Most dental practitioners and practice owners went into the business to deliver great care to their patients; it’s part of their oath. To make this a reality, these small business owners have learned how to handle much of the administrative side, including ensuring that insurance payments are paid out. But crunching numbers is not most dentists’ calling, and meetings with accountants often don’t make much sense to them, or the meetings result in dentists thinking they must change their entire workflow to accommodate this pivotal part of the business.

Long-term financial planning

The mindset that says the business operates first and accounting should catch up may be correct, but there is room to dive deeper into the accountant’s recommendations. While accountants are generally seen on the payroll around tax time, these financial gurus can play an advisory role for dental practices to chart financial recommendations and strategies, such as long-term planning, way beyond April 15.

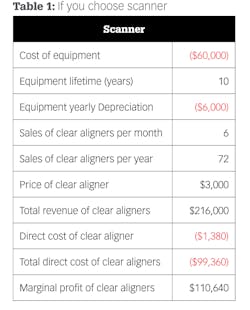

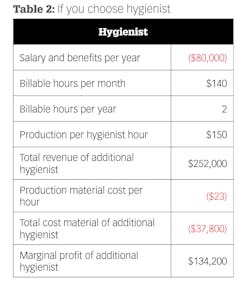

When you look ahead at financial possibilities, you can see that opportunities abound. Minor tweaks or more strategic ways to approach your current situation can level up your practice. For example, after receiving PPP funds, your bank account may be higher than it’s ever been. You may think about bringing in another hygienist or investing in a new scanner. Do you choose the hygienist or the scanner? Let’s run the (simplified) numbers (figures 1 and 2).

Determining potential income variables

Both options add value to the practice, but the calculations show the hygienist as a higher marginal profit, which is a more valuable asset to the practice.

But how do you get to a projection like this? Start by noting all the factors that are different between the two options and exclude anything that is the same. This would mean that the expense projections include the wages of the hygienist and the cost of the scanner but not, for instance, the office manager’s salary. This will be paid in both cases.

When you list the potential income variables, do not shoot for the stars. Look at the history of the hygienist’s billable hours and actual hourly billings. Account for the facts that most clinics cannot instantly fill a chair, and the hygienist will have some administrative time, vacation time, and sick time. To accommodate this in the projections in figures 1 and 2, the working hours were not set at 40 but rather 34 billable hours a week. This allows the hygienist administrative and unscheduled time as well as sick and vacation days.

Also by Nicole Rose Yen

Calculations and considerations when purchasing patient records

Approach New Year’s goals like a marathon

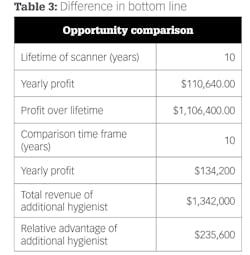

When you compare, think about the lifetime of the options as well as your exit strategy. The lifetime of the scanner is an estimated 10 years, but how long do your hygienists stay with you? To compare apples to apples, I recommend using the same time frame to see how they compare.

Going a step further, calculate the difference in your bottom line over the 10-year lifetime of the scanner (figure 3). While an extra $23,500 a year might not seem like much in a seven-figure practice, extend it over the lifetime of the scanner. The dentist who chooses the hygienist in this scenario will walk away with an estimated $235,600 more than the dentist who chooses the scanner.

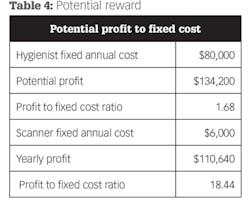

Risks and financial ratios

The raw numbers show profitability, but what about return on your fixed costs? After all, hiring another employee, while potentially more profitable, does come with more risk. If fixed costs and making payroll keep you up at night, then it’s worth looking deeper into financial ratios. One way to weigh the risk to reward, given that no projection can know the future, is to compare potential profit to the fixed cost you’re committing to. The higher the number, the higher the potential reward relative to risk. Let’s look at the numbers in figure 4.

When it’s broken down by ratio, we can see that the scanner has a lot more room for underperformance. Further, the lifetime cost of the scanner (simplified) is $60,000 based on the price from the supplier (in a real-world scenario, you’ll include things like electricity and maintenance), whereas the salary and benefits of the hygienist during the same 10 years is $800,000. Deciding on these factors comes down to your comfort level and exit strategy.

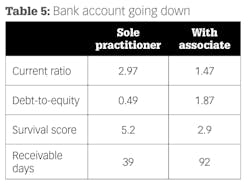

Everyone hopes for calm seas, but business ownership isn’t always choices between two good options. Financial ratios function as an early warning sign for bumps in the road. Here’s another theoretical example. Your business is growing, and your chair is always full. A recent graduate with a great work ethic approaches you and asks if you’d like to take on an associate. It’s a natural fit, so you immediately say yes. You take out a loan to add a chair, and production goes through the roof. But after the last quarter, your bank starts asking for financials more frequently and your bank account keeps going down (figure 5).

The ratios tell a story and give some indication about why the bank is becoming concerned. The current ratio shows that there is less cash on hand to pay immediate debts. There are also increased debts, as seen in the debt-to-equity. Then the survival score has decreased significantly. This all points toward a decreased ability to weather a financial crisis. For dentists, the first place to look when the ratios start shifting unfavorably is at receivable days. In this case, the added associate has overestimated the staff’s ability to bill and receive payment in a timely manner. This, combined with the increased debt, put the clinic in an unfavorable position. Early detection is often the difference between a simple reorganization of duties and a serious financial crisis.

Just like dental practitioners teach that oral health is best maintained proactively, financial fitness is also best when it’s planned. Financial professionals, including accountants, bookkeepers, and advisors, do more than crunch numbers. Include them as you begin your 2022 planning. Ask their opinions before you make your next technology investment or hire a new assistant. Accounting is more than taxes and calculations. It’s what dental practitioners do with these financial figures that enable them to have long-term success and growth. Make sure your financial advisor is included in your planning.

Editor's note: This article appeared in the March 2022 print edition of Dental Economics magazine. Dentists in North America are eligible for a complimentary print subscription. Sign up here.

About the Author

Nicole Rose Yen

Nicole Rose Yen is an advisor at Breakaway Bookkeeping + Advising, focused on turning quantitative metrics into actionable strategies for small-business owners specializing in dentistry. She uses tech integration to streamline business inefficiencies and provides strategic planning and financial insights for her clients. As a numbers whiz, Yen finds joy in creating solutions-oriented business plans for her clients. Contact her for information on bookkeeping and financial planning at [email protected] or (503) 610-8349.

Updated July 29, 2022