New Technologies

Dental Economics` annual survey of equipment and technology purchases shows that two newer technologies - digital radiography and air-abrasion systems - are establishing themselves as essential tools in leading-edge dental practices.

Sean O`Connor

Dental practices invested heavily in new technologies in 1997, with air-abrasion systems, digital radiography, and practice-management systems leading the way. These systems, along with intraoral cameras, lasers, and computer hardware, accounted for $355 million in practice spending last year.

In Dental Economics` annual survey of equipment and technology purchases, conducted jointly with Dewar Sloan Research and Planning Group, over 5,000 of you reported on your purchases and ownership of traditional and high-tech dental equipment. Among other things, this study revealed that two newer technologies - digital radiography and air-abrasion systems - are establishing themselves as essential tools in leading-edge practices.

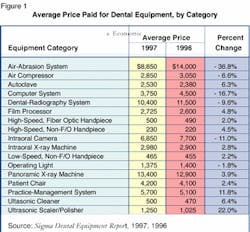

More than 3,000 digital radiography systems were purchased in 1997, nearly double 1996 sales. This increase in sales, along with an increase in the number of manufacturers of these systems, suggests that digital radiography is becoming more widely accepted in the profession as a valuable diagnostic and marketing tool. A slight reduction in the average price paid for a digital radiography system - from $11,500 to $10,400 - also makes the systems more affordable.

Another rapidly evolving equipment category - intraoral air-abrasion systems - drew nearly 6,000 buyers in 1997. This is three times more buyers than in 1996. Two factors seem to be driving the strong sales of air-abrasion equipment. First, the average expenditure for an air-abrasion system fell from $14,000 in 1996 to less than $9,000 in 1997. Doctors can buy a very basic air-abrasion unit for as little as $1,000. They also can spend considerably more for an advanced system with a built-in air compressor, evacuation system, and rapid-curing light.

Another factor driving the growth of air abrasion is its use in conservative and cosmetic dentistry. When an air-abrasion unit is combined with one of the most common system add-ons - a rapid-curing light - the complete package can become a great system for quick, minor operative preparations and tooth-bleaching procedures.

A final category that is not necessarily new, but which also saw considerable growth in 1997, was practice-management and computer systems. The study showed that over 14,000 management-software systems were purchased last year, a 25 percent increase over 1996. The average cost of these software systems increased $600 in 1997 to about $5,700.

In addition to the nearly $80-million investment in practice-management software, doctors invested another $80 million in computer hardware and accessories. The average expenditure for a computer fell to $3,750 in 1997, down from $4,500 in 1996. This is a welcome indication that a practice will not necessarily have to buy the latest and most powerful computer to run the newest practice-management software.

Falling computer-hardware prices also encourage the trend toward computerization of the operatory. In 1997, 21 percent of practices had computers in their operatories, compared to 18 percent in 1996. While this still is a minority of practices, it reflects a continuing trend toward the direct integration of clinical-patient data into practice-information systems.

Overall, the strong allocation of practice-investment dollars toward newer technology and equipment resulted in a nominal decrease in investment in traditional large-operatory equipment like patient chairs, delivery units, and operating lights. In the small-equipment categories, doctor purchases of handpieces, composite curing lights, and ultrasonic scalers increased in 1997, while purchases of ultrasonic cleaners fell.

These trends, when viewed in a 10-year context, suggest that practice spending on traditional dental equipment continues with updating and modernization expenditures, along with stronger investment in the newer-equipment technologies.

Figure 1 below lists the average price paid for certain types of dental equipment in 1997 and 1996, and the percentage of change in price from year to year.

In addition to tracking your purchases of dental equipment, this annual survey also records the current inventory of equipment in your practice.

Figure 2 on page 60 shows the percentage of practices that own a certain number of units. The information is broken down by practice type and can be used to benchmark your practice against your peers.

Dental Economics` annual survey of trends and issues in the dental-equipment market is conducted each January through Dewer Sloan`s Dental Care Economic Model program (DeCEM).