Dentists should target small businesses for new patients, research suggests

The pathway for dentists to take more control of their practices, lessen their dependence on insurers, and attract new patients to their practices comes from an unexpected place—the employer market. How do we know this? In 2020 we hired Finch Brands, a third-party market research firm, to conduct a series of employer focus groups and national surveys to better understand the employer dental benefits landscape. Over the course of six months, data was collected from uninsured and insured small-business owners, in both blue- and white-collar firms, and across a variety of industries. The results? Employers value dental benefits and want to provide them to their employees, but they need a solution that is affordable, simple to administer, and provides access to high-quality care.

Employers recognize the value of a dental benefit

Through research, we found that employers see a lot of value in a dental benefit and want to provide one to their employees for four main reasons. First, it shows employees that management cares about their well-being. Many small businesses are like families. Business owners know their employees personally and truly care about them. Second, employers recognize that a dental benefit will help keep their employees healthy, because oral care is linked to overall health. And they are right. Employees with access to a dental benefit are two to three times more likely to visit a dentist. Third, employers know that when employees prioritize their health, they are present and more productive at work. This increased productivity improves company performance. Finally, a dental benefit helps retain current employees and attract new talent. The job market is very competitive, and a dental benefit can separate one company from another.

Why target small businesses?

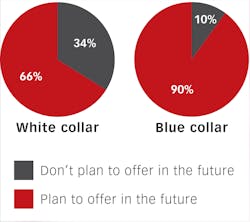

According to the Small Business Administration, there are approximately 30 million small businesses in the United States that employ• 66% of white-collar small businesses that do not currently offer a dental benefit plan to in the future.

• 90% of blue-collar small businesses that do not currently offer a dental benefit plan to in the future.

As you can see, the interest in offering a dental benefit is strong for all small businesses, but especially strong for blue-collar businesses. Why is this? We found that white-collar and blue-collar businesses offer health insurance at the same rate; however, blue-collar businesses offer a dental benefit at half the rate of white-collar businesses. Research participants pointed to increased turnover in blue-collar businesses as the driver for the discrepancy. The good news is that they view dental benefits as a way to lower employee turnover.

Potential obstacles for employers

This begs the question, if employers recognize the value of a dental benefit and plan to offer one in the future, what is their hesitation? ByThe survey and focus group results show that their hesitation is a result of perceived employee priorities, affordability, and value:

• 39% believe that a dental benefit is not a priority for their employees. This belief changes once employers ask employees if they would like a dental benefit.

• 36% believe that a dental benefit is not affordable for their company. A majority of employers estimate that they would need to pay more than $500 per employee.

• 33% believe that dental benefits are not a good value for their company. Employers don’t see the value in existing dental benefits due to the cost and coverage limitations (e.g., waiting periods, exclusions, annual limits, etc.).

Although employers believe that existing dental benefits are not right for their employees or their business, their concerns can easily be addressed with the right solution.

The solution

In our research, we found that employers are looking for a dental benefit that meets three criteria: it’s affordable, it provides high-quality care, and it’s efficient. Small-business owners view traditional dental insurance premiums of $500 as beyond their means. On average, they would like to contribute $200–$300 per employee. Employers also want a dental benefit that gives employees access to high-quality oral care. This goes back to the importance employers place on their employees knowing that management cares about them and that they have access to care that improves their overall health. Finally, employers want to make sure their money does not go to waste. They know that existing dental benefits are wasteful with a lot of money going to third-party administrators. And they’re right. In today’s market, employers spend $95 billion on dental insurance premiums annually, but only 60% goes to dental care.2,3 This is unacceptable for small businesses in particular, because they are faced with the daily challenge of running their businesses on limited funds. Once these criteria are met, employers can offer a dental benefit that works for everyone.

REFERENCES

1. Small business statistics: Facts and FAQs. Small Business Trends. https://smallbiztrends.com/small-business-statistics

2. Dental insurance in the US. IBIS World. https://www.ibisworld.com/industry-statistics/market-size/dental-insurance-united-states/

3. Davis MW. Dental loss ratios and questionable bedfellows in the insurance industry. Dentistry Today. October 26, 2018. https://www.dentistrytoday.com/news/todays-dental-news/item/3976-dental-loss-ratios-and-questionable-bedfellows-in-the-insurance-industry

About the Author

Dave Monahan

Dave Monahan is CEO of Kleer, a leading provider of subscription-based dental care. He can be reached at [email protected].