Can you save your way to prosperity by cutting overhead costs?

by Dr. Brad Dykstra

Continuing the quest of understanding the financial dynamics and drivers of profitability, we will examine the remaining elements of the most basic business principles that apply to every business, even dentistry.

In review, in the most basic form, the formula for determining practice profitability is:

Total income (revenue) - total expenses = net practice profit

In a previous article, we learned what comprises total income and the factors that affect it. We learned how cutting fees is not as effective as increasing marketing in raising the total income amount. Increasing the practice productivity by improving office systems, investing in new, time-saving technologies -- such as digital radiography, digital impressions, and dental lasers -- and learning new procedures can dramatically improve the total revenue of the practice.

In this article, we will look at the remaining two parts of the equation: total expenses and the resulting net practice profit.

Total expenses

Determining the total expenses is quite straightforward. It can be found by looking at the check register, or QuickBooks profit and loss monthly, or the annual report and determining the total outflow of cash via checks or credit card payments.

What are the variables that affect expenses?

The easiest way to think of them is in two basic categories -- fixed expenses and variable expenses. In the short term (less than a year), the variable expenses are ones that go up and down each month and are correlated with production numbers. In most cases there are only two: the lab bill and supply bill. Others might possibly be the marketing budget and contract labor.

Fixed expenses include all of the remainder: labor, facilities, insurance, etc. They stay the same no matter what the production and collection numbers are each month. Some may consider labor a variable cost, but in the short term, it is a fixed cost. In the long term -- anything more than one year -- many expenses can be considered variable.

A common temptation is to find a way to cut expenses by reducing employees, finding cheaper supplies, or using a discount dental lab. Although it is always important to run a lean practice, cutting expenses generally is not the way to increase the practice's net income over time.

Take supplies for example. If the normal supply bill is 5% of production, and you find a way to save 10% on the supply bill (almost impossible to do), this translates into only 0.5 of 1% (5% - 0.5% = 4.5%) increase in the practice net income. It would only take a 0.2 of 1% increase in production or fee increase to accomplish the same result. Long term, you cannot save your way to prosperity.

This temptation to cut costs also segues directly into the marketing budget.

If the marketing budget is 4% of practice income (high for most practices) and is reduced to 2%, it will result in an immediate 2% increase in practice net income. The bigger question to consider is: "What will the effects be over the next six to 12 months?"

If the marketing program is effective, it will be generating more income than it costs. Assume that cutting the marketing budget by 50% (4% to 2%) reduces new patient flow by 30% and production by 10%. The result is detrimental to the bottom line of the practice. If you are not tracking the results of marketing efforts, it is time to start. Eliminate what does not work, and increase what does.

A similar temptation may be to reduce the number of hygiene days available in the practice. Again, remember that about 60% of the dentist's production comes from the hygiene area, so do everything you can to keep the hygiene department strong and productive. Take the extra time to build and reinforce the value of preventive care appointments for patients.

The best way to control overhead percentages is to focus on increasing production, not cutting costs!

Net practice income

Net practice income is what remains after subtracting all expenses from the total income generated and collected. Again, this number is not always as simple or clear-cut as one may think.

When determining net income, it is also important to take into account a few add-backs or additions taken from the total expense department. These may include pension plan contributions for the owner/dentist, car allowances, health insurance, and some continuing education meetings and travel.

If the net practice income of a million-dollar practice is only 35% on the profit and loss statement, but $100,000 was placed into a retirement plan for the dentist, the real net practice income is 45%. Once you understand the numbers of the practice, the decision-making process becomes much easier and more effective.

The net practice income of approximately 40% to 45% is a great number to strive for and attain, but this number is often misunderstood as practice profit. This is not completely correct. What has not yet been accounted for is the dentist's production, wages, and ROI (return on investment) in the practice.

What should your net practice income be (before personal taxes)?

A benchmark to aim toward is a combination of two numbers. The first is being paid for the work you as the dentist produce, similar to what you would pay an associate for the amount produced. The second number is being paid a return on the investment in the practice and for the management of the practice. Once these are accounted for and subtracted from the net practice income, the amount remaining is the true practice profit.

If the going rate for compensating an associate is 33% of production, the owner/ dentist should be compensated at least at this level. On average, the dentist in a solo general practice generates about 2/3 of the total production.

For the million dollar practice, this would translate to the dentist producing $666,666 with the remaining 1/3 produced by the hygiene department. In this case, the dentist's wages as a producer would be $222,222.

The second number is being paid a return on the investment in the practice and management of the practice. A good rule of thumb is to expect a 10% return on the investment in the practice, and a 4% return for the management of it.

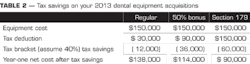

If you have invested $1 million in the practice, the annual return should be 10% or $100,000. If a mature, well-run practice generates $1 million per year, the management fee would be 4% or $40,000 for a total nonproduction return of $140,000. (See Table 1)

Adding the ROI of investing in the practice, the management fees, and the production wages, the total in this example comes to $362,222 or 36.2% of total annual revenue. (Table 1)

When the practice is viewed from a business point of view, the ROI and dentist's wages are expenses that must be accounted for before arriving at the true practice profitability.

The practice profit in the following example would be the total practice revenue minus the normal total expenses minus the total cost of the dentist's labor and ROI. In this case, the real net practice profit is 3.78% or $37,778. This practice is profitable. (See Table 2)

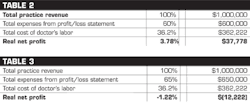

In this same scenario, with the exception of the total expenses (office overhead) from the profit/loss statement at 65% instead of 60%, the practice is not really profitable, but it is running at a slight loss. This actually translates into the dentist working for a lower rate than what an associate would earn. (See Table 3)

In summary, if the goal is to maximize practice profitability, remember the following formula:

Total practice income (total number of patients seen x income per patient [number of procedures per patient x fee per procedure]) - total expenses (variable expenses + fixed expenses) = net practice profit - ROI - dentist wages = true practice profit

Focus on the real drivers of income growth: increasing the number of patients, procedures per patient, and fee for procedure. Reduce overhead to a healthy level. But keeping the focus in this area will not bring long-term growth or prosperity.

Dr. Bradley Dykstra is a general dentist in private practice in Hudsonville, Mich. He is a graduate of the University of Michigan's dental school and received his MBA from Grand Valley State University. Dr. Dykstra speaks on integrating technology into the dental office, and consults through his company, Anchor Dental Consulting. Reach him at (616) 669- 6600, or [email protected].

Past DE Issues