The Impact of the Financial Crisis on the U.S. Dental Industry

By Vijay Sikka, CEO and president at Sikka Software Corporation, and

Gustaf Savin, analytics manager at Sikka Software Corporation

Sikka Software Corporation is the leading innovator in developing business intelligence software for small and medium-sized health-care providers. Their software products enable health-care offices to take control of the business and clinical aspects, which over time have become more complex and involved. The data analyzed in this article is extracted from over 9,500 dental clinics in Sikka Software's vast client network.

The financial crisis of 2007-2009, which is regarded as the worst crisis since the Great Depression, had devastating effects on the U.S. economy and led to the global recession of 2009. Unemployment surged, financial institutions collapsed, and consumer confidence slumped as a result of the crisis. Also, the economic downturn had negative effects on the U.S. dental industry, causing patient visits, practice collections, and net income to plummet.

The U.S. dental industry

When the financial crisis hit the U.S. economy, the dental industry was already in a bleak financial state. According to a recent study by the American Dental Association (ADA), the average net income for general practitioners has exhibited moderate or no growth since the early 2000s. In addition, net income, which measures how profitable it is to run a dental practice, started to decline sharply in the mid-2000s. More specifically, the average net income dropped 13% during 2006 to 2009 (from $219,501 to $191,495).

The decline in net income for dental practices is attributed to several factors including 1) declining utilization of dental care by the adult population, 2) increased financing by lower paying public programs and less out-of-pocket payments, and 3) a change in procedure mix. For example, dental expenditures per capita started to slow down in 2002, several years before the financial crisis. The declining utilization of dental care is driven by the increase in the number of people lacking dental benefits and the austere financial climate.

The financial and clinical impact of the crisis

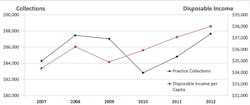

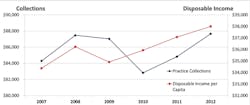

Critical performance measures such as practice collections, patient visits, and doctors' gross production plummeted in the wake of the financial crisis. Practice collections alone dropped 5% between 2009 and 2010 (Fig. 1). However, the dental industry has exhibited strong growth since the crisis. Collections are up 8%, doctors' gross production is up 12%, and patient visits are up 7% since the slump in 2010. The recovery is driven by a steady increase in both patient flow and gross production per visit, which is a result of the better overall economy. For example, the U.S. unemployment rate has decreased from 10% in 2010 to 7.5%, resulting in an increase in the number of people with dental benefits. According to Sikka Software's client data, the percentage of cash patients in the dental industry has decreased from 20% to 17% during the same period, which constitutes a drop of 15%.

The dental in¬dustry was initially not affected by the financial crisis in 2008 (Fig. 1). It took over a year before the economic downturn hit the industry, leading to more no-shows, fewer patient visits, and a lower case acceptance rate. As Fig. 1 illustrates, practice collections closely follow the disposable income per capita. There is a close relationship between collections and disposable income because the end consumer is responsible for a significant portion of the overall dental costs. For example, two-thirds of the population over the age of 65 and one-third of the population between 21 and 64 lack dental coverage. As a result, these people are solely responsible for the considerable out-of-pocket expenses associated with dental treatment. In addition, dental care is in a time of crisis often regarded as optional rather than crucial. Consequently, a lot of Americans postponed their dental treatment until after the financial crisis passed. However, this could have disastrous effects on the long-term oral health in the country.

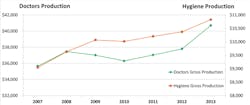

Doctors' gross production dropped considerably between 2008 and 2010, which was a due to fewer patient visits rather than lower spending per visit. In comparison to doctors' production, hygiene production increased slightly during the crisis (Fig. 3). More specifically, patients postponed more expensive procedures such as restorations in favor of less expensive preventative care. Restorative procedures dropped 5% between 2009 and 2010, while prophylaxes increased during the same period. Lastly, both doctors' and hygiene gross production have shown strong growth since the financial crisis. Doctors' production is up 12% and hygiene production is up 8% since 2010. The growth in doctors' production is driven by more patient visits, and increased spending per visit.

As Fig. 3 illustrates, patient visits declined during the financial crisis while gross production per visit increased. The decrease in patient visits during the crisis is a result of the harsh economic climate coupled with an increase in the amount of uninsured patients. According to data from the ADA, the increase in gross production per visit might be driven by increased per-patient spending by patients ages 65+ that purchased more dental services than younger generations. Finally, patient visits are up 7% and gross production per visit 5% since 2010.

Conclusion

In summary, the financial crisis hit the industry hard, leading to more no-shows, fewer patient visits, and lower practice collections. However, collections, patient visits, and spending per visit have exhibited strong growth since the crisis. There are several key lessons to take away from the financial crisis that will help dentists thrive during the next economic downturn. Three of these lessons are 1) analyze the practice's operations, 2) remove financial barriers, and 3) market the practice's services.

Firstly, analyzing the practice's operations will provide valuable insights and guidance, which will help improve the financial as well as the clinical performance. By focusing on reporting, performance monitoring, and benchmarking, it's possible to become more cost-efficient, identify new business opportunities, and increase resource utilization. Secondly, dentists need to remove financial barriers that prevent patients from receiving treatment. For example, the practice should offer competitive fees, affordable payment plans, and collaborate with insurance companies. In addition, the dental practice should provide phase treatment by breaking up expensive treatments into a series of smaller and more affordable procedures. Lastly, the dentist needs to focus on attracting and retaining patients by consistently marketing the practice's services to both new and current customers.

By following these lessons, dentists will be able to thrive during the next economic crisis.

If you are interested in using a business intelligence tool for your practice, download Sikka Software's Dental Practice Monitor™ at no cost. The program shows you a select set of Key Performance Indicators that you can use immediately. It integrates seamlessly with all major practice management systems and installs with a few clicks (www.dentalpracticemonitor.com)

Contact Information:

Veena Padmanabhan

Sikka Software Corporation

Phone: 866-856-7119

920 Hillview Court, Suite 200

Milpitas, CA 95035

email: [email protected]

Past DE Issues