Harvesting profits from rebalanced fees

If your fees aren`t keeping pace, you may be losing the farm rather than reaping the harvest.

Duane A. Schmidt, DDS

A few years ago,* I reported my experience with a Practice Profitability Workshop (a Profits Plus+ high-tech practice analysis) conducted by Dr. Charles Blair, cofounder of Blair-McGill practice consultants and long-time columnist in Dental Economics. Last fall, Dr. Blair called and asked if I was now ready to seek the profitability niche that I believed my practice deserved by going through his Revenue Enhancement Program.

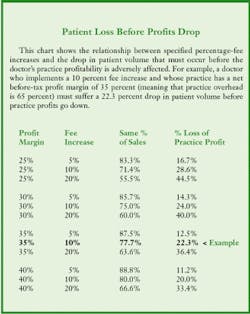

That trick question required that I address something hallowed: fees. Fees are only revered because we dentists do not want to deal with the consequences of changing them. What happens if our new-patient flow trickles to a halt? What happens if we gain a reputation of being "pricey"? What happens if the sky falls in? Dickering with fees is playing with the unknown and few want to chance that. If you think it matters less to a large practice, it doesn`t. It matters more. There is more to lose. As Dr. Blair points out, most doctors who read this article will leave $100 to $500 "on the table" every day.

* "Opening Your Practice`s Profit Window," Dental Economics, August 1996 issue, p. 68

I could think of a dozen reasons why I did not want to tamper with fees at that moment. But none of my reasons held water, and soon, the persistent Dr. Blair had me accept the fortunes of good fortune. In short, he forced me to bank enough additional profits to buy a small farm, every year. The "every year" quote is not a typo!

My staff submitted our current fee schedules to Dr. Blair along with the number of procedures performed for each of the fee codes. In addition we answered questions about lab fees, new-patient counts, and both production and collections. Even staff attitudes about managed care participation were probed. We soon received a computer-generated analysis of our procedure mix and fees. This extensive report detailed specific goals and keys to attain them, and contained an analysis of how lab, operative, crown and bridge, surgery, and hygiene fees integrated to make the unique mix that yields our profit.

From these pie charts and calculated ratios, we could see what Dr. Blair calls "Pots of Gold!" - the clues to shifting our practice emphasis to maximize our yield. He gave us feedback on our total lab-related volume, crown-to-operative ratio, and the perio component of my hygiene department - even our optimum new-patient flow. With this analysis he revealed what we were doing, then gave us ideas on how we could improve sales and our productive mix of services. Dr. Blair also pointed us toward top-notch continuing education courses that would plug the gaps in our financial and clinical understanding.

On other pages, listed beside our fees, were fees other dentists charge in our zip code. These were listed in percentiles, so we saw how we stacked up against the competition. We were asked to pencil in the fee level we might move to and with which we felt most comfortable.

By forcing me to think about it, he learned the level of my self-esteem as it relates to the fees we charge. He also compelled me to review my overhead, including costs vs. fees.

Several conclusions jumped off those pages. Some of our fees priced us out of the market. Most of our fees priced us under the market. But I now saw our true position within our specific market. This information was undiluted by opinion, hearsay, conjecture, or gossip. The numbers truly reflected fact, and, for the first time in decades of practice, I could deal with solid knowledge - and knowledge, as we all know, is power.

I reviewed the procedure mix data and selected new fees that I felt might be comfortable. Then, I faxed my "decision data" to Dr. Blair. A few days later, we held a several-hour telephone consultation to reach each final fee. During our discussion, he discovered several coding errors - mistakes that surely cost me past profits!

Dr. Blair notes "13 Deadly Sins" that anchor dentists in the past en route to determining fees that are fair to patient, staff and doctor, what he calls "13 Deadly Sins" anchor dentists in the past. How many of these "sins" can you identify with?

1. Schizophrenic fee schedules. One of my fees was $50 above local fees. If a patient compared me to another office - on that specific fee - I could have suffered a public opinion setback. On the other hand, most of our fees were in an embarassingly low fee percentile for our market and needed immediate adjustment.

2. Failure to charge. Dr. Blair routinely finds that offices fail to charge for doctor exams. He asks the rhetorical question that should awaken every dentist: "What jury would ever believe that a doctor, who is required to check a patient by law, actually performed the service but did not charge separately for it?" How does our office deal with a patient who rejects a doctor exam? We invite that patient out of the practice. It`s better to lose a patient than a lawsuit.

3. Charging the wrong fee or giving a service away. Dr. Blair finds that one out of two practices submits coding errors on insurance forms - the most common being billing soft-tissue management as a simple prophy when much more is involved. I think his estimate is far too low. My guesstimate is that every dental office harbors cracks in their fee/coding schedules - not only in hygiene, but in other areas, too.

