall, this should be an exciting time in dentistry with all the additional surgical procedures and treatments we can provide, as well as all the amazing technology we have to offer outstanding care to our patients. But with all the education and technology come significant costs that diminish our excitement. What options do we have to help combat the rising costs so our industry can be profitable? Medical billing can help.

More on medical billing ...

Billing to medical insurance: In-network versus out-of-network

Whole-person care for vulnerable patients: The value of medical-dental integration

Are you aware that our specialty can bill to both dental and medical insurance, and be reimbursed by both—up to the full fee that was charged? Patients have medical benefits for many procedures that we provide in a dental setting. Billing to both dental and medical will decrease patients’ out-of-pocket costs, increase case acceptance, and make a significant impact on practice collections. In fact, medical allowances are far higher than anything you’ll see on a dental fee schedule. Billing to medical allows you to be paid as you should: as a medical specialist.

What can be billed to medical insurance?

Any of these procedures can be billed to medical: evaluations, panorex, CT, repeat and limited CT, lateral ceph, periapicals with trauma, bone grafts (including sinus lifts), dental implants, implant removal, surgical stents, interim/final prosthesis, cyst/abscess removal, sinus repair, alveoloplasty, wisdom teeth extraction, biopsies, frenectomies, sleep apnea appliances, TMD appliances, Botox, restorative treatment when needed due to a systemic condition as a root cause, and more.

When you shift your mindset and start to look beyond teeth, you’ll see a lot of medically necessary treatment. Medical typically does not pay for tooth-related procedures unless the teeth are impacted or there is a systemic condition causing destruction to the dentition. With the advanced services we provide to our patients, dentistry is far beyond treating just teeth.

Taking a new view of dental benefits

We also need to shift our mindset about dental benefits. Dental benefits have brainwashed us in so many ways. We allow those fee schedules to dictate the fees we charge for our services. A great example is a clinical exam. Is an exam on a 10-year-old the same as one on a 60-year-old? Absolutely not, yet the fee is often the same. The only time the fee should be the same is for a service like a panorex; then, it would be logical to charge the same fee for all patients.

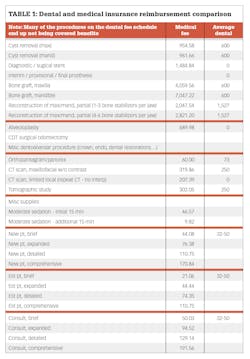

Dental benefits do not allow for a sliding scale based on the complexity of medical decision-making or the time we spend with our patients. But medical does, allowing you to be paid more. In fact, medical will easily pay you double what dental insurance does for that evaluation (table 1).

How often do we write off services because the patient’s dental benefits won’t cover them? I get it; our patients are like family, and we often treat them as such and don’t charge. However, doing so will not pay the bills. How often do we forego providing a service, even though we know it’s in the best interests of our patients, instead allowing dental benefits to brainwash us into thinking it’s not necessary—or that we can “wait” because the dental carrier won’t pay for it or there is a frequency limitation?

As a hygienist, it always bothered me that we had to choose between a panorex and FMX. It had to be one or the other, with a limitation of every three to five years. We know—and so does the dental carrier—that these are two completely different radiographic images used to evaluate and diagnose. It’s also fair to say that every three to five years is not often enough for some patients. It doesn’t matter to a dental carrier as their benefits come with exclusions, limitations, and restrictions. It’s a coupon plan, nothing more.

The dental insurance company doesn’t care that since we are forced to choose between a panorex or FMX, we could be missing maxillofacial cancer (a cancer that’s on the rise due to HIV) if we choose the FMX. It doesn’t matter to them that we need to take a CT to plan surgical procedures; they simply don’t cover the CT scan in most cases. The list of noncovered services goes on and on. You may receive a fee schedule if you are in-network with a dental carrier, but they exclude many of the services from coverage. This only increases out-of-pocket costs for patients if we choose to do what’s in their best interests.

Dental practices work hard to utilize the maximum insurance benefit each patient has for the year. That’s $1,000–$1,500 on average, and that average hasn’t changed since the 1960s. The low reimbursements don’t cover many basic services, let alone surgical procedures a patient may need. If a patient presents to your practice with a toothache from a nonrestorable tooth, an implant or a crown will cost $5,000 on average. That is five times the $1,000 maximum insurance may pay for the year. This forces patients to pay a large chunk out of pocket or decline replacement treatment.

The worst-case scenario in this situation is that the patient doesn’t go to a dentist at all because they don’t have dental benefits. Instead, they go to the emergency room. But most ERs will refer the patient to a dentist. It’s a vicious cycle. Patients think they need to have dental insurance to go to the dentist. Unfortunately, people are dying from strokes and heart attacks due to oral infections, with ERs often charging the patient’s medical insurance several thousand dollars for a visit that likely did nothing for the patient.

Think of how many patients you could see in your practice if you could bill their medical insurance … how many lives you could potentially save if you could just do an evaluation and identify infection. More people have medical insurance than have dental insurance, so being able to bill to medical insurance allows you to market this benefit and opens your practice to more new patients. It’s great for the practice, and it allows patients to get the care they need.

What will you decide to do differently this year to grow your practice? Know that your patients have benefits for procedures you perform every day. Know that medical reimbursement is often significantly more than dental. Dental carriers are forcing certain procedures to be billed by medical first, but most dental practices don’t know how to bill to medical insurance. Now is the time to take the leap into medical billing and increase your collections, case acceptance, and new patients, all while decreasing patients’ out-of-pocket costs. Now is the time to shift your mindset and realize you deserve to be paid as a medical specialist, because you are.

Editor's note: This article appeared in the April 2023 print edition of Dental Economics magazine. Dentists in North America are eligible for a complimentary print subscription. Sign up here.

About the Author

Kandra Sellers, BA, RDH

Kandra Sellers, BA, RDH, is creator and CEO of TIPS Medical Billing, which focuses on medical billing as the gateway to dental-medical collaborative success. Kandra is now viewed as a predominant educator in the field of oral systemic health intertwined with medical dental billing. Having been a successful executive coach for the nation’s largest practice management company, and having worked in the dental industry for over 30 years in many different roles she is a sought after coach that will ensure successful implementation of medical billing into your practice. Contact her at [email protected] or visit her website at tipsmedicalbilling.com.

Updated February 6, 2023