Measuring your real investment results

by Gene Dongieux, CIO, Mercer Advisors

For more on this topic, go to www.dentaleconomics.com and search using the following key words: net investment results, fund operating expenses, taxes, asset management expenses, after-tax return, hedge funds, Gene Dongieux

Q Why is my net investment result lower than my market performance?A After you get your gross market return, expenses and taxes reduce your net earnings. The main categories are fund expenses, taxes, and asset management expenses.Fund expense is the amount charged to manage an individual fund. The fee should vary according to the managerial skill required. For example, an S&P 500 (U.S. Large Growth) index fund should have very low fees because it simply tracks the index. An Emerging Markets Small Value fund should charge more because the manager monitors country economic and political stability, as well as searches out smaller value companies within those countries.

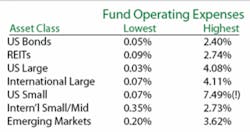

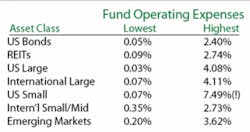

The table below shows the highest and lowest fund expenses for bonds, real estate investment trusts, and five stock asset classes ranked by risk and difficulty to manage. Note the difference between the highest and lowest fees in each asset class.

A bunch of investors with the expensive funds are paying 2% to 4% more than investors with the lowest cost funds in the same category! That's not percentage of increase — that's percentage of your investment balance, so it comes right off the top of your return in good markets and bad.

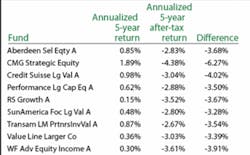

Funds must pay taxes out of invested money, which is one more reason return chasers lose money — they miss the growth spike but come in time to pay the tax on the growth. The way a fund is managed also affects its tax liability. Funds that buy and sell less often will pay less in taxes. Since investors coming and going can force buying and selling, that means that funds that can attract a more stable investor base can pay less in taxes.

The above table shows the difference that taxes can make. A positive return can become a negative after-tax return. Within these funds, that accounts for an average of 3% to more than 6% of your balance per fund disappearing between gross market return and net in-your-pocket return.

Asset management fees don't have this kind of range. The typical asset manager (the one who coordinates all your investments) has a sliding scale from 1.5% to 0.5%. The higher your balance, the smaller the percentage you pay.

Hedge funds are a hybrid, some functioning as funds and some more as portfolio managers. A typical hedge fund fee would be a flat 2% of balance plus 20% of that year's earnings. This was not an issue last year, when the market fell (and many hedge funds did not survive), but in previous years, it would have been a big bite out of your return.

You have not measured your true investment results until you have included these after-market factors.This is why fees and taxes are a critical part of your total asset management plan.

All data for both tables from Morningstar universe as of 12-31-08. Fees are based on prospectus Net Expense Ratios.

Gene Dongieux is the author of “If You Have It Made, Don't Risk It: A Physician's and Dentist's Guide to Investing.” As chief investment officer for Mercer Advisors, he manages more than $2 billion in client assets. Dongieux has been quoted in The Wall Street Journal and Investment Advisor magazine. Contact him at [email protected].