As pricing transparency in dentistry and medicine becomes a hotter topic, it may leave you wondering if you’re pricing your procedures appropriately. You might be increasing prices in step with inflation or just taking a guess, but if you want to be confident in your pricing, it requires analysis. In retail, this is simple because direct costs are clearly documented and easily tracked. But how do you handle pricing analysis in the dynamic world of dentistry?

There are barriers to running a full pricing analysis and completely valid reasons that a practice owner might opt to not make a data-informed decision with their pricing—namely, insufficient information, disjointed systems, and cost effectiveness. In these cases, a simplified model will help alert the practice owner to any red flags in their pricing.

Analyzing your pricing, even in a simplified way, is more labor intensive than other analyses. If you run a profitable clinic, you may wonder why you should bother if everything is working. But if you’re serious about profitability and sustainability in economic downturns, you should do a pricing analysis before updating your fees in 2023.

Overcoming cost effectiveness

Measuring the direct costs associated with every procedure and patient represents an impressive amount of streamlining in systems; the absence of those systems can mean a lot of time spent tracking. For most clinics, this information is simply not worth the investment and stress.

Want to read more from Nicole Rose Yen?

Accounting is more than your taxes

So how do you get the information you need to make decisions without becoming overwhelmed? Select one to three patients for your most common procedures as well as your highest-dollar procedures, and follow the costs plus time for only those sample patients.

There are two parts to consider when doing a pricing analysis: gross profitability (where only direct costs are considered) and operating profitability (where direct costs and a portion of indirect costs are considered).

Overcoming a lack of information

As most clinics are not entirely integrated, conducting an analysis will require amalgamation from various sources. If you’re leveraging your practice management system, much of the information can be found there (from price to time spent), as well as from your accounting system. But if not, as recommended, calculate for only one to three patients per procedure and you’ll be able to do it manually if necessary.

If you use an external lab, know that many don’t itemize their invoices by patient; however, they’ll still have the information in their own systems. Request a summary for your sample patients. If you use several labs, it’s worth comparing patients with cases sent to different labs, as the expense can vary greatly. For the purposes of your calculation, you can use an average or continue throughout separately if you want more information about different scenarios.

Calculating the direct cost of the procedure

Once you’ve done the hard work of tracking time and chasing down supplies and lab costs, how do you calculate the total direct cost of the procedure? To calculate gross profitability, focus on direct costs or the expenses incurred to provide the procedure. Make a list of everything involved with your most popular procedures: dentist commission, assistant hours, hygienist hours, lab expenses, and supplies. (Tip: some supplies will be used for every patient, so you can take note of these once and use it for all procedures you are calculating.)

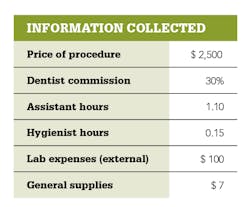

Figure 1 is an example, a hypothetical smile clinic:

To calculate the dentist cost, multiply the commission by the price of the procedure:

Dentist commission: 30%

Price: $2,500

Total dentist cost: $750

To calculate the assistant cost, calculate the number of total working hours per year (2,080 are available to work in a standard year, and subtract any nonworking hours like PTO). Then divide the total compensation by the total working hours. Once you have the hourly cost, multiply that by the hours the assistant spent on the case.

Total compensation: $65,000

Working hours per year 2,080

PTO: -80

Total working hours: 2,000

Hourly cost: $33

Hours spent: 1.1

Total assistant cost: $36

To calculate hygienist hours (paid hourly), simply multiply the time spent by the hourly wage.

Hourly wage: $35

Hours spent: .15

Total hygienist cost: $5

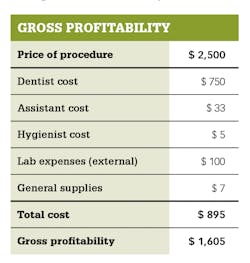

When you put all the factors back into the equation in cost form, you’ll see this (figure 2):

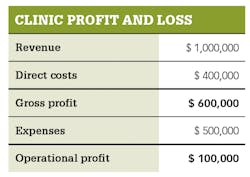

This procedure has strong gross profitability. If your pricing has passed this first test, then it is time to allocate indirect expenses—rent, electricity, website maintenance, marketing, and all other expenses that are not directly linked with a procedure. There are many ways to analyze your pricing and allocate indirect expenses. For these purposes, opt for a simplified model that estimates overhead as a percentage of direct cost (figure 3).

At this clinic, for every $4 spent on direct costs, $5 are spent on indirect costs. Divide direct costs by four and then multiply by five to estimate overhead expenses.

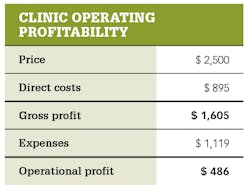

The estimated operational profitability for this procedure is around 20% (figure 4).

Considerations and shortcomings in the calculation

This calculation favors simplicity, which does come at the expense of some accuracy. The more detail you put in, the more reliable the output. In this way, calculations that average the procedure for three patients are more accurate than when you use only one. As every clinic owner knows, price is not collections. If your clinic’s collections deviate significantly from production, substitute price in this calculation for average collection for the procedure.

Whether your clinic is in a stage of growth or maintenance, accurate pricing is key to long-term profitability as well as sustainability in bull and bear markets. The investment in calculations takes resources, but it can represent the difference between retiring early and being forced to close your doors.

Editor's note: This article appeared in the January 2022 print edition of Dental Economics magazine. Dentists in North America are eligible for a complimentary print subscription. Sign up here.

About the Author

Nicole Rose Yen

Nicole Rose Yen is an advisor at Breakaway Bookkeeping + Advising, focused on turning quantitative metrics into actionable strategies for small-business owners specializing in dentistry. She uses tech integration to streamline business inefficiencies and provides strategic planning and financial insights for her clients. As a numbers whiz, Yen finds joy in creating solutions-oriented business plans for her clients. Contact her for information on bookkeeping and financial planning at [email protected] or (503) 610-8349.

Updated July 29, 2022