The new tax law:Strategies to maximize your savings

by John McGill, MBA, CPA, JD

The Jobs and Growth Tax Relief Reconciliation Act of 2003, signed into law by President Bush on May 28, 2003, reduces rates on ordinary income, capital gains and dividends, and dramatically expands write-offs for new practice investments. Unfortunately, many of these tax benefits are phased out in future years to meet Congressional budget goals. Here's how to maximize your tax savings under this highly complex and controversial tax law change.

The new tax law provides huge tax reductions for doctors and their practices. It enacts tax cuts of $330 billion over 10 years, as well as an additional $20 billion of emergency funding for cash-strapped state governments.

If all of the tax cuts contained in the new law continued for the entire 10-year, budget-time horizon, the total price tag would reach over $800 billion! As a result, Congress phased-out most of these tax cuts after only a few years, in order to hold the cost to the $350 billion mark required to gain approval from both political parties.

What follows is an explanation of the provisions of the new law, along with recommended strategies to generate maximum tax savings.

• Child tax credit — The new law increases the tax credit available for each child under the age of 17 from $600 per child to $1,000 per child, but only for 2003 and 2004. Thereafter, the child credit reverts to current-law levels of $700 per child for 2005 through 2008, $800 for 2009, $1,000 for 2010, and $500 per child each year thereafter.

Unfortunately, the child tax credit is phased out for higher income individuals (over $75,000 of modified adjusted gross income for single doctors and $110,000 for married doctors), so most doctors will not qualify for this tax break.

Strategy: Don't tell your spouse. You'll enjoy "practicing up" for the credit just the same!

• Eliminate marriage penalty — A "marriage tax penalty" exists when the combined tax liability for married doctors is greater than the sum of the taxes owed by each spouse if each was not married and filed a single return. The new tax law eliminates this penalty for 2003 and 2004. It increases the standard deduction amount and the size of the 15 percent regular income tax bracket for joint returns to twice that for single taxpayers.

• 10 percent rate bracket expanded — The new law increases the amount of income taxed in the 10 percent rate bracket from $6,000 to $7,000 for single doctors and from $12,000 to $14,000 for married doctors, for 2003 and 2004.

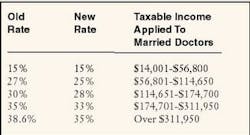

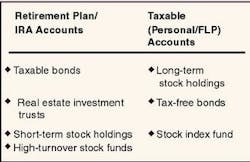

• Reduction in other tax rates — The new tax law also reduces income tax rates as shown in Table 1.

How much will you save?

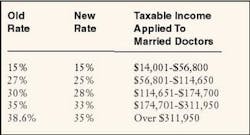

The federal income tax savings from these changes are shown below, based upon a married doctor with taxable income (after all deductions and exemptions have been subtracted) as shown in Table 2.

The tax savings shown above do not factor in any benefit from the child tax credit, lower tax rates on capital gain and dividend income, or any tax benefit from the increased expensing-election and bonus-depreciation provisions discussed below.

Strategy: Rather than giving the government an interest-free loan, doctors should immediately act to reduce their federal income tax withholding and/or estimated tax payments so that they can receive these tax savings now! However, make sure that your federal withholding and estimated tax payment are sufficient to avoid an underpayment penalty. Doctors must pay in at least 90 percent of their 2003 tax liability, or 100 percent of their 2002 tax, as a general rule. However, if the doctor's 2002 adjusted-gross income exceeded $150,000, the doctor must pay in at least 90 percent of his 2003 tax liability, or 110 percent of his actual 2002 tax to avoid the penalty.

Tax rate on dividends cut

Under the new tax law, dividends will be taxed at a maximum rate of only 15 percent to most doctors, down from a maximum rate of 38.6 percent under present law. Moreover, those in the lowest tax bracket (e.g., children age 14 or older) will pay tax at a maximum rate of only 5 percent for tax years 2003 through 2007. The 5 percent maximum rate for low-bracket taxpayers drops to zero for 2008, meaning that dividends will be tax-free for that year!

Stock dividends paid by both publicly-traded companies, as well as closely-held firms (including dental practices), qualify for the favorable tax treatment. Subchapter S company dividends, if paid from prior profits accumulated while operating as a "C" corporation, qualify for this extremely favorable tax break, although the doctor's pass-through share of the practice profits do not. Dividends from money market and bond mutual funds and REITs also do not qualify.

