Implant Dentistry: Crucial Factors Influencing Future Growth

Changes, challenges, partnerships, and potentials.

by Jean A. Sagara

Ask manufacturers associated with implant products and they will likely share their disappointment over the slow growth of implants as a treatment modality during the past 20 years. Ask these same individuals what they think the future holds for implant dentistry over the next 20 years — even the next 10 years — and they will describe a future that bears little resemblance to the past. They will forecast a growth that favors everyone — the dentist, the patient, and the manufacturer. Their view is informed by the facts. They suggest that changes in three critical areas are impacting growth positively:

- The products

- The costs

- The patients

A reprise of the problem

In our February article in this series, we reviewed the status of implants as a treatment option. We considered what the barriers to greater adoption appeared to be. We also advanced the views of dentists and laboratory and manufacturing leaders concerning the imperatives for success — namely, good case-planning and clinical communication among the restorative dentist, the surgeon, and the laboratory technologist. Nevertheless, based upon our conversations with general practitioners, we had to acknowledge that certain barriers to a wider acceptance of the implant dental solution remained. The obstacles included:

- Complexity of the implant procedures.

- Costs and timelines associated with the treatment.

- Commitment required to become expert with the technology.

A changing context

If we look more carefully at the reasons for the emerging growth given by the industry, they do, in fact, go a long way toward directly addressing these three concerns.

Products are becoming easier to use, accompanied by fewer risks and enhanced outcomes. Cost comparisons are acquiring more sophistication as the long-term view is applied to the virtues of implants: the more stable implant reduces bone resorption vs. the crown-and-bridge approach.

Moreover, patients are becoming better informed and more willing to contract for a better-looking, more functional result. Naturally, none of this is lost on younger dentists entering practice who understand that implant dentistry can become an ever-increasing part of their practices. Their willingness to study at the postgraduate level to acquire a higher skill base is motivated by the anticipated return on that investment as they assess market changes.

Clinical partnerships

Today, specialists dominate the implant market and perform 80 percent of all implant treatments in the United States. Another way to look at it is to realize that only 6-7 percent of dentists perform implant surgery. Most often, these specialists are periodontists and oral surgeons. General practitioners may participate in related services, such as CAT-scan imaging, case-planning, and restorative work, but the "heavy lifting" traditionally has belonged to the specialists.

In particular, look at the apportionment of dollars from implant treatments: the surgeon receives the most significant share, not the restoring dentist or the dental laboratory. For significant growth to occur, GPs must change and take advantage of the opportunities as referring and restorative dentists. To encourage this, technology must create a more level playing field by reducing the risks while stimulating increased market awareness of the superior performance of implants. With this accomplished, an informed consumer will expect the practitioner to not discourage the implant modality. Thus, a growing demand will emerge for implant dentistry.

The traditional consumer-patient

It is estimated that, currently, $145 million is spent annually on denture adhesives. In addition, at least 40 percent of denture-wearers have worn the same device(s) for more than 10 years. This latter statistic suggests that, at a minimum, these denture-wearers are experiencing accelerated bone loss. With 40 million Americans over age 55 having lost some or all of their teeth, the scale of projected bone loss is too profound to calculate if crown-and-bridge remains the primary treatment.

In our first article, recall the statistic that not more than 3 percent of the potential implant market had been secured. Some have placed that statistic as low as 1 percent, suggesting a significant disinclination by general dentists to embrace implants for their edentulous patients. But bone loss is not a good thing, and treatment alternatives that offer a more stable oral environment need to be more seriously considered.

All other things being equal, if the general view holds that implants give replacement teeth a more stable base with less risk to abutment teeth while providing a better solution in the overall treatment plan, the clinician's responsibility to overcome resistance is compelling.

