Are index funds too good to be true?

by Gen Dongieux, CIO, Mercer Advisors

Q I have heard a lot about index funds lately. They sound great, almost too easy.A It's true that index funds don't chase returns or try to forecast future market movement. In general, they also have lower fees; however, their very mechanics create gaps through which return leaks out, and you can't build a diversified portfolio with just index funds. Quantitative asset class funds are the better solution, offering the advantages of index funds without their problems.Tracking

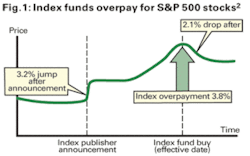

An index fund's highest priority is to track its benchmark. Whenever maximizing return is not the highest priority, return is sacrificed. There is a tremendous difference between using a benchmark as a point of comparison and strictly adhering to the benchmark's holdings. Adhering to a benchmark for its own sake brings no additional value, and makes the fund vulnerable to speculators. Annually, benchmarks announce that they will reconstitute themselves to reflect the last year's market movement. Index funds must trade to match the new "holdings" on the date named by the index. The announcement is meant to give index funds a heads-up for trading, but it gives the rest of the market a heads-up, too, in effect showing the index funds' poker hands to the market.

Studies have shown that speculators such as hedge funds regularly take advantage of events like the Russell 2000 Index (U.S. Small Stocks) reconstitutions. The figure on this page shows how the market buys after the announcement and inflates the price that index funds must pay on the trade date. Between the announcement date and the buy date, targeted stocks increase in price in the 7% to 8% range on average, and that premium is passed on to fund investors. After the effective transation date, prices fall over 2%.

Quantitative managers would rather have better returns than to perfectly mirror an index. They can wait for trading conditions that bring the most economically advantageous trade. The mandate of each quantitative asset class fund is to maximize return within its individual asset class. Each asset class can do this in different ways.

Many investors don't realize that index funds were not created to capture the market. Indexes are made up however the indexer wants. For example, the S&P 500 was created not by a financial company, but by a publishing company (!) to sell more publications. Indexes can overlap (thus increasing allocation in overlapping) and there are some areas of the market that literally no index touches.

Academicians who have studied the market (including Nobel prizewinners) have divided it methodically into asset classes. Asset class funds are thus designed to capture their own portion of the market with no overlap, no drift, and consistent management. These factors improve performance.

In addition, academicians have found the best long-term return is found in areas of the market that indexes don't venture into — and that aren't familiar to most individual investors. Emerging Markets performance has drawn more followers lately, but few break out Emerging Markets Value and Small. There is no index for these or for International Small, which also has higher expected returns than most stocks.

Creating an optimized investment portfolio is not easy, but it would be impossible if you only had index funds to work with.

Gene Dongieux is the author of "If You Have It Made, Don't Risk It: A Physician's and Dentist's Guide to Investing." As chief investment officer for Mercer Advisors, he manages more than $3 billion in client assets. Dongieux has been quoted in The Wall Street Journal and Investment Advisor magazine. Contact him at [email protected].