Appropriate compensation for associate dentists

QUESTION: I plan to hire an associate dentist and pay him or her based on collections, with a percentage reduction of the associate's dental laboratory costs. How do I calculate the laboratory fee reduction? Does it even make sense to have a reduction of dental lab fees?

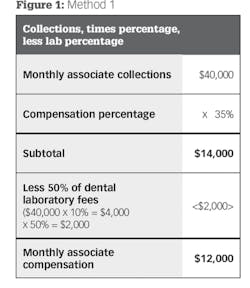

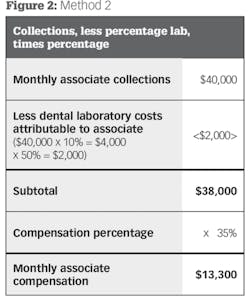

ANSWER: If there is to be a reduction of the dental laboratory costs from the associate's collections, there are two methods of calculating the reduction. The first method (Figure 1) is for you to pay the associate on his or her collections, multiplied by the collection percentage paid, less the lab reduction percentage. The second method (Figure 2) is for your practice to pay the associate for his or her collections, less the percentage of dental lab costs, multiplied by the collection percentage paid. Both methods have different economic outcomes, which means it’s important to specify how a reduction to dental lab costs will be handled in the associate's employment agreement.

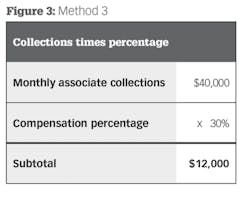

However, there is a third option that is simpler. Rather than calculating dental lab reductions, consider paying the associate a lesser percentage of collections and forget about calculating the dental laboratory reduction percentages (Figure 3). To control dental lab quality and costs, you can specify the dental labs that the associate may use. If you allow the associate to use a dental lab not on the approved list, the associate should be responsible for 100% of the fees.

In the examples in the methods, assume the monthly associate collections are $40,000 and the dental lab reduction percentage is 50%. The associate compensation percentage is 35% in Methods 1 and 2, and 30% in Method 3, which has no laboratory reduction percentage.

Reductions and calculations of lab fees lead to the associate payment process being more complex than it needs to be, which is why Method 3 may be a good option. Specify the dental labs that can be used by the associate to control both quality and cost.

Related reading

Options for associate compensation

DE's Business Lab: Appropriate associate dentist pay

QUESTION: What are options for compensating the associate I plan to hire?

ANSWER: Options for compensating an associate are a percentage of collections, a percentage of production, or a base salary, which may include an annual bonus for some specialists.

For general dentists and some specialists, determining whether the associate is paid a percentage of collections or production comes down to which method works best for your staff and software system. If your practice will have more than one associate, all should be compensated in the same format.

Collections: Paying the associate based on collections is relatively simple to calculate. However, due to initial collection lead times, the associate should request the greater of a base compensation rate per month, workday, or hour for a defined period of time, often 90 to 180 days. Thereafter, the associate should be paid only on the collection percentage. The base is "trued up," typically on a quarterly basis.

Rather than a base compensation rate for a defined period of time, some practices, often corporate ones, pay the associate as a draw rather than a base. The draw is offset against the associate's future collections. The associate should be very cautious about taking a draw in excess of what future collections are predicted to be, particularly where the associate has limited ability to control patient flow or the collection policy of the practice. In addition, the associate needs to know whether any excess draw must be repaid should the employment be terminated, which should be specified in the employment agreement.

Production: If production is used to pay an associate, adjustments should be made for insurance and other write-offs, patient refunds, uncollectible accounts, and laboratory remakes (adjusted production). With adjusted production, a base for a limited time may not be necessary. The adjustments are "trued up," usually on a quarterly basis.

If your practice collection percentages are healthy, adjusted production works well because there is no lag time from the date of production versus the time it takes to collect the fees. If the collection percentage is a problem, it is best to hire the associate after the collection problem is resolved.

Base salary: Some specialty practices—notably orthodontics and oral and maxillofacial surgery—pay an associate a yearly base compensation rate, with bonuses based on productivity. This is typically paid within 30 days of the end of each calendar year until ownership is offered and accepted.

Another method of paying bonuses is discretionary based on the associate's overall contribution to the practice, and further based on the practice's cash and financial position. An advantage to discretionary bonuses is that all activities of the associate are evaluated, not just productivity. The practice’s cash and financial position is important as there may be less profit to distribute if the practice relocates during a particular year, or if the practice is shut down for a period of time, as was the case in 2020.

For general dentists and some specialties, paying an associate on either collections or adjusted production works well and depends on the practice software system and what works best for the staff. For certain specialty practices, such as orthodontics and oral and maxillofacial surgery, a base salary with performance bonuses works well.

Editor's note: This article appeared in the March 2022 print edition of Dental Economics magazine. Dentists in North America are eligible for a complimentary print subscription. Sign up here.

About the Author

William P. Prescott, JD, EMBA

William P. Prescott, JD, EMBA, of Wickens Herzer Panza in Avon, Ohio, is a practice transition and tax attorney, as well as a former dental equipment and supply manager and representative. His most recent book, Joining and Leaving the Dental Practice, 4th edition, is available through the ADA Center for Professional Success. ADA members can download the e-book for free at ada.org/prescottebook. For this and Prescott’s other publications, visit prescottdentallaw.com. Contact him at (440) 695-8067 or [email protected].