The pension plan

Sorting through the complexity of your office`s retirement benefits.

Brian Hufford, CPA, CFP

The title of a recent Wall Street Journal article by staff reporter Ellen Graham describes all of our fears well: "Dreams of Cushy Retirement Clash With Meager Retirement Savings." The article describes the results of a Wall Street Journal/NBC News poll of Americans and their opinions on retirement savings. According to the poll, "57 percent conceded they haven`t calculated or don`t know how much they need to save each year to reach their goal." Likewise, "of the 55 percent who are now saving for old age, 26 percent have accumulated just $10,000 or less."

How much do you need to save for your retirement? Our experience indicates that most doctors underestimate their actual, monthly retirement-savings need. Will you really be able to live on $4,000 to $6,000 per month, even if your house is paid for? A very enlightening exercise is to review your current budget and identify items that will increase or decrease during retirement. Frequently, we find that with most doctors, their expenditures stay much the same or actually increase during their retirement years. In our experience, the most frequent range of monthly, pretax retirement income needed for dentists is $8,000 to $12,000 per month in today`s dollars. To reach this goal, depending upon your current age, you typically will need between $1,500,000 and $2,500,000 of retirement savings accumulated, along with excellent investment performance.

Finding the right plan

What is the best savings vehicle for your retirement dollars? This question is straightforward and, yet, the answer is much in dispute. The solution is very dependent upon the current and future status of income-tax laws, which have a significant impact upon the amount of money accumulated. To illustrate: If you need to save $30,000 per year to reach your retirement goal, the ability to deduct the savings in the 40-percent, marginal federal and state income-tax bracket means that you only need to find $18,000 per year of "real" dollars ($30,000 - $12,000 of tax savings = $18,000).

In other words, if we can deduct the savings amount and have $18,000 per year of cash flow, we can save $30,000 per year in a deductible pension plan or only $18,000 per year in nondeductible personal savings. This difference obviously is very large. The problem is that in order to be able to deduct retirement savings, we must comply with the income-tax regulations related to "qualified" retirement plans. These regulations determine how much can be saved each year, how employees are covered and when the money can be taken out without penalty.

The complexity of the retirement- plan regulations have caused many to settle for simplistic "knee-jerk" solutions to their retirement-savings needs, rather than find suitable advisers to achieve the best result. Some advisers say that you should "never use a retirement plan because of employee costs." Commission salespersons offer life insurance or annuity products intended to provide better results than tax-qualified, retirement-savings plans. We have reviewed nearly every savings scheme under the sun over the past 10 years, from off-shore trusts, to variations of welfare-benefit plans, to "deductible" forms of traditional life insurance. In nearly every case, upon running the numbers, a well-designed retirement plan provided the best result by far with the least amount of regulatory risk. Based upon our experience, it is extremely rare that a dental practice cannot set up a retirement-plan design that doesn`t work very effectively to help the doctor achieve financial freedom more quickly than any other savings method available. The whole problem with qualified plans is finding suitable advisers to design a custom plan that achieves the optimal result in doctor vs. staff costs.

Once again, assuming a 40 percent, marginal federal- and state-tax bracket, if a doctor implements a deductible retirement plan with staff costs of $10,000 and savings for the doctor of $10,000, the result is worse than saving without a deductible pension plan. For a total cost of $20,000, the doctor receives $10,000 or 50 percent. The doctor could have kept 60 percent or $12,000 without a pension plan. However, if the doctor can save $30,000 with a staff cost of $10,000, the result is excellent. He would keep only $24,000 in personal savings without the retirement plan vs. $30,000 with the retirement plan. In this case, the doctor has "redirected" $16,000 of income taxes: $10,000 to his staff and $6,000 to himself. The staff wins, the doctor wins and the IRS loses! This is the result that we want. The key is effective retirement-plan design.

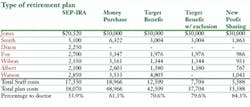

Let`s examine the principles of retirement-plan design with a hypothetical Dr. Jones (see charts above).

The foundation for effective retirement plan design in a dental practice involves two simple principles. First, for doctors who are age 45 or under, the retirement plan should provide the maximum available defined-contribution limit, which currently is the lesser of 25 percent of compensation or $30,000. Secondly, staff costs in total should not exceed the total federal and state income taxes that the doctor would pay without the retirement plan. In other words, typically, the doctor should receive at least 60 percent of the total retirement plan costs (assuming a 40-percent, marginal federal- and state-tax bracket). To illustrate the characteristics of each type of plan, along with its ability to fulfill the two guiding principles, we will examine the results.

SEP-IRA: With the SEP-IRA, Dr. Jones receives only $20,520 out of a total cost of $38,070 or 53.9 percent of the total plan contribution. The SEP-IRA produces a poor result in this example because of the characteristics of SEP-IRAs. This type of plan only allows the doctor to save 15 percent of compensation, instead of the 25 percent allowed by other types of defined-contribution plans. The doctor must cover any employee who earns $400 and who has performed services in three of the preceeding five years. This means that part-time employees must be covered. The employees are 100-percent vested in contributions that are made. Thus, once a contribution is made, the employee is entitled to keep the entire amount upon leaving your employment. The advantage of the SEP-IRA is that it is easy to establish and administer. The other advantage of SEP-IRAs is that contributions can vary from year to year, based upon profitability.

Money-purchase plan: The money-purchase plan allows a full 25 percent of pay to be contributed for Dr. Jones, so that a full $30,000 may be contributed. Without the benefit of other design features, however, the staff costs are expensive, with the doctor keeping only 61.3 percent of the entire amount contributed to the plan. The money-purchase plan has two other advantages over the SEP-IRA. Part-time employees working less than 1,000 hours per year may be excluded; thus, Sandy Dixon, the part-time hygienist in our example, is not included in the plan. Also, the plan can be designed with a six-year vesting schedule, so that employees who terminate employment forfeit part of the contributions that the doctor made. This discourages turnover of staff, rewarding long-time employees and the doctor. The disadvantages of money-purchase plans are the `fixed" nature of contributions and the need for professional administration.

