The Practical Investor

Risk-free investing for the long term with inflation-indexed bonds — Part II

by Marvin Appel, PhD, and Brian Hufford, CPA, CFP

Last month, we discussed the dangers that inflation poses to any long-term investment goals. We introduced I-bonds, a U.S. government savings bond with interest rates that are guaranteed to keep pace with inflation. I-bonds also provide complete safety of principal as well as certain tax advantages.

This month, we will complete our discussion about inflation-protected investments offered by the federalgovernment by describing a second investment option-Treasury Inflation Protected Securities (TIPS). We will offer some guidelines that will allow readers to judge whether inflation-protected bonds are worth buying. Finally, we will review the pros and cons for I-bonds vs. TIPS, as well as for inflation-protected securities compared with other types of bonds.

Treasury Inflation-Protected Securities

Like I-series savings bonds, the return on TIPS arises from two components. First, there is a fixed, real rate of return determined at the time of purchase that will not change. Second, there is a variable return to balance out losses of purchasing power from inflation. (Inflation is measured by the Consumer Price Index for urban consumers, called CPI-U.) This inflation-adjustment is paid as a monthly increase in principal (or decrease, if the cost of living falls), but the real return is paid as interest once every six months. The total return is the sum of both yields. The yield quoted on TIPS is only the real part.

For example, suppose you buy an inflation-protected Treasury Note for $10,000 that yields 3 percent and that the cost of living rises by 2 percent during the next six months. Then, after six months (half a year), you would receive an interest payment of $150 (half a year's interest at 3 percent per year = 1.5 percent of principal at each payment), and your principal would rise to $10,200 (2 percent, equal to the rise in the CPI-U). Six months after that, you would receive interest of $153 (1.5 percent of $10,200); your principal would be further adjusted to reflect inflation during the next six months. Monthly principal adjustments and twice-yearly dividend payments would continue until the bond matures, at which point you would receive the original $10,000 principal multiplied by the increase in the consumer price index. The flow chart below illustrates the process.

Tax consequences

Both the principal adjustments and the dividend payment count as taxable interest income, even though you do not receive any cash in hand from increases in principal until you sell the bonds. There are no tax advantages of TIPS compared to regular Treasury Notes. Theoretically, during periods of high inflation, the tax liability from TIPS could exceed the disposable income produced for investors in higher tax brackets. (Of course, TIPS held in an IRA or other qualified pension plans owe no taxes until asset distributions from the retirement account are made.)

Where do you buy TIPS?

You can set up an account with the U.S. Treasury to buy new issues directly through its Web site, www.pub licdebt.treas.gov/bpd/bpdhome.htm. There are no costs to buy bonds this way, although there may be a fee if you sell them before they mature. Otherwise, most stock brokers can sell them to buyers just like any other bond. Generally, the costs to buy and sell a TIPS through a broker should be minimal, but make sure you understand the charges before making any final decisions.

When buying bonds from a bond dealer, you often do not pay a separate commission. Instead, the price paid for the bonds includes a mark-up over what the bond dealer paid. The price of a bond may be negotiable, especially for a good customer, so ask to get your bonds at the minimum commission the broker's firm allows.

Just as merchants are reluctant disclose how much profit they make on a sale, it is sometimes hard to get brokers to reveal their profit margin on your bond purchases. One way to get an idea of the size of the broker's mark-up is to get a price quote from your broker (late in the business day), and then compare it to the quote in the next day's newspaper. Your broker's quote will not be as favorable as the newspaper quote, which applies to large institutional traders. But if the difference is too large for your tastes, you can look for a different broker or buy from the Treasury department.

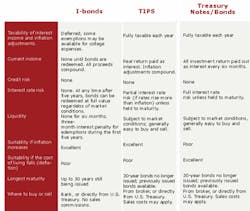

The table on the preceding page compares different federal government securities. They each have their pros and cons, depending on your tax situation, as well as the extent of your concern over inflation. (If you are saving now for a distant expense, you are at greater inflation risk than if you are looking to invest money that you will need within the next several years.)

How much yield should inflation-protected bonds pay before they are good investments?

The high inflation of the 1970s changed the landscape of the bond market. During the past 15 years, the fixed yields on long-term government bond yields ended up being, for most of the time, from 3.4 percent to 5 percent per year more than inflation. (Before the 1970s, interest on U.S. Treasury bonds rarely reached 3.4 percent above inflation.).

U.S. inflation-protected bonds have only been around since 1997. In their much shorter history, the real yields on 10-year TIPS have ranged from 2.6 percent to 4.4 percent (excluding the inflation adjustment). I-bonds have paid from 2 percent to 3.6 percent per year above inflation since their introduction in 1998. As of December 21, 2001, I-bonds are paying 2 percent; TIPS maturing in January, 2011 are paying 3.5 percent (plus inflation adjustments).

During the past ten years, whenever real yields dropped below 3 percent, investors never had to wait for more than a year until rates recovered back above that level. Our rule of thumb, therefore, is to buy only when the real yield exceeds 3 percent.

Conversely, during the same period, real rates never remained above 4 percent for very long. So if you get the opportunity to invest in inflation-protected U.S. government bonds at a real yield of 4 percent or higher, pursue that opportunity aggressively. (This advice assumes that you have already determined such an investment to be appropriate for your financial goals.)

A sea of change in the economy, such as an extended period of high inflation or deflation, could change these guidelines. (For example, in the early 1980s, in the wake of the inflationary 1970s, interest rates exceeded inflation by margins far above current levels, and inflation-protected securities were not available. The situation now is clearly different.) We also cannot predict any future usefulness of the guidelines suggested here based on past observations.

Choosing between TIPS and I-bonds

All else being equal, I-bonds are more favorable than TIPS. With I-bonds, interest and inflation-adjustments compound tax-deferred; I-bond holders also get to choose when to cash in their bonds, whereas the maturity of a TIPS is pre-determined. Because of these advantages, I-bond yields should be slightly below those of TIPS. However, the current disparity is too great, and the real yield too low, to recommend buying an I-bond at its current 2 percent real yield.

I-bond rates are reset every May 1 and November 1. If you are unsure about buying an I-bond, wait until two weeks or so before these dates and compare the I-bond rate to the prevailing TIPS rate for a bond maturing in approximately 10 years (available daily in the Wall Street Journal). If the I-bond rate is above the TIPS rate, buy before the rates change. In fact, if it is less than ½ percent below the TIPS rate, lock in before rates change. If the I-bond rate is three-quarters of a percent or more below the TIPS rate, wait until after November 1 or May 1 to buy I-bonds at the newer rates.

TIPS are among the safest possible investments. They are the only investments that eliminate both inflation risk and credit risk while providing a very high degree of liquidity. They are suitable for a wide range of investment objectives, especially for those of you considering investing in other types of bonds.

The behavior of the bond market in the past ten years suggests the following guidelines for judging if a TIPS or an I-bond is a good value:

- Do not buy an inflation-protected investment if the real yield is below 3 percent per year (for bonds maturing in at least five years).

- A very good time to buy inflation-protected securities is when the real yield is 4 percent or higher.

- If the yield on an I-bond is within one-half percent of the yield on a 10-year TIPS, and especially if the I-bond yield is the same or higher as the TIPS, buy the I-bond before yields change on November 1 or May 1.

- If the yield on an I-bond is more than three-quarters of a percent below the yield on a 10-year TIPS, wait until after the yields change on November 1 or May 1 to buy the I-bond.