Defined-benefit vs. defined-contribution plans

by Gene Dongieux, CIO, Mercer Advisors

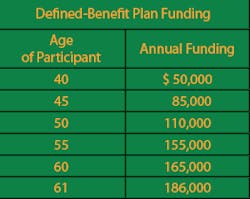

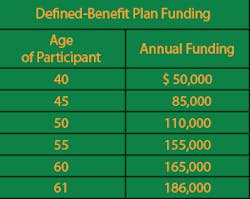

Q My practice is going well, and I’m looking for ways to pump more money into savings and maybe retire earlier. A friend of mine said he can save twice as much in his defined-benefit plan as I can in my profit-sharing plan. Is this too good to be true? How does it work?A Defined-benefit (DB) plans are terrific for some people, especially after recent legislation. They are most closely akin to what many of our parents retired with: a guaranteed monthly payment based on income at retirement and one of several formulas. Very broadly, if you are older and have saved less, but have significant extra income, a defined-benefit plan can help you save a lot fast — substantially more than the $46,000 maximum under a profit-sharing, money purchase, or 401 (k) plan.1 As early as age 49, you can start making six-figure contributions to a defined-benefit plan — depending on your income, planned retirement age, and other factors. As a bonus, diverting more money into tax-favored investing means lower total taxes.The table below shows the possible maximum defined -benefit plan funding for a participant earning $225,000 a year or more.2

The maximum annual benefit from a defined-benefit plan is $180,000 per year, depending on your income and assuming that you will retire at age 65. Whether a defined-benefit plan is right for you depends on a number of factors. Defined-benefit plans make the most sense for doctors who are:

- Over 40

- Able to fund at least $50,000 annually

- Compensated in excess of $100,000 annually

- Interested in being able to retire sooner

Assuming this describes you, next, look at your staff. Defined-benefit contributions are determined by years to retirement, so if your staff is a younger group and you are older, you can keep more plan benefits for yourself.

There are some other significant differences between defined-benefit plans and defined-contribution (DC) plans, such as your profit-sharing plan. The biggest is the difference in the objectives. For defined-contribution plan accounts and after-tax accounts, the objective is to maximize net wealth. For defined-benefit plans, the objective is to reach a target amount (to provide the pre-“defined benefit.”).

In defined-contribution plans, there is no limit on how much you can earn. In a defined-benefit plan, there is. The government sets an earnings range that it expects defined- benefit plans to achieve, and it’s conservative so that market fluctuation will have less impact. If your total exceeds the target amount in a given year, your maximum contribution the next year will be adjusted downward (or upward if it underperforms). If your earnings exceed the target by too much at retirement, you may face hefty penalties. Therefore, it is in your best interest to invest conservatively — probably more conservatively than you would with other accounts.

In a defined-benefit plan, you must fund a specific amount annually; in a profit-sharing plan, funding is optional. However, if you determine during the plan year that you will not be able to meet the plan’s funding requirements, the plan benefit formula can be amended downward.

Defined-benefit plans can be more expensive to set up and administer due to the elaborate actuarial calculations, although costs may end up being a smaller percentage of the overall benefit. Defined-benefit plans also may be used with defined-contribution plans, which provides a measure of flexibility as well as another layer of tax-preferred saving.

Your financial advisor should be able to tell you whether a DB plan makes sense for you.

1 The $46,000 maximum does not include the potential 401(k) catch-up contribution for participants age 50 or older.

2 Your actual maximum allowed funding is actuarially determined and will depend on a number of factors in addition to age and compensation such as the plan’s benefit formula, the earnings on plan assets, and the plan’s stated retirement age.

Gene Dongieux is the author of If You Have It Made, Don’t Risk It: A Physician’s and Dentist’s Guide to Investing. As chief investment officer for Mercer Advisors, he manages over $3 billion in client assets. Dongieux has been quoted in “The Wall Street Journal” and “Investment Advisor” magazine. Contact him at [email protected].