Filling the gap: Advanced retirement plan strategies for dentists

What you'll learn in this article

- Advanced retirement savings strategies for high-earning dentists beyond the 401(k) limit

- How backdoor and mega backdoor Roth IRAs can create long-term, tax-advantaged growth

- The benefits and ideal candidates for implementing a cash balance pension plan to maximize tax savings and retirement contributions

Being a dentist comes with both challenges and opportunities when it comes to financial planning. Whether you’re starting as a new associate dentist or opening your own practice, there are many considerations and complexities as you navigate your personal finances. Two of those considerations are around saving for retirement and tax planning, both of which can be very intertwined.

As a financial planner working with dentists for many years, I have seen how difficult it can be to find new opportunities to optimize retirement savings while also managing tax implications. For many, once they reach the maximum level of annual savings into a 401(k), which is $24,500 for 2026, they feel that they have exhausted their options. As your practice and production grows, your earnings rise along with it, and while this is definitely a positive, it also creates more challenges from a tax perspective.

Additional reading: Reducing your tax bite: 7 tax-advantages strategies for dentists

On the surface, it may seem that you don’t have any other beneficial options out there. However, there are a few unique strategies for dentists to consider that have the dual benefit of current (or future) tax savings along with tax-advantaged growth potential.

Backdoor Roth IRA

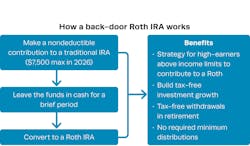

Let’s start with one of the more simple and straightforward strategies for high-earning dentists, whether you are a practice owner or not. Given dentists’ high level of taxable income, it is very likely that you aren’t able to make a regular contribution to a Roth IRA. However, an alternate strategy is to utilize the “backdoor” method (figure 1),1 where you (1) make a nondeductible contribution to a traditional IRA, (2) leave the funds in cash or a money market fund in the IRA for a reasonable period, and then (3) convert the balance to a Roth IRA. If there are no earnings while the contribution is held in the IRA, then the conversion would be a nontaxable event. For 2026, you can contribute a maximum of $7,500 into a Roth IRA (additional $1,100 catch-up contribution if age 50-plus).

While a backdoor Roth IRA is not designed to save you on taxes today, the goal is to help save on future taxes. With traditional IRAs and pretax 401(k) accounts, funds grow tax deferred but are eventually taxed upon withdrawal in retirement (particularly in your mid-70s when the IRS requires you to take a portion out every year). With a Roth IRA, your assets grow tax free, and distributions in retirement are also tax free (as long as the account has been open and funded for at least five years and you are over age 59.5). What’s more, you never have to worry about required distributions in your 70s as those do not apply to Roth IRAs.

Be sure to coordinate with your financial advisor and/or tax preparer regarding a backdoor Roth as you need to be mindful of the pro-rata rule. To keep it simple, having any pretax IRA accounts already in existence may make a portion of the converted amount of your backdoor Roth taxable.

Mega backdoor Roth

The next level up is a mega backdoor Roth.2 This is another excellent strategy that allows high-earning dentists to sock even more away into the Roth bucket beyond the annual Roth IRA maximum.

Where this strategy is different is that you need to incorporate your 401(k) to make it happen. Taking it a step further, your 401(k) plan must allow for after-tax contributions and provide a method for converting those funds to a Roth (for example, in-service distributions). After-tax contributions are different than contributing to the Roth portion even though those contributions are also after tax. Although after-tax contributions don’t offer the same tax-free growth as a Roth, the key advantage is the ability to make contributions that exceed the standard deferral limits and convert them. Because of this, you can technically still defer the maximum but then make additional after-tax contributions above that (up to the $72,000 employee + employer maximum for 2026). Regarding in-service distributions, this is the ability to withdraw or roll over your 401(k) account assets while still employed.

Assuming your 401(k) plan allows for these features, here’s an example of the process. Let’s assume you've contributed the maximum $24,500 already, and then the practice provides a match contribution equivalent to $7,500. This brings your total overall contribution to $32,000. Since the combined annual maximum (employee + employer combined) is $72,000, you now can make an after-tax contribution of $40,000.

Once the after-tax contribution has been made, you can then convert that portion to a Roth either through an in-service distribution and roll over to a Roth IRA, or an in-plan conversion of the after-tax funds to the Roth 401(k) bucket, if the plan allows. It is important to take care of the conversion quickly after making the after-tax contribution to avoid any taxable earnings being generated.

Given the complexity of this strategy, along with the fact that your 401(k) plan needs to allow for both after-tax contributions and a mechanism to move funds from after tax to Roth, it is critical to discuss this with your financial advisor and/or tax professional.

As a dental practice owner, you may also be able to customize your 401(k) plan to allow for these features if you don’t have them in your plan already. This can be done if you’re a practice owner looking to launch a new 401(k) plan, or if you’re looking to update the documents and design of your existing plan. Be sure to talk to your 401(k) plan provider—specifically your third-party administrator—about this as well.