The emerging consumer-patient

Currently, nursing homes may feature large numbers of false teeth on bedside tables at night, but the Baby Boomers are likely to have none of it! As they age, they are becoming more educated about their medical and dental health-care options. They make no apologies for their vanities, seeking out cosmetic, youth-sustaining enhancements such as teeth whitening, laser vision correction, cosmetic facial surgery, liposuction, etc.

The "celebrity culture" was, many argue, appropriately chastened by the events of September 11, 2001, but the informed consumer did not disappear. That same consumer is increasingly empowered by word of mouth and the Internet to contract for the best health-care options available. Sophisticated patients want higher quality treatment, particularly if implant manufacturers and industry leaders increase their direct-to-consumer advertising and public awareness campaigns. Such initiatives mean that implant dentistry will grow from consumer activism. Consumers will demand its superior benefits, and the industry will move toward a new standard. The implant solution will be sought by the many — no longer the few.

Implant manufacturers respond

Implant manufacturers recognize that public awareness is not the only effort that they must undertake. They also must improve their technology if they are to remain relevant and viable in a field being shaped by competitive market demographics. As it happens, they are making improvements. Millenium Research Group (MRG) has provided us with a useful understanding of the United States dental implant market. It segments the market by three key product characteristics that include:

Shape: Parallel, walled, threaded screws vs. tapered, threaded-screw implants. The latter is shaped more like a natural tooth root — thin at the bottom and wider at the top. MRG estimates that by the year 2006, tapered threaded-screw implants will represent 32 percent of all dental implants, up from 20 percent in 2000.

Coating: In the past, all implants were smooth. Many still are, with machined surfaces such as hydroxyapatite-coated or titanium-plasma spray-coated. This is changing, however, with 54 percent of all dental implants now noncoated. These rough-surfaced implants reportedly provide superior performance, more stability, and promote healing at least 3-4 times as fast as the alternative.

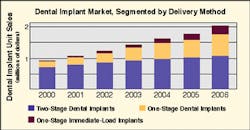

Method of delivery: Typically, implants have been placed in a two-stage process. A more efficient method is emerging: the one-stage delivery method. This also is credited with promoting higher levels of healing and improving the implant's strength while reducing the cost and total chair time required. To quote Millenium Research Group, " ... the most exciting aspect of the dental implant market in terms of delivery method concerns the emergence of the immediate-load, one-stage implant." In this approach, surgery typically is followed by the immediate attachment of the prosthetic structure. The same research group estimates this method will grow at a steady rate from 2002 to 2006. (See graph.)

The graph charts the U.S. dental implant market, segmented by delivery method. It illustrates the dynamic direction being taken by implant manufacturers, and portends ease of use for dentists with the improved implant systems now available.

The implant solution will engage

Naturally, if better results can be achieved in a shorter period of time, patients and dentists both benefit. Patients benefit from a less costly, less problematic procedure; dentists benefit from more rapid patient turnover and increased patient flow. As one industry spokesperson said to us, "... overcoming the resistance of the general practitioner is the holy grail of implant dentistry." Manufacturers are investing considerable time and money into research and development to improve their products. They also are working to improve practitioner training. Lastly, they are developing mass marketing and public relations campaigns to raise awareness about dental implants.

Whether it is the newly arrived DenX guided-imaging systems, or the existing market leaders such as Nobel Biocare, 3i, or Sulzer and Straumann, implant manufacturers are working to enhance their partnerships with general dentists and dental specialists. They recognize that growth in implants requires fusion of the three elements we have reviewed:

- The market opportunity created by an informed and demanding consumer.

- A more highly skilled and confident general practitioner working together with the surgeon and laboratory expert to recommend and pursue the implant treatment option.

- A better portfolio of products from the implant manufacturers that reduces complexity and costs.

The dynamic of change is underway! Everything would seem to be falling into place. So, for the general practitioner and all the participants who can benefit from this development, we say, "Carpe diem." On your mark, get set, ready ... go!

(Note: For more information on the manufacturers listed, please visit Sagara's Resource Listing at www.tra nscendonline.com.)