How I substantially grew my practice with in-house financing

I began my career in dentistry with a world of expectations, but admittedly, I had limited experience on how to best deal with the pressures of growing a practice. I quickly became frustrated with the everyday conundrum of my patients choosing partial treatment options against my recommendations. In their minds, the cheaper option was the best option, regardless of the negative effects on their long-term health.

Each day I proceeded as dictated by their pocketbooks, unknowingly propagating the commoditization of dentistry. As a young practitioner, I had a choice: Either discount the product, or stand my ground and not cheapen the experience I thought I was delivering. Ultimately, neither of the options sat well with me.

Establishing financial arrangements with a patient is less a process and more an emotional experience. Having the financial means to pay for the recommended treatment is just as important as scheduling the time to get the treatment done or having the mental strength to show up for the appointment. Essentially, it's our job as the captains of this process to create a way to fit dentistry into our patients' lives while providing the best treatment possible.

I began offering Comprehensive Finance, an in-house payment option, in 2011, and this became the tool that made it easier for my patients to fit dentistry into their lives. As the owner of a group practice in North Carolina, I aggressively piloted an original in-house financing program to the tune of $1.2 million in total treatment values in less than a year. My business partner and I quickly increased our production as well as our revenue. It was then that I realized something had changed-my patients were saying yes to my recommended treatment options, and I was having much more fun practicing dentistry.

This in-house payment option allows you to approve any patient for any amount of treatment. A banking and credit analysis is run in order to determine the interest rate. The best part is I am earning the interest on the loans, so my profits quickly increase.

RELATED:8 simple rules for increasing treatment acceptance

As this payment option evolved, so did my practices. In 2012, I decided to offer in-house financing as a first-choice payment option in my office. I approved most patients and simply required a down payment from each patient to cover my hard costs. Down payments were typically covered by cash, insurance, or a combination of these, and they were paid directly to me the day of treatment.

Using this system, not only was I finally able to feel good about my patients choosing the option that was best for their overall health, but I was benefiting my business and doing more work than ever before.

Early in my career, many of the consultations and treatment plan presentations ended with an upset patient. The cost of dentistry is not cheap, as we know, and overcoming price was a daily struggle for me and my patients. Having an option that allowed me to provide comprehensive dentistry at monthly payments my patients could afford increased overall satisfaction in my office.

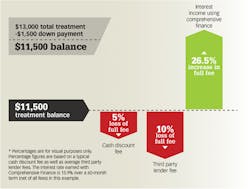

Here is a real-world example of how offering in-house financing helped my patients. A patient we'll call Mary first came into my office a few years ago. She had always had problems with her teeth, even at a young age. She would get a little bit of work done each year, but she couldn't afford what insurance did not cover. She was following the advice and financial options that dentistry usually offers, but as the years passed, her mouth continued to deteriorate and the cost of treatment became more expensive. Now, at the age of 32, she had over $13,000 worth of dentistry that needed to be done. We had the option of doing what most practices do every year, which is a bit at a time, or we could use her $1,500 of insurance as a down payment and finance the remainder. We financed $11,500 over 60 months, which allowed Mary to make monthly payments she could afford. She was able to get her mouth restored to optimal health in a couple of appointments. For us it was great because we were able to provide treatment in fewer appointments, making us more efficient and much more profitable.

For Mary's case, we produced an additional $13,000 in treatment that we wouldn't have done, and we will end up collecting more than that including the interest income. (See figure 1 to compare fee collection rates and how offering this in-house financing option can substantially increase profits compared to other financing options.)

Offering in-house financing to each patient allowed my partner and me to grow our business by 40%. Currently, our newly-founded group, CarolinasDentist.com, is doing an average of $300,000 in treatment per office, totaling over $1.1 million in production each month across four locations.

Figure 1: Case Study

Many of my colleagues have asked what happens if patients stop paying. That seems to be the biggest question for many practitioners, and I was worried about that as well. I can honestly say that the team at Comprehensive Finance works harder than any office member at ensuring that payments are made. I am able to track all late payments and oversee the ongoing collection efforts. My four practices are collecting at an outstanding rate of over 95%. From a collections standpoint, I am collecting more than I would if all of my patients were approved through a traditional third-party lender, and that takes into account all fees and missed payments.

I have come to realize that having the ability to finance a patient's treatment is less about me getting to do the work and more about my patients finally getting what they deserve. We will never eliminate all obstacles or be able to wave a magic wand of "case acceptance," but as a general dentist, you must offer the best financial options available in order to overcome one of the largest obstacles our patients face. Patients' readiness stems from feeling comfortable with the overall treatment experience. Their experiences start from the moment they walk through the door to the moment they walk out. I am pleased to say that we have more patients walk out satisfied with their chosen financial arrangements than ever before.

In-house financing has created secured monthly income for my practice and removed one more barrier to achieving my ultimate goal: creating a legacy of disruptive innovation while also changing the way our profession is perceived.

Clifton Cameron, DDS, was born and raised in Fayetteville, North Carolina. He naturally fell into the field of dentistry, and it quickly became his passion. He earned his degree at the Virginia Commonwealth University School of Dentistry. Dr. Cameron believes in providing leading-edge care and prioritizes staying up-to-date on the latest and greatest trends in dentistry. He strives to deliver the best care imaginable at CarolinasDentist's state-of-the-art facilities, which are equipped with only the best technology.