* Strategy: "S" corporation doctors who previously operated as a "C" corporation should pay out a higher percentage of their profits as dividends to qualify for this 15 percent rate.

* Strategy: Borrowing to buy dividend paying stocks can pay off handsomely with dividends taxed at a 15 percent rate and the margin interest deductible against ordinary income, taxed at rates of up to 35 percent. However, the new law allows doctors to deduct margin interest only to the extent of net investment income (not counting dividends and long-term capital gains). So to benefit from this strategy, doctors must have interest income, short-term capital gains or money market or bond fund dividends to deduct the margin interest against.

Lower capital gains rates

While Congress did not raise the $3,000 annual limit on deductions of excess capital losses, it did reduce the rate on long-term capital gains received after May 6, 2003, to only 15 percent. Congress rejected the IRS' plea for a January 1, 2003, effective date; unfortunately, this will lead to a paperwork nightmare for doctors with 2003 capital gains. Doctors receiving installment-sale payments after May 5, 2003 (from practice, office building or other real estate sales) qualify for these lower tax rates, even though the actual sale occurred earlier.

Moreover, the maximum rate on long-term capital gains for taxpayers in the lowest (10 to 15 percent) income bracket (e.g., children age 14 or older) drops to only 5 percent for sales after May 5, 2003, until 2008, when the tax rate falls to zero! Thereafter, the rate springs back to 10 percent in 2009.

These changes further enhance our long-recommended strategies for funding children's educational costs with tax-deductible dollars. As a result of investment losses, many doctors' college funds are well below the amounts required to meet their children's educational needs.

* Strategy: Doctors with appreciated stocks, bonds, or real estate, who need additional funds for college, can transfer these assets to their adult children, or to a family limited partnership (FLP) or limited liability company (LLC) set up on the children's behalf. The appreciated stocks, bonds, or real estate then can be sold and the proceeds used for college, with the gain taxed to each child 14 or older at a maximum rate of just 5 percent!

Children age 14 or older with no other income can receive up to $28,400 in long-term capital gains and dividend income this year, and pay federal income taxes at a rate of only 5 percent! Moreover, the total tax of $1,420 ($28,400 x .05) can be reduced to zero for college-aged children, by using the educational tax credits.

* Strategy: Doctors should hold stocks, bonds, and real estate at least a year before selling. While long-term rates have dropped to a maximum of 15 percent, short-term gains from assets owned for less than a year continue to be taxed at rates as high as 35 percent.

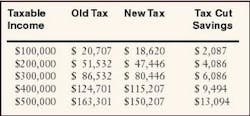

* Strategy: The new law places a real premium on deciding which investments to hold in retirement (retirement plan and IRA) and taxable accounts. For best results, use the allocations shown in Table 3.

* Strategy: As a result of these lower tax rates, doctors should avoid deferral schemes funded with after-tax dollars, such as tax-deferred annuities. In addition to the higher fees and surrender charges, all amounts withdrawn from annuities are taxed at higher ordinary income tax rates (maximum rate of 35 percent). If the same assets were held personally, all capital gains and dividends would qualify for the 15 percent maximum rate.

Increased expensing election

The new law quadruples the amount of new or used dental and office furniture and equipment (including computer software and some business automobiles as discussed below) that doctors can elect to immediately write-off (expense) each year. This amount increases from $25,000 to $100,000, in 2003 through 2005. Despite rising opposition, luxury sport utility vehicles (SUVs), and other vehicles with a Gross Vehicular Weight Rating (GVWR) of 6,000 pounds or more continue to qualify for the increased expensing amount. The new law also increases the maximum first-year tax write-offs for other business autos to $10,710. Finally, doctors now can file amended tax returns to increase or decrease the amount of equipment they wish to immediately expense, rather than depreciate, without IRS approval.

Bonus first-year depreciation increased

Under the new law, the amount of bonus first-year depreciation on new equipment purchases is increased from 30 percent to 50 percent, for purchases after May 5, 2003, and before January 1, 2005. While most doctors will use the $100,000 expensing election to immediately write off the cost of new equipment purchases, the 50 percent bonus first-year depreciation is available for purchases above this amount, as well as for leasehold improvements (but not buildings or other real estate) that do not qualify for immediate expensing.

This article was reprinted from the Blair/McGill Advisory. This newsletter ($195 a year) and consulting information are available from Blair/ McGill and Company,(704) 424-9780, or (888) 249-7537 toll-free.