Cash balance pension plan

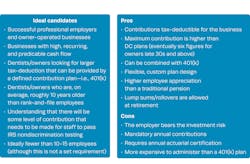

Now, let’s dive into the most powerful (yet lesser known) strategy. A cash balance plan3 is a specialized type of retirement plan to supercharge not just your retirement savings but also potentially provide a significant tax benefit for every year of contribution. While it is a type of pension, it is essentially a hybrid of a DB (defined benefit) and DC (defined contribution) plan as it comes with all the usual DB requirements but looks and feels more like a DC plan, yet with much higher contribution limits. A cash balance plan can offer the best of both worlds because dentists could potentially triple or quadruple their annual retirement savings and receive a tax deduction for the business. For example, a dentist born in 1970 may be able to make a maximum contribution of over $215,000.4

Here is a more specific example of the long-term benefits for a dental practice owner to incorporate a cash balance pension:

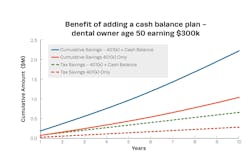

Let’s assume a dental practice owner is age 50 with $300,000 of earnings (figure 2). Let’s also assume an estimated marginal tax rate of 39.95% between federal and state taxes.

They are currently maxing out their 401(k) in the amount of $32,500 ($24,500 + $8,000 catch-up) and making employer contributions in the amount of $39,500. Let’s assume an annual investment growth of 7%.

Sticking with only the 401(k) and maxing out as referenced would still be advantageous, both due to the ability to save $72,000 per year along with projected tax savings of over $28,700 per year (or approximately $287,000 over 10 years).

Next, let’s assume the dentist decides to incorporate a cash balance pension and can contribute $95,000 (earning 4% assumed growth). Now, the dentist is maxing out a total of $167,000 combined between the 401(k) and cash balance plan.

From a retirement savings perspective, the dentist would accumulate $95,000-plus per year (the contribution maximum increases with age) on top of the $72,000 in the 401(k). All these funds would grow tax deferred.

On top of that, the income tax savings for the business adds another big benefit. In this example, the dentist would be projected to save nearly $66,700 per year combined between the 401(k) and cash balance plan, which equates to nearly $670,000 cumulative tax savings potential over 10 years.

This shows the immense potential benefits of a cash balance plan, but it is important to note that such a plan doesn’t work universally for all types of businesses. Due to the nature and structure of cash balance plans, they are best suited for professional service businesses with high, recurring cash flow. They are also generally best for employers with 15 employees or fewer. These two characteristics generally fit with most dental offices, making the cash balance plan a worthwhile consideration. Figure 3 shows a summarized breakdown of ideal candidates as well as pros and cons of a cash balance plan.

With year-end approaching, many dentists may be already thinking of ways to further boost their retirement savings as well as reduce their tax burden. Remember that while you may feel that you have exhausted all options, there are advanced strategies like these to consider that may help with your planning both for the short and long term. Of course, with any advanced planning strategies, be sure to consult with your financial planner and tax professional to make sure they align with your specific situation and goals.

Editor's note: This article appeared in the January 2026 print edition of Dental Economics magazine. Dentists in North America are eligible for a complimentary print subscription. Sign up here.

References

- Rahill DF. Backdoor twists and mega turns. Financial Advisor. September 1, 2024. https://www.fa-mag.com/news/backdoor-twists-and-mega-turns-79227.html

- Long KC. How the mega-backdoor Roth works. Journal of Accountancy. May 9, 2023. https://www.journalofaccountancy.com/news/2023/may/how-mega-backdoor-roth-works/

- Frequently asked questions on the cash balance pension plans compliance. US Department of Labor. Employee Benefits Security Administration. https://www.dol.gov/sites/dolgov/files/EBSA/about-ebsa/our-activities/resource-center/faqs/cash-balance-pension-plan-faq.pdf

- Maximum contribution calculator. FuturePlan by Ascensus. https://www.cashbalancedesign.com/resources/maximum-contribution-calculator/

About the Author

Kevan Melchiorre, CFP

Kevan Melchiorre, CFP, is cofounder and managing partner at Tenet Wealth Partners based in Champaign, Illinois, an independent wealth management firm. Kevan is a fidiciuary financial advisor and certified financial planner professional with more than 15 years of experience. He was recognized nationally by Forbes as a top wealth advisor in 2019 and 2021, and he has been quoted in national publications for his expertise and insights, including Forbes and Barron’s. Contact him at [email protected] or call (217) 281-4251.

Disclosure: The information provided in this communication was sourced by Tenet Wealth Partners through public information and public channels and is in no way proprietary to Tenet Wealth Partners, nor is the information provided Tenet Wealth Partner's position, recommendation, or investment advice. This material is provided for informational/educational purposes only. This material is not intended to constitute legal, tax, investment, or financial advice. Investments are subject to risk, including but not limited to market and interest rate fluctuations. Cash balance contributions are estimated and must be certified annually by an actuary. Investment growth rates are illustrative and not guaranteed. Investment Advisor Representative of Sanctuary Advisors, LLC. Advisory services offered through Sanctuary Advisors, LLC., a SEC Registered Investment Advisor. Tenet Wealth Partners is a DBA of Sanctuary Securities, Inc. and Sanctuary Advisors, LLC.