Target-benefit plan: A target-benefit plan is a hybrid plan that has characteristics of both defined-benefit and defined-contribution plans. It allows the doctor to skew contributions for the benefit of older employees; e.g., the doctor. In this case, the doctor receives a full $30,000 and 70.6 percent of the total contribution to the plan. Since the doctor is older than all of the staff except for Cindy Watson, the final result is favorable. A target-benefit plan is a type of money-purchase plan and, therefore, has the same advantages related to vesting and part-time employees. Also, like the money-purchase plan, it is fixed in nature and must have professional administration.

Target-benefit plan with exclusion: Qualified retirement plans do not have to cover all full-time employees. A plan may meet a "ratio percentage test" if it covers 70 percent of the percentage of highly compensated employees; i.e., the doctor and his spouse, if she is employed by the practice. In our example, Dr. Jones has four, full-time staff members. The doctor may exclude by job classification "all financial coordinators." Therefore, Cindy Watson could be excluded, resulting in an annual savings of $4,805. Since three out of four eligible employees (75 percent) are included in the plan, it meets the ratio-percentage test and will qualify.

Our policy is to avoid excluding staff unless absolutely necessary because of the effect this exclusion has on staff morale. However, if one older employee causes the complete destruction of the plan design, it is an effective tool. A good alternative might be to offer the excluded employee a $2,000 IRA payment instead of including this individual in the plan. In this example, by excluding Cindy Watson, the doctor achieves a $30,000 pension cost and 79.6 percent of the total cost.

New comparability profit-sharing plan: Currently, nearly two-thirds of all defined-contribution plans that we design for dental offices are of this type. This plan has many advantages for a dental office where the doctor is older than the average age of the staff. Unlike the age-weighted, profit-sharing plan or a target-benefit plan, the new comparability plan does not look at the individual ages of each staff member. Instead, it establishes two groups of participants: the doctor is in one group and all other staff members are in the other group.

The staff contributions are based upon a calculation of the average staff age. Therefore, one employee - like a Cindy Watson - need not be excluded because of age and the related exorbitant costs.

In this example, Dr. Jones is able to include all full-time employees in the plan, and yet he receives a full $30,000 and an 84.3 percent share of the total benefits. Further advantages of this plan are that it is a profit-sharing plan and, therefore, the employer may vary contributions based upon annual profitability of the practice. Likewise, six-year vesting may be used. The only disadvantages of this plan are related to its complex mathematics and complex qualification under the tax code. Many administrators - such as stock-brokerage firms, banks and insurance companies that offer inexpensive administration for most types of plans - do not have the ability to offer this type of plan. Because of the obvious benefits, if you have not had a study to review this type of plan for your practice, you may be missing some huge employee cost-savings.

If Dr. Jones were 54 years of age, instead of 44 as in our example, he might wish to consider a defined-benefit pension plan. A defined-benefit plan is unique in that it provides a specific retirement benefit. We find that a doctor, who is beyond age 45, depending upon past contributions to retirement plans, may be able to contribute in excess of $30,000 in a defined-benefit pension plan. This is because the tax code allows a participant to fund a large benefit between age 60 and 65. If the doctor is older - with a short time to fund this large benefit - the annual deductible amounts may be extremely large.

In our example, assuming Dr. Jones is 54 years old, a defined-benefit plan would provide for an annual cost of $82,264 for Dr. Jones, with as little as $4,283 for staff costs. Dr. Jones could receive as much as 95.1 percent of a total $86,547 pension cost. The resulting income-tax savings - with this size of deductible-pension benefit - is staggering (for Uncle Sam, that is)!

For doctors who have not planned well in saving for retirement and who have attained 45 years of age, the defined-benefit plan offers an excellent ability to catch up. The older the doctor is, the larger the annual defined-benefit cost.

One other important item: after 1999, doctors are allowed to have both a full $30,000 defined-contribution plan and a maximum defined-benefit plan. Happy days are here again from a retirement-savings standpoint! Also, the "success tax," or excess accumulations (15 percent) tax on large distributions during retirement from pension plans, has been repealed.

In summary, to achieve the best results for your retirement savings, you absolutely must have an expert pension adviser with the ability to design and administer the plan properly.

10 Questions for Your Pension Adviser

1. Have you looked at the specific details of my practice, such as age, length of service, salary levels and hours worked each year to recommend the best type of plan for me?

2. Have you prepared a study projecting the allocation of contributions for current and future years for the types of plans being evaluated?

3. Do you have the ability to modify the provisions of the proposed plan to assure that my practice gets the best result related to age-weighting, social security integration, vesting and coverage for my individual needs?

4. Do you have access to actuarial staff to be able to consider defined-benefit plans? Can your firm prepare and administer a target-benefit plan or new comparability profit-sharing plan?

5. Who will assure that all plan provisions annually stay in compliance with changes in pension law?

6. Who will perform the annual administration of the plan to provide the required communication to staff members, the Department of Labor and the Internal Revenue Service?

7. Who will maintain and keep records of all plan documents, IRS filings and administrative documentation?

8. How many plans like mine does your firm administer? Have you had any adverse IRS audit results?

9. If an employee retires or leaves, who will calculate and certify the appropriate benefit that should be paid? Who will calculate the allocation of forfeitures?

10. Will I have complete control of choosing investment philosophy or will I be restricted to using only one investment source? (We believe pension administration and investment advisers should be totally separate.)

Which retirement plan works best for Dr. Jones?