Section 199A and entity selection

William P. Prescott, JD, EMBA

The new 2017 tax bill, commonly referred to as the Tax Cuts and Jobs Act (the 2017 Act), made significant changes to the tax code, including the enactment of Internal Revenue Code Section 199A. Section 199A affects professional and nonprofessional practice business owners who do not operate as C corporations. This article considers how Section 199A impacts dental practice owners.

Should a practice owner consider changing the practice entity in light of Section 199A? No, because many provisions of Section 199A require clarification and further guidance. Once the entity form is changed or a planning strategy is prematurely implemented, it usually creates a tax effect and can be difficult to undo.

Section 199A defines qualified business income (QBI) as profit generated from a pass-through entity. Under Section 199A, the pass-through business owner is granted a pass-through deduction against the allocable share of the owner’s W-2 wages (i.e., the owner’s wages plus a percentage of wages paid to the other employees of the practice or business). Taxable income means income from all sources less permitted deductions, exemptions, and any credits (collectively taxable income).

Specified service, trade, or business

For a specified service, trade, or business (SSTOB), the pass-through deduction is limited. An SSTOB includes dentists and most other professionals. If an SSTOB owner’s taxable income is below $157,500 (single) or $315,000 (married), the pass-through deduction is 20% of QBI. If an SSTOB owner’s taxable income is between $157,500 and $207,500 (single), or $315,000 and $415,000 (married), the pass-through deduction phases out and is limited. If an SSTOB owner’s taxable income is above the income thresholds of $207,500 (single) or $415,000 (married), there is no pass-through deduction. However, all tax rates beginning in 2018 are lower across the board than the 2017 rates.

C-corporation conversions

C corporations now have a 21% tax rate versus a 35% tax rate. The 21% rate, when combined with a possible second capital gains tax upon dividend distributions on the sale of the practice,1,2 does not fare better than the rates for an S corporation, limited liability company, or sole proprietor. There is considerable debate on which entity provides maximum tax reduction given the particular level of taxable income.3 Unlike the 2017 Act, the 21% C-corporation rate is intended to be permanent.

Qualified trades or businesses

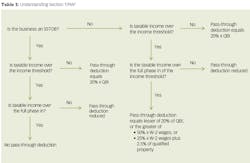

Qualified trades or businesses (QTOBs), such as real estate, practice management entities, and other nonpractice entities, are businesses that are not SSTOBs. If a QTOB owner’s taxable income is below $157,500 (single) or $315,000 (married), the pass-through deduction is 20% of QBI. If the QTOB owner’s taxable income is between $157,500 and $207,500 (single), or $315,000 and $415,000 (married), the pass-through deduction phases out as taxable income rises. If a QTOB owner’s taxable income is above the income threshold, the pass-through deduction is not eliminated, but equals the lesser of the following: 20% of QBI, or the greater of 50% of the owner’s allocable share of W-2 wages, or 25% of the owner’s W-2 wages plus 2.5% of the purchase price of qualified property. Qualified property means depreciable property used in the business, including equipment and real estate placed into service within the later of 10 years or the depreciation period. See Table 1 for a chart that helps clarify the SSTOB and QTOB pass-through deductions.

One good and three questionable planning strategies

Because SSTOB practice owners will desire to reduce taxable income from practice operations and reallocate it to a QTOB, some advisors are advocating four strategies: (1) increased retirement plan contributions, (2) forming practice management entities that are not SSTOBs, (3) changing nonowner associates and retired practice owners continuing to work after a sale from employee to independent contractor status, and (4) increasing rent where the practice owner owns the practice real estate in a separate entity.

Retirement plan contributions

Increasing retirement plan contributions, especially for the practice owner and staff, is a good idea, irrespective of the 2017 Act. The rationale is that if the practice owner does not save in a tax-qualified retirement plan, how disciplined is the practice owner to save outside of a tax qualified retirement plan? Safe harbor 401(k) profit-sharing plans can provide significant benefits to practice owners and their spouses, and also allow the staff to contribute to the 401(k) plan at a relatively low cost to the practice. Further, if a practice owner is 50 years of age or older, the practice can adopt a defined benefit or cash balance plan that can provide for extreme contributions for the owner, although the same mandatory contribution must be made each year (e.g., for five years).

Practice management entities

Administrative and management companies provide billing, collection, insurance coding, and other ancillary services (including employment of administrative staff) to the practice. Practice owners are being advised to establish these companies through a nonprofessional separate pass-through entity owned by the practice owner or owners, the owner’s spouse, or possibly the children.

Some practices have been utilizing administrative and management entities through separate administrative and management services agreements for some time. In addition, corporate practices customarily use administrative and management companies to avoid nondentist ownership of practices in states where only a licensed dentist can own a dental practice.

If your practice is utilizing an administrative and management services agreement, the services provided should equate to the fees paid. In addition, prepare yearly minutes to document that the administrative and management services were performed. Furthermore, document the provision of the administrative and management services in every way possible, including time spent on administrative and management services versus clinical services. This is similar to a mileage log for business automobile use between multiple offices.

