Are you depending on the sale of your dental practice as your retirement fund?

Are you depending on the sale of your dental practice as your retirement fund? I am sure this question crosses your mind as you progress through your dental career. Certainly, a portion of your retirement funds will come from the sale of your dental practice, but you may be surprised by what net proceeds are realized after the cost of the sale—along with the associated income taxes.

This article will help you understand what costs to expect. If you are thinking of selling your practice, you will incur the cost of sale, broker fees, and attorney fees. You will also incur federal and state income taxes associated with the sale, which could approximate up to 35% or more of the sale if not managed properly. To manage these costs, you will need to determine what ordinary income property upon sale is as opposed to capital gain property.

Minimizing the tax costs

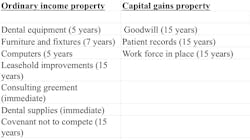

First, understand what components of the sale create what type of tax. For example, under current tax laws, the highest regular tax rate (37%) will be higher than the capital gains tax rate (20%). The idea here is to allocate as much of the sales price allowed by law to capital gain property (capital gains tax rates), as opposed to ordinary income property (ordinary tax rates).

Please keep in mind the Internal Revenue Service (IRS) has a "pecking" order on how to allocate the sales price of your practice. The order of allocations starts with the "hard assets" (ordinary income property) and concludes with the allocation of the "soft assets" (capital gain property).

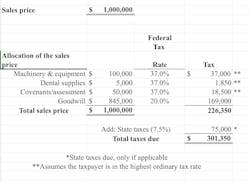

To minimize the amount of income taxes associated with the sale, a majority of the sales price will need to be allocated to the capital gains property assets as opposed to the ordinary income property. Below, I will demonstrate the potential tax costs associated with the sale of a dental practice at $1,000,000.

Editor's note: This article appeared in the November/December 2025 print edition of Dental Economics magazine. Dentists in North America are eligible for a complimentary print subscription. Sign up here.

As you can see, the tax costs are approximately 30% of the sales price of $1,000,000 ($301,350 / $1,000,000). If more of the sales price is allocated to ordinary income property, the tax costs to the seller are higher.

One thing to point out here is that the sale of a dental practice will avoid the net investment tax of 3.8% you usually incur when you have a capital gain like a stock sale.

Keep in mind that the buyer wants more allocated toward the ordinary income property as opposed to the capital gains property that the seller desires. So why does the buyer want more allocated to ordinary income property?

The depreciation/amortization chart below will help you understand why this is the case.

For example, say the buyer wants a majority of the sales price allocated toward the dental equipment because it can be written off (expensed/depreciated) over five years as opposed to goodwill, which will be amortized (expensed) over 15 years. Dental CPAs are often called upon to help negotiate the allocation of a fair sales price.

IRS requirements

When you sell a dental practice, the IRS requires both parties to disclose who the buyer and seller are, what the sales price was, and how it was allocated. The IRS form that requires this information is Form #8594, Asset Acquisition Statement, under IRS code section 1060.

As a result of this IRS requirement, the attorneys associated with the sale will include a paragraph inside of the asset purchase agreement (APA) requiring both the buyer and the seller to agree at the time of closing to file IRS Form #8594.

Conclusion

I hope the above has assisted you with the understanding of the tax costs involved in selling a dental practice. If you feel you need additional help, please reach out to a dental CPA near you.

*Please note that as of the date of this publication, the most recent change in tax legislation, One Big Beautiful Bill Act, does not impact the sale of a dental practice.

About the Author

Allen M. Schiff, CPA, CFE

Allen M. Schiff, CPA, CFE, is a founding member of the Academy of Dental CPAs. This group of very knowledgeable CPA firms specializes in practice management services for the dental industry. He serves on the ADCPA executive committee and is the current president of the ADCPA. Reach him at (410) 321-7707 or [email protected].

Updated February 20, 2019