Ready or not: New overtime rules may have big implications for your practice

Ali Oromchian, JD, LLM

On May 18, 2016, the Department of Labor (DOL) released new rules regarding overtime. Referred to as the "Final Rule" or the "Overtime Rule," the new standards take effect December 1, 2016. For dentists, the biggest impact of these changes will be on the way and the amount that they pay their dental team members. Under the new law, more salaried employees (assistants, front desk staff, and even hygienists) may now qualify for overtime when they work more than 40 hours per week (or, in certain states, eight hours per day or 40 hours per week).

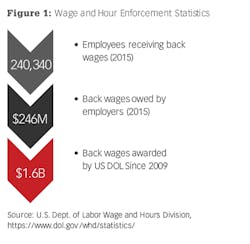

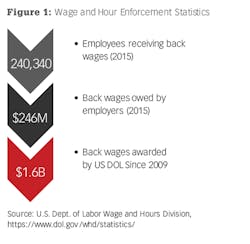

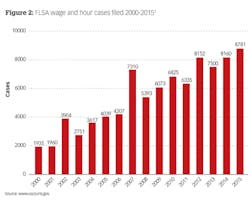

First, a quick primer on the law: The new standards are intended to better implement the goals of the Fair Labor Standards Act (FSLA). The FLSA defines the terms under which workers are entitled to receive overtime. Most notably, the salary level below which employees become entitled to overtime has increased from $23,660 to $47,476 annually.

Therefore, a salaried worker making $47,476 or less per year will now be entitled to overtime pay. There are criteria other than salary that may make an employee eligible to receive overtime compensation. In rare cases, you might still be required to pay overtime if someone earns more than $47,476, depending on that worker's salary, frequency of pay, and job requirements.

Getting your practice ready: 5 key steps

1

The burden of change is yours-The new standards don't put much of the burden on workers themselves. Your business will be expected to make all the necessary changes to ensure compliance, including keeping track of overtime hours worked. This means that you could be required to maintain records that you have not maintained before, such as keeping detailed time records for all of your salaried employees. Prepare now to make sure that you're ready once the rule becomes effective.

2

Education is key-Familiarize yourself with the new rules and make sure that you understand them completely. If you're concerned, seek the advice of a dental attorney with experience in employment law, or the advice of a human resources (HR) management firm. As with most aspects of your business, you're better off being safe than sorry to make sure you're not exposed to a wage and hour lawsuit.

3

Assess your exposure-Determine whether this new rule exposes you to additional payroll expenses, and, if so, how much. For example, if you have only one employee impacted by these rules and you're fairly certain that this employee will never be required to put in overtime, then your exposure may be low. But if you have a number of employees who currently earn less than the threshold and you have no idea how many hours those employees might be putting in each week, then you need to take steps to avoid making unnecessary payroll expenditures.

4

Identify necessary changes-You may need to make changes in order to manage your exposure. For example, you may have to change some job requirements in order to eradicate (or lessen) the overtime requirements for your staff. Or, you may have determined that you want everyone's roles and requirements to stay the same and that you can afford to pay the overtime as required. Even in this case, additional work may be placed on your HR or payroll staff (who in turn could end up putting in overtime hours themselves). If you haven't considered it before, this might be a good time to look into outsourcing some of your HR and payroll needs in order to save yourself money and concerns about noncompliance.

5

Communicate to your team-Once you're ready to implement changes to comply with the new overtime rule, communicate these changes to your employees. A crucial element of this communication is to update your employee handbook to address these new rules and to ensure that employees have the opportunity to review these changes before they go into effect.

One area of major change you might need to implement and clarify in your handbook is when overtime work is expected or allowed. You don't want your employees engaging in unrequested projects or other work and then expecting you to pay a huge overtime bill. At the same time, you can't give someone 60 hours' worth of work per week, expect the person to complete it or risk losing his or her job, and then refuse to pay for overtime hours. There has to be a balance of respect and honesty regarding what is expected and what is paid.

Simply doing nothing about the new FLSA requirements is not an option. Your employees may be aware of this new rule and may have already anticipated how their income or job requirements will change. Some may be looking to exploit the system, while others may be concerned about impending layoffs to offset increased payroll costs. Either way, communicating your expectations with your employees is the best way to protect yourself and your practice.

While the above information is not exhaustive, it is intended to give you a quick guideline about some issues your small business might face when the new rules take effect. Do yourself a favor by educating and preparing yourself now so that you will be ready for the change come December.

Reference

1 Alfred RL. FSLA Suits Continue to Skyrocket: New Record High in 2015, More than 9,000 Expected in 2016. Sayfarth.com. http://www.seyfarth.com/news/FLSA-Suits-Skyrocket. Published November 20, 2015. Accessed August 1, 2016.

Ali Oromchian, JD, LLM, is the founding attorney of the Dental & Medical Counsel, PC law firm. He is also cofounder of HR for Health, which provides a cloud-based human resource management solution for dental practices. Mr. Oromchian is well known for his expertise in legal matters pertaining to dentists. He has served as a key opinion leader and legal authority in the dental industry with dental CPAs, consultants, banks, insurance brokers, and dental supply and equipment companies. He serves as a legal consultant for numerous dental practice management firms who rely on his expertise for their clients' businesses.