Independent contractor status

Associates are being advised to form separate entities and practice as independent contractors to obtain a pass-through deduction of 20% of QBI, depending upon taxable income. A pass-through deduction is unavailable to associates who are employees. The entity should not be a limited liability company because it is considered a disregarded entity or sole proprietorship under state law, not a separate entity, as is an S corporation.

If an associate undertakes this strategy, the associate should form an S corporation, then enter into an employment agreement with the S corporation, giving it control over all business and professional activities of the associate. Thereafter, the associate should enter into an independent contractor agreement between his or her S corporation and the practice.

This methodology follows the Sargeant case.4,5 While this is not a bulletproof strategy, if corporate formalities are followed (e.g., preparation of shareholder’s and director’s minutes on an annual basis), and at least one nontax business purpose exists, the worker usually will be treated as an employee of his or her corporation and not the practice.6 An example of a nontax business purpose may be where the associate works for another practice. In most cases, however, following the Sargeant methodology will not work because the S corporation must be formed prior to entering into the arrangement.7,5

Retired dentists who continue to practice to transfer goodwill and provide clinical services are also being advised to practice through their existing C or S corporations, not only for the pass-through deduction of 20% of QBI, but also to deduct direct business expenses, insurances, and benefits not otherwise deductible as an employee.

Expect increased worker classification audits, particularly in light of Section 199A. Notwithstanding Section 199A, the Internal Revenue Service (IRS), the Department of Labor (DOL), and the states all have different standards for determining worker classification status. The IRS standard is whether the business or practice has control over the worker’s activities, irrespective of whether that control is exercised.8 If control is present, the worker is an employee. The strict DOL standard is an analysis of whether the worker truly is in business for him- or herself. If not, the worker is an employee. The states each have their own standards which appear to follow the DOL standard to a greater extent than the IRS standard.9

Real estate entities

If the practice owner owns the practice real estate, the goal is to attempt to ensure that the real estate entity qualifies as a QTOB. With sufficient rent, a QBI could be generated. However, if the real estate entity leases only one property, there is authority that the real estate entity is not a QTOB.10 To support the argument that the real estate entity is a QTOB, the landlord could consider hiring maintenance and janitorial staff and require the tenant to reimburse the landlord for those costs.10 Additionally, paying too high a rent risks having it recharacterized if rent exceeds the fair market value of the facility within the geographic area. Furthermore, increased rents can lead to difficulties for associate buy-ins and future sales of the practice and real estate.

Further guidance expected

Expect further guidance on Section 199A. The American Bar Association Section of Taxation Committees have been asked to provide comments to the IRS and issue a white paper on Section 199A. Additionally, the American Institute of CPAs has requested guidance on the complex calculation of QBI.11 Hopefully, guidance will be issued in time for CPAs to properly prepare 2018 tax returns.

Should the practice owner change the entity form as a result of the 2017 Act? No—at least not until further guidance is issued. However, if you do practice as an S or C corporation, it is necessary to comply with corporate formalities in order to maintain limited liability.References

1. Prescott WP. The current status of personal goodwill. Dental Economics. 2016;106(10):54-55.

2. Sklarz MG, Dirmann JM, Prescott WP, Kliegman EV. Personal goodwill in asset sale of “C” corporations. The Practical Tax Lawyer. 2017;31(3):15-20.

3. Understanding Tax Reform – How Will It Impact Small Business? Small Business Council of America. Webinar presented on: January 9, 2018.

4. Sargent v. Commissioner, 93 TC 572 (1989), 929 F2d 1252 (8 Cir. 1991).

5. Prescott WP. Worker classification: A continuing problem. Dental Economics. 2017;107(10):28-33.

6. Department of the Treasury Internal Revenue Service. Independent contractor or employee? Training materials. https://www.irs.gov/pub/irs-utl/emporind.pdf. Published October 30, 1996.

7. Dutch Square Medical Center Limited Partnership v. United States, 74 AFTR 2d 1994, 6356, 94 2 USTC (DSC 1994).

8. Prescott WP, Cook J, Longman RA, Williams BJ. Worker classification—the IRS, DOL and the state of California. Panel at: the American Bar Association 2018 Midyear Meeting; February 9, 2018; San Diego, CA.

9. Prescott WP, Longman RA, Khalsa SN, Petrova G. Worker classification, the IRS, DOL and states. Panel at: the American Bar Association Section of Taxation 2018 Meeting; May 11, 2018; Washington, DC.

10. Gorin SB. Section 199A – planning to maximize deductions. Webcast by: the American Bar Association Section of Taxation; April 3, 2017.

11. AICPA asks IRS to clarify QBI. Business Valuation Resources website. https://www.bvresources.com/articles/bvwire/aicpa-asks-irs-to-clarify-qbi. Published February 28, 2018.

William P. Prescott, JD, EMBA, of the law firm Wickens, Herzer, Panza, Cook, & Batista Co. in Avon, Ohio, is a practice transition and tax attorney and a former dental equipment and supply representative. His most recent book is titled Joining and Leaving the Dental Practice (third edition). For this and Mr. Prescott’s other publications, see prescottdentallaw.com. Mr. Prescott can be contacted at (440) 695-8067 or [email protected].