How to get out alive, Part 5

by Rick Willeford, MBA, CPA, CFP

So far we have discussed the importance of tuning up your practice as your primary financial engine to fund your current needs and retirement goals and other major purchases - what I like to call “Doctor at Work.” We have also discussed accumulating and growing your money or “Money at Work.” But we have not discussed one major leak in your system - “IRS At Work”! As you are learning, it is not how much you make that counts, but how much you get to keep! We will spend the next few issues looking at some tax tips, traps, and techniques to save some money.

Your first line of defense in cutting taxes is to maximize the use of a government-approved retirement plan. There is a wide array of plans available, from small IRAs to SEPs, SIMPLEs, 401(k)s and beyond. Your retirement plan advisors should reevaluate your situation every year to ensure that you have the best plan for you. However, in the February 2004 DE® article titled “Do You Have the Wrong Retirement Plan?” I said many folks are still using SEPs and SIMPLEs and that they may have outgrown them. Since then, a number of folks have changed to Safe Harbor 401(k) plans, but they may still be leaving a lot of money on the table.

Thinking big, how would you like to put, say, $200,000 in your retirement plan with a staff cost of around $25,000? Then read on to see if this applies to you.

Is a Dual DB/DC Plan for you?

This may be possible with a new retirement plan concept of which most folks aren’t aware. It may save you a lot of money. It involves having a defined-benefit plan plus a defined-contribution plan, a “Dual DB/DC Plan” for short. (You will see it referred to as a “cash balance, floor offset plan” as well.) Although the concept is not new, recent tax law changes have made it even more appealing.

First, some background. Most folks have a defined-contribution (DC) plan. This is your typical IRA, SEP, SIMPLE, 401(k), and/or Cross-Tested plan. The “defined contribution” means that you select a particular contribution to put in the plan each year, including zero if you so choose. Hopefully, the funds grow over time, but you really do not know how much the plan can pay as a benefit when you retire. That depends on the stock market gains and losses, interest earned, etc. The IRS limits how much you can contribute each year. The annual limit to contribute to a DC profit-sharing plan is $45,000 for 2007.

The other broad category of retirement plans is a defined-benefit (DB) plan. This is the original “pension plan” that big businesses offered their employees long ago. For instance, when General Motors hired a young person, GM would tell that person that he or she would receive a certain benefit at age 65. That benefit would depend on the number of years the individual was employed and his or her salary at retirement. In other words, the company defined the benefit in advance, and then - with the help of an actuary - the company determined how much its annual contribution to that employee’s account should be to back up that promise. (As an aside, it is the cost of these promised benefits that is becoming a huge weight for GM, Delta Airlines, and other big companies. If these companies declare bankruptcy, it may not be because they are insolvent. Instead, among other things, it would allow them to break their defined-benefit promises to their employees.)

The annual contribution amount that the actuary calculates for a defined-benefit plan is higher for an older person. As you get older, you have fewer years to accumulate retirement funds for a theoretical retirement age - say, 65. In your mid-40s, that annual amount begins to exceed the $45,000 DC limit. That often coincides with the time that you begin earning more and would like to put more than $45,000 into a retirement plan. As you get closer to age 60, the annual contribution could get as high as about $200,000! (There is a limit.)

So you could make a huge contribution for a huge tax deduction. But there is a problem. Let’s say that the contribution equals 75 percent of your pay (compared to a typical 20 to 25 percent of pay). If you have staff about your age, then you would have to contribute an amount equal to 75 percent of their pay, too! Not what you had in mind. So, DB plans are often not attractive unless you have a fairly young staff. That is why fewer than 5 percent of dentists have them.The staff issue, plus the fact that a lot of folks can’t afford to save more than $45,000 a year, make it a bad choice.

The Dual DB/DC plan eases the staff issue, but you still need the ability to afford the huge contribution. Newer rules essentially say that, if you contribute around 7 to 8 percent of staff pay to a DC profit-sharing plan, then you get a free pass to let you put the huge amount into the DB plan. Many profit-sharing plans already put close to 7 percent in for the staff anyway - if not a lot more - so staff costs may not go up much.

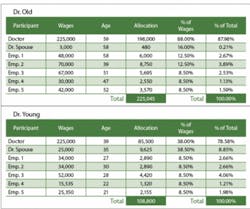

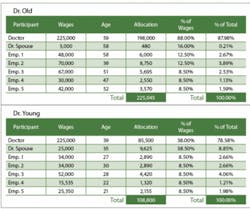

Two examples are shown below. (Note that these are two actual cases, and are not as ideal as they could be; but I wanted to show what typical situations could look like.) In the case of Dr. Old (age 59), the youngest staff person is 39, followed by age 47, and the rest are in their 50s. Even so, the doctor gets to contribute about $198,500 for himself and his spouse, yet he only has to contribute about $26,000 for his five staff members. So, the doctor gets about 88 percent of the benefit. (Note that two of the staff members do get 12.5 percent of their wages. If he had more young employees, this would not have happened.)

In our second scenario, Dr. Young is only 39 years old, but she has two really young staff members, ages 21 and 22. Out of a total contribution of $108,800, she and her husband get $96,125, while the staff gets $13,675. So the doctor and husband get about 87 percent of the total benefit!

Check with your current advisors to see if this has a place in your financial and tax planning. If they give you a blank look, then move on; because it may take a fairly sophisticated retirement plan advisor to be familiar with the Dual DB/DC concept and how it works.

Raymond “Rick” Willeford, MBA, CPA, CFP®, is president of The Willeford Group, CPA, PC, and Willeford CPA Wealth Advisors, LLC. As a fee-only advisor, he has specialized in providing financial, tax, and transition strategies for dentists since 1975. Willeford is the president of the Academy of Dental CPAs, a consultant member of AADPA, and is available as a speaker. Contact him at (770) 552-8500 or at [email protected].