4. Add value to "recare." This one we had picked up on during his Practice Profitability Workshop several years ago. Certainly, our fees did not change, but patient perception of quality and value did. With computerized billing, the change is keystroked.

Way back in the mid-19th century, we billed our patients simply, "Profes-sional Services: X dollars." That was very cool - and very dumb - and we eventually learned just how much that statement hurt us. We learned a fact that now stares at us from a sign on the wall in our staff lounge: "Perception is Reality."

Today, for instance, a recare appointment is typically billed as "periodic oral exam, X-rays, and prophy": three services. To add value to the recall visit, list items such as toothbrush, oral cancer exam, blood pressure check, and health history update on separate billable lines. Then, bill these out at "no charge."

The patient now understands what he pays for and, more importantly, perceives what you give him. Adding value to your services is especially important if your recare fees edge into the higher percentile for your area.

5. Failure to raise fees regularly. Does it amaze you how haphazardly we run our businesses? Dr. Blair finds that 35 percent of us fail to raise fees annually. Again, I think he is being kind. I`ll wager the number is far higher!

But, since we can be sure that all costs will rise - and that staff always will expect ever greater rewards - there simply is no basis for failing to keep pace with our annual, increasing costs of doing business. The doctor who does not moderately increase fees annually misses the boat, since many insurance companies prepare for an annual increase - in the expectation that fees will rise.

6. Adjust fees on a piecemeal basis. If we balance our fees so that they reflect the market position we seek, then future fee increases can be done as a percentage and the entire process is simplified.

7. Pricing out "loss-leader" fees. The hope here is that we can snare new patients and make back our initial losses. This hope sustains only the vain. People are smarter than that, and the ploy will backfire as surely as alginate gels.

Of course, the initial examination fee should be moderate enough to remove a barrier to patient-entry into the office. We want a prospective patient to meet our staff and see how wonderful we really are - facts hard to portray on the telephone.

8. Failure to delegate fee increases. Guilty as charged. Yes, it is easy to back-burner these important issues as we deal with making a living. Trouble is, it is tougher to make that living with unbalanced fees. So, balance them, and the sooner the better. Delegate the duty to a trusted staff member, then forget about it.

9. Failure to tie fee increases to salary increases. What better way to ensure that our staff shoulders the task of explaining fee increases to patients than to give them a salary bump right after we balance our fees. It does not take them long to anticipate when you will raise fees again.

10. Public fee announcement. Never. Price is the fourth reason people choose a dentist and they will not choose you just because you are cheap. If they choose your office for that reason, look out - they view dentistry as a commodity rather than a service. Patients who complain are told, "We are proud of our fees and we adjust them only to account for increased costs." That is enough said.

11. Failure to know how your fees stack up in your market. This information is obtainable only from select sources. You will never learn the specifics by calling your competitors and pretending you are a shopping patient. The true facts are found on insurance claims and this data is privileged, and closely guarded, but it is available. Dr. Blair has a resource.

Be careful and ask if the fees for your area are zip-code specific or merely national fee schedules with a local zip-code multiplier. The Great Lakes Regional Fee Schedule, for example, may not fit Cedar Rapids, Iowa, where my practice is located.

12. Jumping your fee increases. When our patients take smaller bites (of fee increases), they may never need the Heimlich maneuver as a result of choking on them. Dr. Blair counsels 3 percent in January and 3 percent in July for orthodontics, and annual fee increases for general and other specialty practices in amounts determined each year.

"After hundreds of Revenue Enhancement consultations, I have yet to see a single practice fail to gain profitability strength from this service. Never once have we seen a practice price itself into trouble with reasonable fee increases." - Dr. Blair

13. Failure to get individual procedural mix and fee consulting advice. We could obtain some dubious caliber of fee data and then try to accomplish this on our own. With what result? We would sell ourselves short on fees and miss coding errors that might cost us thousands of dollars each year. Do-it-yourself legal, accounting, and, yes, even dental advice costs dearly. So does do-it-yourself procedure mix and fee-balancing.

Dr. Blair guaranteed me a 10 to one return on my fee counseling investment. He had it wrong. It was 10 times that. Buying popular Internet stocks early on would not have been so profitable.

Fee positioning and procedure mix analysis is a "mind" game for all of us. What a shame that some professionals fail to seek professional help when they play that game.

The net result? Net worth!

The fear that many dentists have about adjusting fees is one that I once shared. Our 21-chair, 8,000-square-foot, 45-employee practice functions under fears just as real as those suffered by the three-chair, three-employee office.

But fear is a strange and wicked master and only reluctantly releases its stranglehold. In the four months since we have balanced our fees - through 10 dozen patient visits daily - we have yet to have one patient remark about our new fees. This, in the face of a printed treatment plan - showing plainly marked fees - for every service we offer.

Take-home profits have soared 39% over the same quarter last year. Of course, we are only talking money ... and the farm!

Editor`s Note: Dr. Blair can be reached at (704) 424-9780