Are you ready to sell?

At a point in every dentist’s career, the time comes when he or she needs to devise and implement a transition strategy so that the practice built over the years will continue on in the hands of a young purchaser. This can be one of the most rewarding times in a professional’s career for both the buyer and seller if performed properly. If shortcuts are taken and executed improperly, both dentists and their families are susceptible to continued liability and the destruction of typically a doctor’s single largest asset.

Many established dentists are questioning how you know when you are ready for the sale of your practice.If you can answer the following three questions affirmatively, chances are you are at the point where you should consider selling your practice:

1) Financially, can I afford to sell my practice?

You should begin by appraising all of your assets, including your practice. Review them with your financial advisor. Your advisor can assist you in determining your current financial position and your needs and wants in retirement. You now will have the ability to analyze whether or not your investments will support your retirement plans. Once you find that you are approaching the point of financial freedom, it is important to properly diversify your assets so that fluctuations in the markets will not significantly derail your efforts now that you have committed to a transition strategy.

2) Is there something I would rather do than practice dentistry?

Develop a plan outlining what you would do with your newfound time and retirement freedom. Do you want to travel, play golf, sail the world’s oceans, or spend time with your family? Part of determining the when and how a transition should occur is planning for life after practice ownership. If you find there is nothing you would rather do each morning when you wake up than go to the office - and yet you have reached financial freedom - you may want to explore a preretirement sale. This option will provide increased freedom and cash out of your equity, while allowing you to continue to enjoy practicing with your successor. However, if your answer to the first question is “no,” a preretirement sale is generally not an acceptable option.

3) Is the quality of the dentistry I provide to my patients deteriorating?

First and foremost as a health-care provider, you have a duty to provide the quality of care your patients expect. If the quality of your care declines, you will find yourself with a rapidly deteriorating practice and quite possibly a lawsuit.

After answering these questions, you should be able to determine if you are ready to design and execute a transition strategy or to identify a target date when you will want to pursue this. Once you have set the target date, you can work backwards to identify the time frame you will need to begin to formalize your plans and start searching for a buyer.

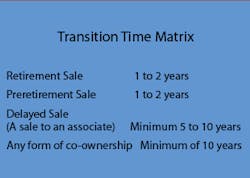

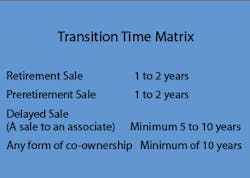

The transition time of a sale can take anywhere from a year or two for a traditional retirement sale to a minimum of 10 years for a partnership buy-in/buy-out. Often, dentists want to obtain an associate for a period of time prior to the transition, so they can “groom” the purchaser. This strategy requires a minimum of five years to accomplish properly. If your target date is less than five years out, the only feasible options are a traditional retirement sale or, if the practice is large enough, a retirement sale with the continued employment of the seller post-closing.

Peter Ackerman, CPA, is a principal of The Dental Marketplace, and past president of American Dental Sales. He provides practice brokerage, appraisal and consulting services throughout Illinois, Missouri, Indiana, Iowa, and Wisconsin. You can reach him by phone at (312) 240-9595, or via the ADS Web site at www.dentalsales.com.