Practice values: Now what’s it worth?

Editor's note: In the first of this two-part article on valuation, Mr. Prescott discusses practice values in the current environment. His second article will discuss partnership values and related tax issues.

Historically

Fifty years ago, established practices had relatively no value because it was not expensive to establish a new practice or join an existing one due to high patient supply and demand. No incoming dentist wanted to work with old equipment at an existing location with low square footage. As the ability to attract new patients decreased and the cost of establishing a practice increased, it became more difficult to establish a practice. Eventually, existing practices became more valuable.

What’s new?

What’s changed in dental practice values through the years? Until recently, not much. But now, sharply rising dental school debt has resulted in the need for incoming dentists to purchase large practices—with about $1 million-plus of yearly collections—to earn a living and meet debt obligations. While the COVID-19 crisis and fear of the unknown appear to be a long-term threat, so is the proliferation of corporate practices.

The crisis

Many dentists who were planning to sell within one or two years are now deciding to retire. On the other hand, some dentists will be forced to work longer than they expected to if their retirement plan balances significantly decline or their practices incur significant debt.

To the extent that social distancing and new dental practice COVID guidelines remain in effect, the result could be a decline in revenue, increased operating expenses, and reduced profit. One way to reduce the risk of a reduction in patients is to implement effective protocols and systems as efficiently as possible. Practices that do so will flourish and should be able to get production back to or near pre-COVID levels, and many are already doing so.

Corporate practices

Corporate practices have traditionally used the same valuation formulas that provide a sufficient cash flow for a private purchaser. But lately, some corporate practices have been paying much more than fair market value in primarily urban areas that the corporate office chooses. For years, overpayment for practices was common in veterinary medicine so that the profession could roll up into one that is primarily corporate owned. The same is now occurring in dentistry.

The “hold-backs” of approximately 20% of the purchase price that were payable based on performance after years one and two are no longer the norm. For a practice with desirable collections, operating expenses, and demographics, the hold-backs are sometimes waived, and the selling dentist is fully paid in cash at closing. In the past, a dentist selling to a corporate practice was required to continue to work for about two years. Now, in some cases, the continued work requirement is also being waived. It remains to be seen if the hold-backs and continued work requirements will remain in place.

Dentists who sold to corporate practices before the pandemic and who have not yet been fully paid the accrued compensation and accrued rent are concerned. Additional concerns are whether corporate practices will run out of money and whether they will follow effective social distancing protocols to maintain desired production levels.

Traditional valuation methods

Common methods of valuing dental practices are summation of assets, capitalization of earnings or some form of it, and other similar practices. The findings often are averaged but are subject to a verification analysis. The valuation methods are the same for both a complete or fractional purchase and sale.

Asset summation

The asset summation method calculates the fair market value of tangible assets and goodwill. Tangible assets consist of dental equipment, office equipment, furniture, technology, dental supplies, and dental instruments. The fair market value of tangible assets can be easily calculated by the dental equipment and supply company that services the equipment. There are also methods to calculate tangible asset value from the practice’s tax returns and financial statements.

The determination of the value of goodwill is a different story. Each year the Goodwill Registry, compiled by the Health Care Group, Inc., publishes a 10-year rolling average of goodwill rates for nearly all health-care practices based on the last year’s collections.1 It lists the number of practices reviewed and provides categories of no goodwill, statistical mean, statistical median, high, and low.

The approximately 30 factors that are relevant to calculate goodwill can be summarized into the categories of profit in all forms and collections per year. The higher the profit percentage and collections per year, the higher the value, and vice versa.

Goodwill has traditionally been calculated on the basis of the collections of a practice for the calendar or fiscal year immediately prior to the sale. The critical determination of goodwill value in specialty practices is whether the purchaser will retain the seller’s patients and/or referral base.

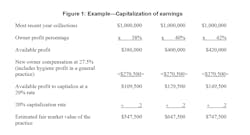

Capitalization of earnings

The capitalization of earnings method for valuing a practice is the yearly profit above purchaser pays in all forms calculated over a predetermined repayment period. The greater the profit, the higher the value of the practice. While this is difficult to grasp, the reciprocal of the repayment period is the capitalization rate. The lower the capitalization rate, the longer the repayment period. Unfortunately, 10-year repayment periods prior to the pandemic were becoming increasingly common, which increased practice values. What happens postpandemic will be based on supply and demand.

Similar practices

As a valuation method, similar practices are comparable to an average, or midpoint, between two extremes. While similar practices can be useful to state an average selling price of a dental practice, all practices have varying statistics, such as profit, that affect value. The similar practice method is often used in destination locations where demand for practices is high and supply is low.

Verification analysis

A verification analysis is a form of the capitalization of earnings valuation method. Its purpose is to confirm or reject the findings of the valuation report. A verification analysis should calculate the length of time anticipated to pay for a practice given the practice’s incoming owner’s anticipated level of collections, compensation in all forms, payment of the purchase price, and payment of operating expenses. Think of the verification analysis as an appraisal of the appraisal, which will confirm or reject the appraisal findings based on how long it will take to pay for the practice.

Summary

Unknown circumstances make it important for every practice owner to know the value of his or her practice for purposes of a sale or associate buy-in, and this will hopefully avert a catastrophe. Should a catastrophe occur without knowing the practice value or having instructions for loved ones in place on how to dispose of the practice, the value will rapidly dissipate to zero.

Reference

1. The Goodwill Registry. The Health Care Group Inc. http://www.healthcaregroup.com/Goodwill-Registry-Online-by-Specialty.html

WILLIAM P. PRESCOTT, Esq., EMBA, of WHP in Avon, Ohio, is a practice transition and tax attorney and former dental equipment and supply general manager and representative. His most recent book, Joining and Leaving the Dental Practice, third edition, is available through the ADA Center for Professional Success. ADA members can download the book for free at success.ada.org/en/practice-management/joining-and-leaving-the-dental-practice. For this and Prescott’s other publications, visit prescottdentallaw.com. He can be contacted at (440) 695-8067 or [email protected].

About the Author

William P. Prescott, JD, EMBA

William P. Prescott, JD, EMBA, of Wickens Herzer Panza in Avon, Ohio, is a practice transition and tax attorney, as well as a former dental equipment and supply manager and representative. His most recent book, Joining and Leaving the Dental Practice, 4th edition, is available through the ADA Center for Professional Success. ADA members can download the e-book for free at ada.org/prescottebook. For this and Prescott’s other publications, visit prescottdentallaw.com. Contact him at (440) 695-8067 or [email protected].