The acronym “KPI” (key performance indicator) gets tossed around frequently by business thought leaders. With so much jargon floating around the business world, it can be hard to tease out exactly what terminology is essential and how it applies to your particular organization.

For dental practices, metrics matter and are critical to running a profitable business, but the trick is knowing which ones are actually worth tracking. Before we dive into the specifics, let’s answer the pivotal question on many practice owners’ minds: why do KPIs matter?

Be more than a dental practitioner

You likely chose dentistry as your career path because you’re passionate about health care and live to serve others. You want to influence the lives of as many patients as you can. In order to accomplish that goal, you need to be more than a dentist; you also need to embody the business owner role.

Establishing an efficient, successful, and influential business is only possible if you track and truly understand your KPIs. Not only do KPIs support your business objectives, but they also tell you which objectives are actually important and will make the greatest impact on your patients’ lives and on your business.

KPIs are also critical for performance management and patient satisfaction. They can illuminate the key areas of your practice that are falling short, providing you with valuable solutions for remediating those weaknesses. These could be new tools and technology to provide better care or new procedures to serve more patients in need.

From a financial perspective, KPIs can also help you identify important financial goals that will increase the future value of your practice. Aside from the growth and longevity of your business, the value of your practice matters to your long-term personal financial goals. If you plan to eventually sell your practice to help fund your retirement, then you need to focus on activities that increase your practice value today—and you’ll know which activities you should focus on by measuring and tracking your KPIs.

Which KPIs matter most to dental practices?

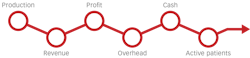

Roger P. Levin, DDS, is a well-known thought leader and the founder and CEO of the Levin Group. He wrote "The 6 critical KPIs for dentists," speaking to the benefits of KPIs and outlining some of the most important metrics that practice owners should be tracking (figure 1).

As you consider those operational KPIs, it’s also important to think about how they translate into financial KPIs and how the combination of the two will help drive your practice’s value.

In the CPA world, we consider your accounting processes akin to regular hygiene visits. Without a consistent focus on accounting (the regular checkup), you cannot ensure a healthy practice or diagnose issues to develop a proper treatment plan. Your accounting structure and process should include a dental-specific chart of accounts that allows you to benchmark your performance against industry averages, your practice’s historical performance, and your ongoing budget and goals. Once you have the proper accounting measures in place, then you can measure the following five financial KPIs (figure 2):

- EBITDA (earnings before interest, taxes, depreciation, and amortization)

- Net cash flow

- Gross margin

- Net operating margin

- ROI (return on investment)

Having a general understanding of these terms can provide a strong advantage to help you build a more profitable practice.

Breaking down the five financial KPIs for dentists

Below, I have outlined what you need to know about the financial KPIs you should be tracking for your business:

EBITDA: Earnings before interest, taxes, depreciation, and amortization (EBITDA) is a measure of a company’s overall financial performance and provides a snapshot of short-term operational efficiency. This term is gaining momentum in dentistry. Why? Practice valuations were historically driven in large part by measuring a practice’s collections. But now, EBITDA is being adopted by more institutions in dentistry as a key valuation metric, thus making understanding your EBITDA more important than ever.

Gross margin: This is a company’s net sales revenue minus its cost of goods sold (COGS). In other words, it is the collections a practice retains after incurring the direct costs associated with producing the goods it sells and the services it provides. The higher the gross margin, the more capital a company retains on each dollar of collections, which it can then use to pay other costs or satisfy debt obligations. Our definition of gross margin for a dental practice is net patient collections minus dental supplies, labs, and clinical staff expenses. Maintaining an exceptional gross margin is the first step in maintaining healthy practice cash flow.

Net operating margin: This historically has been referred to as “industry standard” in the dental world. Industry average is defined as net patient collection minus your primary expenses, including staffing, supplies, labs, advertising, and general overhead (prior to any owner or associate compensation). For example, in general dentistry, the net operating margin has been approximately 40% over the last several years. Higher ratios are generally better, showing that the company is efficient in its operations and is good at turning collections into profits. We believe this will be a very impactful metric to continue to monitor closely as we see labor costs increase, inflation potentially on the rise, and insurance continuing to impact reimbursements.

Net cash flow: In a certain way, this is the easiest metric to understand, yet it’s also the most important. Net cash flow is the difference between the money coming in and the money going out of your practice for a specific period; in other words, it represents how much money is left for you. This is an essential component to measure as you consider the leverage you might have on your practice and how well it can service its debt and provide remaining cash flow for you as the practice owner. It goes beyond just analyzing your profit and loss performance; it also factors in the health of your balance sheet.

ROI: This is a widely used financial metric to measure the probability of gaining a return from an investment. As a dental practice owner, it’s important to have an understanding of this concept and key financial terms. For instance, if you invest in a new technology that costs you $50,000 but generates profits of $30,000 annually, then your ROI is 60%. Choosing to invest resources into practice improvements or technology is an important mindset in order to maintain your net operating margins and cash flow and sustain the value of your practice.

Measuring and understanding these five financial KPIs, in addition to the six operational KPIs introduced by Dr. Levin, allows you to clearly determine whether you are best leveraging your spending within your practice and how well you are managing your ROI. If you properly follow your operational KPIs, have a good accounting structure, and are tracking these metrics closely, you’ll be able to put together those two sets of metrics for optimal success in your practice, thus maximizing your practice’s value and personal success.

In the next article in this series, we will take a deeper look at how practice valuations are derived and offer steps you should take once you know your practice value.

Editor’s note: This article is part one in a series and originally appeared in the September 2021 issue of Dental Economics. Subsequent articles will appear in future issues and at dentaleconomics.com.

Brad McKeiver, MBA, CPA, is partner-in-charge of Aprio’s National Dental Practice. McKeiver works extensively with dental professionals and practices as a strategic business advisor. Having worked with hundreds of dental clients over the past several years, he understands the needs, demands, and complexities his dental clients face. From single practitioners and multi-location practices to larger dental service organizations, McKeiver provides custom solutions for every stage of the dental practice lifecycle.

About the Author

Brad McKeiver, CPA, MBA

Brad McKeiver, CPA, MBA, is the leader of Aprio’s National Dental Practice, where he oversees the firm’s growing staff of dental CPAs and accountants. McKeiver serves as a strategic business advisor to dentists and owners of dental practices and helps them make informed business decisions that increase practice profitability, growth, and value. He also speaks regularly at dental conferences and professional events across the nation.

Updated May 2, 2022