Success by numbers

Allen Schiff, CFE, CPA

During the fourth quarter, dentists are not only busy guiding patients to help them take advantage of their unused insurance benefits, they’re also busy preparing financial reports for end-of-year tax planning for their practices. It’s one thing to look at the reports and numbers, but it’s quite another to learn the story they tell—the story of the practice’s current level of financial success and opportunities for improvement.

When you look at the story the numbers tell in terms of success, it’s all about the last chapter—retirement. While you enjoy your work, at some point the culmination of your practice’s success will enable you as a business owner to enjoy life after dentistry. (Yes, there is such a thing and it can be wonderful.) But you have to start with the end in mind and set a goal to not only collect money, but also manage it wisely, now and into retirement. So, let’s look at the numbers and some practical advice to ensure the numbers are in the right range to provide for your future.

© Khatuna Bandzeladze | Dreamstime.com

Set a goal

The first step of money management is to enlist the help of a trained and experienced professional, such as a qualified CPA and/or financial manager. Together you should determine your financial retirement goal, the amount of money you will want and need to live the life you envision when you’re no longer practicing. A recent American Dental Association Health Policy Institute report found the average age of retirement for dentists has increased to 70.1

No matter your current age or the age at which you want to retire, the key is to start planning now and make sure your practice’s numbers are in line with your long-term goals. As the president of the Academy of Dental CPAs, I advocate that you select a CPA and/or financial planner who knows dentistry, understands your unique needs, and can proactively add value through insights and experience. Remember, it’s not about what you pay; it’s about the value these professionals can bring to the table. Money management is an investment in your future.

Know what’s coming in and from where

There are two sides of profitability—income and expenses. Let’s start on the positive side of income and the numbers that set the stage for a solid financial performance. First, every practice should be collecting 98% of what it produces. There will always be insurance adjustments and write-offs, but the goal is 98%. If you are not collecting 98% of production, this is the first area to start changing.

When it comes to total office production, 75% should be from general dentistry and 25% from the hygiene team. If hygiene is contributing more than 25% of total production, this may indicate that you are not converting hygiene patients who need treatment into scheduled and completed dentistry. If this is the case, make sure your team is utilizing visual aids and technology to enhance patient understanding and value of the dentistry, and that they are offering third-party financing to overcome cost as a barrier to care.

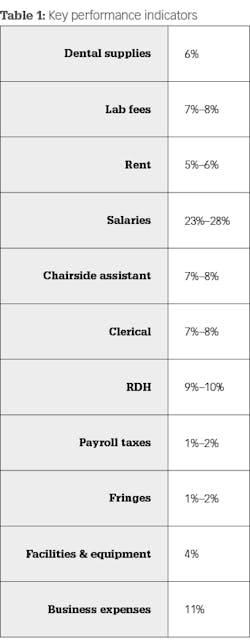

The other side of profitability is overhead, which should be between 60% and 65% of collections. There are six key performance indicators that can be measured and monitored. Ideally, these expenses should be within the stated ranges, although there may be variances that depend on the technology and total health-care services offered in the practice (table 1).

The bucket of business expenses includes everything from advertising to uniforms. If you’d like the details of these components and the recommended percent of collections, you are welcome to email me at [email protected]. I’d like to offer just one piece of wisdom when it comes to managing overhead—always remember that your team is critical to your success, and salaries and perks are not the first things you should look at to tighten your belt if production becomes stagnant or declines. Treat your team well and they will treat your patients well.

The final 40% of collections is what I call “output.” This consists of the doctor’s salary or draw (depending on how the business is set up); automobile costs, meals, and entertainment; travel, life, and disability insurance; and retirement contributions. All of these are to benefit the doctor and are part of his or her compensation package. It’s this piece of the pie that the doctor will use for his or her current lifestyle and to invest for retirement.

What contributes to retirement?

In general, there are four primary income sources that can contribute to the dentist’s retirement: personal home, retirement plan, value of the practice, and value of the facility (if owned). Because each person is different and the laws in each state vary, there is no silver-bullet formula to share. Again, that’s why hiring the right financial planner and/or dental CPA can be a smart investment. For example, this person can demonstrate how a 401(k) plan makes more sense for most dentists than a SEP or SIMPLE plan due to allocation. Or, this person can explain how the $800,000 gained from the sale of a practice nets only a $550,000 contribution to your future after taxes and expenses of sale.

Whether you work to live or live to work, looking at your numbers and listening to the story they tell so you can make appropriate adjustments can ensure your story has a happy ending.

Reference

1. Munson B, Vujicic M. Supply of dentists in the United States is likely to grow. http://www.ada.org/~/media/ADA/Science%20and%20Research/HPI/Files/HPIBrief_1014_1.ashx. American Dental Association Health Policy Institute research brief. Published October 2014.

Allen Schiff, CFE, CPA, is the managing member of Schiff & Associates LLC (S&A) and president of the Academy of Dental CPAs (adcpa.org). He has more than 35 years of experience in the area of dental practice management. His services include business planning to obtain financing, succession planning, exit strategies, and long-range planning. For the last 31 years, Schiff has taught in dental schools on the subject of dental practice management.