Considering monetizing your practice? There’s an important deadline approaching.

Congratulations on surviving COVID-19; it's a real testament to your mental toughness and business savvy. In theory, you are now free to focus on growing your practice and enjoy some smooth sailing. However, the reality is that you are now faced with making one of the biggest decisions of your career. Dictated by proposed federal tax law changes, this decision must be made by July 1, 2021.

Large, successful dental practices are very attractive to silent partners, or invisible dental support organizations (IDSOs). These groups are eagerly investing in great practices, general and specialty, in all 50 states. IDSOs purchase 51% to 90% of a practice for cash up front with the doctor retaining ownership of the balance.

Doctors continue to lead the practice with their brand, team, and strategy intact for years or decades. They grow bigger, faster, and more profitably by utilizing the resources of their IDSO partner. Doctors also have considerable upside gain potential on their retained ownership interest. 2021 could be the peak in the volume of these transactions as taxes may double in 2022.

A shocking prediction

President Biden has repeatedly promised to eliminate the long-term capital gains tax preference. If this occurs, the tax rate on the proceeds of the sale of part or all of your practice will increase from the current 20% maximum federal tax to a proposed 39.6%. In addition, you may also owe a 3.8% surtax, and of course your home state will want their piece as well. In some states, your combined federal and state tax bill could be in excess of 50% of the cash proceeds in a monetization of your practice in 2022.

In summary, this new tax rate will double your tax bill for monetization completed in 2022 and beyond. Assuming no growth in the value of your practice, your net proceeds after tax in 2022 and beyond will be 25% lower than in 2021. But even with growth rates far above the industry standard, it will take five years or more to return to 2021 net values.

Tax math example

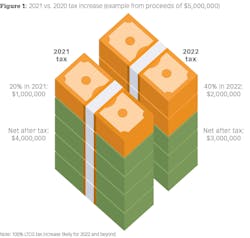

For this simple example, we will use a 2021 tax rate of 20% and a 2022 and beyond tax rate of 40%.Practice monetization proceeds: $5,000,000

• Tax bill in 2021: $1,000,000

• Net after tax: $4,000,000

• Tax bill in 2022 and beyond: $2,000,000

• Net after tax: $3,000,000

Five years to return to 2021 net value

To understand how long it will take you to return to your 2021 net, after tax practice value:

If you grow your practice bottom line (earnings before interest, taxes, depreciation, and amortization, or EBITDA) by 10% each year, compounded, in 2021, 2022, 2023, and 2024, and again in 2025, only then will you finally return to your 2021, after tax, net value. If you grow your practice EBITDA at less than a 10% per year rate, as do over 90% of all US dentists, you may die before you return to the net values of 2021.

This example assumes you pay no state taxes and that future valuation metrics for dental practices remain at 2019 value levels, where they are in 2021 for many doctors. Certainly, those metrics can go both up as they did in 2018 and 2019, and down as we witnessed in 2008-2013 and 2020.

July 1, 2021

In over $500,000,000 of dental practice monetization transactions completed by my company, Large Practice Sales, in the last 36 months, the average transaction required 184 days from engagement to cash in the doctor’s pocket. To ensure that you complete a transaction in the current 2021 tax year, you need to start the process before July 1.

Additionally, President Biden has ordered the IRS to increase the number of tax audits by 50% or more. He has also promised to increase the IRS enforcement budget dramatically to provide the resources for that attack.

Decision time

Most dentists did not join the profession to get rich, and their practice value is not what drives them. However, I have yet to meet a single doctor eager to pay higher taxes. If you are even thinking about monetizing all or part of your practice in the next five years, now is the time to understand its value today and its potential after tax value in 2022 and beyond.

About the Author

Chip Fichtner, Cofounder and Principal of Large Practice Sales

Chip Fichtner, Cofounder and Principal of Large Practice Sales, has completed more than $1.0 billion in IDSO partnerships in the last 24 months with dozens of IDSOs nationally. He has built, bought, and sold companies in a variety of industries and has been featured in numerous media outlets. His tolerant wife of 34 years allows him to live on airplanes visiting clients every week. Learn more at largepracticesales.com.

Updated December 2024