The real cost of slowing down!

I don’t know how many times a dentist has told me how he or she plans on cutting back and slowing down as he gets closer to retirement. I had never thoroughly analyzed the effects of a cutback before, so I decided to take a very close look at what the exact results of such a cutback would be.

On first blush, you might presume a practice with an overhead of 60 percent that cuts back its income $100,000 per year would result in a $40,000 loss in income. However, the only expenses on the last $100,000 were basically laboratory and clinical supply expenses, which together usually total about 15 percent. Add another 10 percent savings for salary cutbacks, and the total incremental expense is approximately 25 percent on the last $100,000 of income. In this case, reducing the practice income by $100,000 would have resulted in an expense savings of only 25 percent - or $25,000 - but it would result in a loss in owner net income of 75 percent, or $75,000. Since this practice had a price value of 70 percent of its gross collections, a reduction of $100,000 would result in a lowering of its price by $70,000!

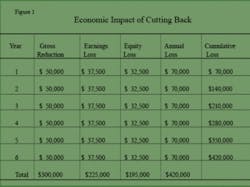

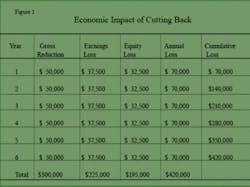

Now consider the plight of another dentist whose practice we listed (see Figure 1). Over the past six years, he reduced his income by $300,000 as a result of cutting back his production time. For the sake of analysis, let’s use an average annual cutback of $50,000 per year for five years. Let’s see what economic impact that decision has on his practice.

This particular dentist unknowingly actually cut his practice back past his break-even point. That is, he did not generate enough income to cover his annual expenses! I am sure he would not have knowingly taken this course of action, and I am equally sure that he did not realize the financial implications of his actions.

He might have thought that a $300,000 reduction in his practice income, spread over six years, would create $120,000 loss in income, and that it was worth it for the extra “free” time. But he did not understand the true structure of the economics of a dental practice - that is, the overhead from the first dollar earned up to the break-even point is 100 percent. After the break-even point, overhead expense is approximately 25 percent of the incremental earnings. The blended overhead rate may be 60 percent, but this is useless information. In this case, this statistic misled the owner into taking a much more costly path than he would have otherwise taken. In this case, the final result was much worse - the practice could not be sold during the owner’s lifetime because it did not make a profit.

The saddest part of not understanding this phenomenon is that I have seen too many dentists in the last years of their practice working for free, when their health and passion for practicing have both greatly diminished. When dentists considering retirement understand that the sale proceeds will equal the income they earn for the next three years, and they continue to practice, they work those years for free! Another decision that would not have been made if the facts were fully understood.Earl M. Douglas, DDS, MBA, is the founding president of American Dental Sales. He is president of Professional Practice Consultants Ltd. Dr. Douglas personally services the Southeast area of the United States, and has affiliates nationwide. He can be reached at (770) 664-1982 or write to him at 11285 Elkins Rd, A-2, Roswell, GA 30076. Visit his Web site at www.ppcsouth.com.