Surviving (even thriving!) in 2021: Findings from the 2021 Dental Economics/Levin Group Annual Practice Survey

For the 16th consecutive year, the team at Levin Group is pleased to collaborate with the editors at Dental Economics to provide our profession with important insights on the state of dentistry. Many thanks to those dentists who provided valuable information about their practices’ successes and challenges in 2021.

This year’s data was collected from general dentists at the end of 2021 and in early January 2022. We asked the respondents toCOVID-19 has had a dramatic effect on both dentistry and the world. The impact of the pandemic has varied greatly across different businesses, but dentistry appears to have held up well. The Dental Economics/Levin Group Annual Practice Survey demonstrates that most dental practices experienced stable or increased practice production in 2021. Despite the uncertainty of COVID, and even with the emergence of new variants, dentistry has not been negatively affected in terms of overall practice production and performance.

Our survey was designed to focus primarily on private practice performance. Ninety-three percent of the responses came from general dentists in private practice. Almost all of those were practice owners or partners in a private practice. The average age of a dentist participating in this year’s survey was 53. So, this year’s survey results are reflective of private practice performance and future expectations.

We break the survey results down into four key categories:

- Production, collections, profit, and overhead

- COVID-19’s impact on staffing

- Insurance reimbursements

- Miscellaneous facts

Production, collections, profit, and overhead

The survey indicated that 90% of practices experienced an increase in production in 2021 versus 2020. Almost two-thirds (64.9%) reported their increase was greater than 10%, and more than a quarter (25.7%) reported an increase in practice production of more than 25%.

This is a positive indicator for the profession. However, we do want to note that 2020 was an unprecedented year, with most practices shutting down for a period, and many practices experiencing lower production and collections than in 2019. It is important to recognize that some of the clear improvements reflected in this year’s survey data are not surprising when using 2020 as the base comparison year.

Related reading:

- A profession in transition: Findings from the 2018 Dental Economics–Levin Group Annual Practice Survey

- It's all about production: Findings from the 2019 Dental Economics–Levin Group Annual Practice Survey

- A profession seeking stability: Dental Economics/Levin Group annual survey

Collections, a critical metric in every practice, were good, but not quite as strong as production. Seventy-five percent of practices reported an increase in collections, and 20% reported that the increase was greater than 25%. That’s an astounding increase. Additionally, 52% reported the collections were greater than 10%. For comparison, our 2020 survey indicated that 74% of practices reported lower collections than in the full year 2019. This reflects a very positive upturn in both production and collections in 2021 over the prior year.

Unfortunately, higher production and collections in the 2021 survey did not equate directly to higher net profit. As mentioned earlier, 90% of practices had increased production and 75% had increased collections, but only 46% of practices reported an increase in net profit in 2021. This means that more than half of practices had the same or lower profit in 2021. Unsurprisingly, 69% of practices reported higher overhead in 2021, with the same percentage responding that rising overhead was their “biggest challenge right now.” This is a clear example of higher overhead eating into profitability.

Levin Group’s interpretation:

As mentioned above, when comparing 2021 production data to 2020, with its unprecedented uncertainty and unpredictability, it is not surprising that production and collections were significantly stronger in 2021. However, there are industries such as restaurant and hospitality that have been severely affected by COVID-19 both in 2020 and 2021. Fortunately for us, dentistry has been able to continue to provide services for patients and attract increased numbers of new patients.

We believe that one of the key factors contributing to the strength of the dental profession is that consumers (our patients) have excess discretionary savings that can be spent in nontraditional business areas such as dentistry. Between the government stimulus programs and patients not spending money on traditional things, such as luxury goods, entertainment, and restaurants and travel, more dollars are being allocated to dentistry at present. This could explain the increase in production and collections.

However, practices are experiencing higher overhead, including the cost of personal protective equipment (PPE). In our survey, 95% of practices reported that they have been able to acquire the necessary PPE, but 91% reported increased cost for PPE since COVID-19 hit. Half of practices reported that their PPE cost is 20% or higher than it was prepandemic. This is one of the contributory factors in rising overhead in dental practices, along with increased staffing costs and reduced insurance reimbursements.

It is particularly important to note that a practice that has higher production and collections without higher net profit, a common scenario reported in the survey, is a practice that is working much harder just to tread water from a profit standpoint. If production starts to weaken and overhead keeps increasing, maintaining profit levels will be challenging. Updating practice systems is one strategy to improve overall efficiency, maintain high production, and help control and reduce overhead.

COVID-19’s impact on staffing

No one will be surprised to learn that staffing is viewed by most practices as a significant challenge, even a crisis. Here are the- More than 95% of respondents believe there is a shortage of dental staff available for hire.

- 66% were actively seeking dental staff members at the time of the survey (January 2022).

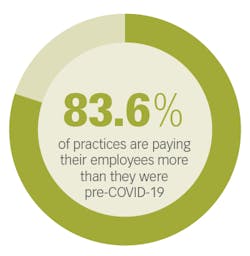

- 83.6% of practices are paying more for staff compensation (not including doctor compensation) than pre–COVID-19, with 50% of all respondents indicating that their labor costs were more than 10% higher in 2021.

- 34% of respondents indicated that they have smaller teams now than prepandemic.

Levin Group’s interpretation:

Staffing has become a crisis in dentistry across the nation. Enormous numbers of employees in all industries have resigned from their jobs in an era that has been designated as “the great resignation.” Although some government stimulus programs have been reduced, the return to work is occurring at a much slower pace than many economists expected.

