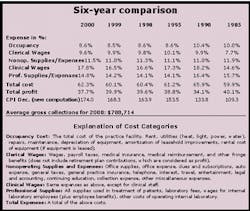

6-year comparison — 2000 Annual Practice Profitability Survey

by Charles Blair, DDS

Current practice profit percentages are even more impressive compared to those of five and 10 years ago.

Practice-profitability percentages increased in most segments of the dental profession last year, continuing the long-term trend of higher profitability. Current practice-profit percentages are even more impressive compared to those of five and 10 years ago. Here are the results of our annual practice overhead and profitability survey, along with our analysis and predictions.

The survey drew more than 500 responses from The Blair/McGill Advisory family of 8,000 subscribers across the country. The average gross collections (per practice) is shown on the chart, along with the average overhead expense and profit percentage.

Significant increases were reported in production and collections during the past year, with most reporting higher profit percentages as well. Orthodontics showed the largest gain, up 1.6 percentage points; followed by periodontics, up 1.5 percentage points; and pediatric dentistry, up 0.6 percentage points. General dentistry and oral surgery registered declines in profitability percentages, dropping 2.2 and 3.7 percentage points respectively.

Over the past five years, practice-profitability gains were even more impressive. Pediatric dentistry led the way, up 3.5 percentage points compared to 1995; followed by orthodontics, up 2.5 percentage points; and oral surgery, up 1.3 percentage points. Periodontics was off by 0.7 percentage points.

All segments of dentistry showed gains in practice-profit percentages compared to 10 years ago (1990). Pediatric dentistry showed the biggest gain, up 7.3 percentage points; followed by general dentistry and oral surgery, up 3.6 percentage points each; followed by orthodontics, up 1.5 percentage points; and periodontics, up 0.1 percentage point.

In retrospect, dental practice profitability percentages hit their ebb in 1989, with every segment except oral surgery reporting a profit percentage below 40 percent during that year. Since then, every segment of dentistry has registered significant gains in practice-profitability percentages on a cumulative basis, although there have been significant year-to-year fluctuations.

More importantly, practice gross collections have registered significant increases in every segment of dentistry on an annual basis. Thus, even though practice overhead expense percentages have risen in some segments of dentistry, the total practice profit (measured in dollars) has grown in every segment of dentistry.

General dentistry

This segment of the dental profession registered a decline in practice profit percentage in 2000, the first such decline since 1997 and only the second such decline since 1994. Total overhead expenses increased from 60.1 percent in 1999 to 62.3 percent in 2000, while the practice-profit percentage declined from 39.9 percent in 1999 to 37.7 percent in 2000. While clerical labor costs dropped slightly due to increased computerization, efficiency, and outsourcing measures, this was more than offset by significant increases in clinical labor, supply, and lab costs.

Compared to five years ago (1995), overhead percentages were also higher, rising 1.1 percentage points from 61.2 percent to 62.3 percent, while the practice-profit percentage dropped from 38.8 percent to 37.7 percent. Confirming the one-year trend discussed above, general dentistry registered the biggest cost increases in the clinical labor and supply and lab areas, which more than offset a drop in clerical-labor costs.

General dentistry's profitability performance was much more impressive compared to 10 years ago (1990), when practice-profit percentages were only beginning to recover from their all-time low registered in 1989. Practice overhead-expense percentages declined from 65.9 percent in 1990 to 62.3 percent in 2000, for a drop of 3.6 percentage points, while practice-profitability percentages increased from 34.1 percent in 1990 to 37.7 percent in 2000.

General dental practices participating in our comprehensive "Profits Plus" program again registered double-digit increases in practice gross collections during 2000, well above the industry average of 7 percent. This significant increase in practice gross collections is related to several factors. First, most doctors are raising fees at an average rate of 5 percent per year, accounting for much of the increase, with the remainder attributed to gains in productivity and improvement in procedure mix.

I see a growing number of general dentists providing composite restorations, endodontics, and lower-level periodontal services in their hygiene departments. However, the fastest growing segment of general dentistry is cosmetic and aesthetic procedures, according to the recently released ADA/Colgate Oral Health Trend Survey. The survey revealed that tooth whitening is the fastest growing segment in most practices (25.1 percent), followed by veneers, laminates, and bonding (21.2 percent).

More general dentists are reducing managed-care participation or eliminating it all together, rather than joining up. Replacing these "discounted fee patients" with full-fee patients has helped doctors report significant gains in collections, even if practice production did not change.

While these factors are extremely positive, operating costs in general dentistry are rising significantly. Most doctors have seen a significant increase in the percentage of their overall production coming from the hygiene department, where labor costs are at an all-time high. Supply and lab costs also are rising, due to the dramatic increase in upper-level cosmetic and crown-and-bridge dentistry. Occupancy costs have increased as a result of new equipment and technology purchases necessary to keep pace, while continuing-education costs to learn and implement new procedures and techniques have escalated as well.

Despite these rising costs, my forecast for general dentistry is extremely positive. I see the demand for general services continuing to increase, particularly for cosmetic-related procedures and other "big ticket" items, while the effective supply of practitioners continues to decline.

I believe that this increase in demand for services and the decline in the supply of practitioners will create further positive changes for general dentists. First, the impact of managed care has peaked in general dentistry, and its decline will accelerate as more doctors opt to discontinue managed-care participation. Moreover, the declining supply of practitioners will make it easier for doctors to implement regular fee increases of 5 to 10 percent annually, leading to greater profitability. Furthermore, implementation of new technology will allow doctors to produce more clinical dentistry in the future within a given facility space, resulting in lower-percentage occupancy costs.

Clerical-labor costs should continue to decline as more doctors move away from managed care and insurance assignment, and utilize back-office computerization for scheduling, coding, billing, and electronic claims submissions.

The above article was reprinted with permission from The Blair/McGill Advisory, a monthly newsletter devoted to tax, financial planning, investment, and practice-management articles exclusively for the dental profession, available from Blair/McGill & Co. Call (704) 424-9780 for further information.