People are taking their time to decide when they will come back to the workforce, and how they will manage issues such as childcare. They also have to negotiate the roadblocks of school openings and closings in different parts of the country. Many will now refuse to accept positions where they cannot work from home, at least part-time. Most dental practices cannot create part-time, work-from-home positions, which will eliminate many potential employees from returning to or entering the dental profession.

Practices are paying signing and longevity bonuses, increasing salary levels, and using various other strategies to attract and retain team members. Some have simply decided that they can operate more efficiently with fewer team members and are not replacing those who leave. This could have a long-term negative effect on the ability of practices to increase production and collections.

No one knows exactly how all of this will play out, but dentistry has been, and will continue to be affected by the loss of staff. Of particular importance are the significant loss of dental hygienists and the unmeasured statistic of how many hygienists have moved from full-time to part-time employment. Given that hygienists are the second highest producers in a dental practice (behind doctors), many practices would have even higher production if they were fully staffed. Anecdotally, we have spoken to many dental hygienists who have resigned from their positions and do not intend to return to dental hygiene in the future. Over time, it is likely that the current shortage will have to be made up by new hygiene graduates.

Staffing challenges will continue to impact dental practices for the foreseeable future. Practices that can retain their current team using incentives and motivational programs and a positive culture will find continued growth easier and more accessible.

Insurance reimbursements

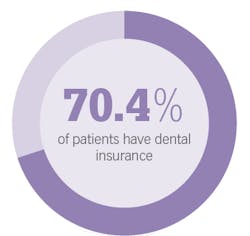

We were extremely interested to analyze trends in dental insurance participation by private practices in the second year of theLevin Group’s interpretation:

We were surprised to find that only 7% of practices surveyed enrolled in new insurance plan participation in 2021. Normally, when facing economic challenges, dental practices respond by adding more insurers and accepting lower reimbursements if necessary, to gain more patients. And although the broader economy is showing stress and strain, dental practices had good production in 2021, possibly precluding dentists from their typical reaction of adding more plans.

It was also not surprising to find that many practices have experienced lower reimbursements from their insurers. This has been an ongoing (and erratic) trend for several years, and the pandemic has done nothing to slow it down. Practices will need to understand how to increase production and collections annually despite lower insurance reimbursements. This means that practice performance and the implementation of highly efficient business systems will become more important than ever before to increase production, collections, and net profit.

Miscellaneous findings

As in previous Dental Economics/Levin Group Annual Practice Surveys, there were other findings that stood out and will be of interest. These include:

Just over 20% of practices reported an increase in the amount of third-party financing since the onset of COVID-19.Levin Group's interpretation:

It is very logical that practices are increasing the use of patient financing and dental membership plans. Patient financing has become critically important to many practices, assisting patients in their ability to afford treatment. Dental membership plans are a relatively new way for patients to pay for their dental care, and an increased number of patients appear to have participated in these plans in 2021.

Teledentistry has been a major focus since the onset of the pandemic. We found that many practices became interested in it as a way to serve patients remotely in 2020. Teledentistry will continue to be part of the profession, but it is unlikely to grow at the pace that was originally predicted in 2020 during a time when practices were either closed or reopening at a slower pace. We look forward to surveying about this subject in the future.

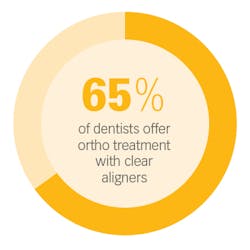

With the strong marketing effort by aligner companies, and several new companies having emerged, it is not surprising to see that two-thirds of general dentists offer aligner orthodontics to patients. Aligners offer general practices an opportunity to respond to patient interest and enhance their service offerings.

Implant dentistry is not a new service, and most general dentists, based on our observation, do not place many implants annually. While referrals to orthodontists for aligners and surgical specialists for dental implant placement remain strong, we do believe that the use of aligners and implants will continue to grow in the profession.

Summary

Thank you to everyone who participated in this year’s survey. Your valuable input will benefit our profession by providing important insights into the key measurements of dentistry in our country.The 2021 Dental Economics/Levin Group Annual Practice Survey provided both predictable and surprising insights. The expectation, based on results reported in the 2020 survey, that practices would increase production and collections in 2021 due to pent-up demand and a higher level of busyness proved to be correct. However, it was surprising to see the impact of accelerated overhead on net profit in many dental practices.

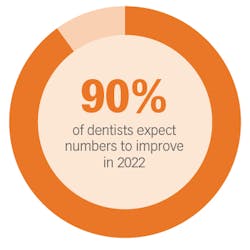

When asking dentists in this year’s survey about their outlook for the future, 9 out of 10 doctors reported that they’re expecting to do the same or better in 2022. Two-thirds of them expect revenue to increase by 10% or more this year, which indicates strong optimism within our profession.

The positive direction for production and collections in dental practices may well continue, even in the continuing pandemic; however, higher staffing costs and other associated overhead could continue to depress net profit. Last year was a vast improvement over 2020, and if practices can focus on creating highly efficient operational systems, employing faster methodologies for team training, and enhancing their ability to find and retain staff, 2022 could be an outstanding year for dentists and their teams. We look forward to finding out just how good it is in next year’s Dental Economics/Levin Group Annual Practice Survey.

Editor's note: This article appeared in the March 2022 print edition of Dental Economics magazine. Dentists in North America are eligible for a complimentary print subscription. Sign up here.

About the Author

Roger P. Levin, DDS, CEO and Founder of Levin Group

Roger has worked with more than 30,000 practices to increase production. A recognized expert on dental practice management and marketing, he has written 67 books and more than 4,000 articles, and regularly presents seminars in the US and around the world. To contact Dr. Levin or to join the 40,000 dental professionals who receive his Practice Production Tip of the Day, visit levingroup.com or email [email protected].