From production to collections: An overview of the operational cash flow cycle

Jonathan W. White, CPA

T. Lynn Coward, CPA, CFP

Editor's note:

This article is part of a series on the preservation of the independent dental practitioner.

In today's challenging business environment for independent dental practices, understanding the revenue cycle and how to improve net collections is imperative. Oftentimes, practitioners will focus on increasing overall production, but they do not investigate whether the maximum profit is being derived from current production.

This article is designed to provide dentists with an overview of the operational cash flow cycle from production to collections. Throughout the cash flow cycle there are numerous points that providers should focus on, including adjustments, refunds/nonsufficient funds (NSF) items, and accounts receivable. Focusing on these areas can make a significant impact: an increase in collection rate by 2% in a $1,000,000 practice adds $20,000 to the bottom line.

Adjustments

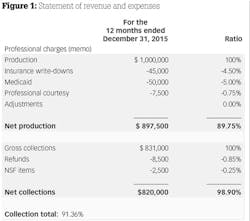

Dentists are acutely aware if production numbers are decreasing and will take action to find solutions. Gross production is a measure of work performed but not an indication of actual production available for collection. Medicaid adjustments, insurance write-downs, professional courtesies, and write-offs are all adjustments to production that are not collectable. A dental-specific statement of revenue and expenses should include this information to provide insight on how pervasive adjustments are to production. In the example, adjustments reduced production by 11.25%.

Reducing the impact of adjustments increases the potential cash flow from production. Each practice is impacted by adjustments, but the types and severity vary greatly. A fee-for-service practice is impacted by adjustments that are primarily within the dentist's control. In contrast, practices in-network with insurance or accepting Medicaid are limited in controlling adjustments. Although reducing adjustments can be challenging, there are solutions to mitigate the impact. Below are items to consider when reviewing adjustments:

• Negotiate the in-network reimbursement rate with insurance companies. The services of an outside firm that specializes in insurance negotiations can be helpful. Specifically, focus on those procedures most frequently performed. Achieving full reimbursement on infrequent procedures will provide minimal financial benefit. Once the rates are set, the actual reimbursement should be routinely monitored to ensure compliance by the insurance company.

• In the past, Medicaid was either a significant or very minimal part of a dental practice. However, things have changed as more dentists see this as an option to increase patient flow. To successfully make this transition, dentists need to educate themselves and the staff as to how to manage the patient from scheduling through billing. The goal is to not only maximize reimbursement, but to adjust the dentist's and staff's expectations. Again, the impact of Medicaid to the practice needs to be routinely evaluated.

• Employ a marketing strategy to increase patients without signing up for in-network insurance or Medicaid. The cost of attracting fee-for-service patients should be less than the write-downs experienced by joining a network.

After accounting for all adjustments, net production represents the actual dollars available for collection.

Refunds and NSF Items

Once net production is determined, refunds and NSF items can further erode the actual collection percentage. Refunds can represent insurance overpayments, prepayments not utilized, or unsatisfied patients. If the dentist is not writing the refund checks, he or she should scrutinize and approve all refunds to ensure they are valid. Erroneous or fraudulent refunds reduce cash flow and can signal significant problems with staff or practice procedures.

NSF items include returned checks and chargebacks of automated clearing house (ACH) debits, or credit charges for practices that offer in-house financing. Timely follow-up on these items increases the chances of collection. Banks often offer an automated check processing (remote capture) that allows instant verification and access to funds. The additional service cost can be offset by increased collections, reduced staff time to follow up on bad checks, and the need for daily deposits.

Net collections are determined after subtracting any refunds and NSF items (figure 1). The collection percentage is a function of net collections over net production. The collection percentage is also impacted by a change in the accounts receivable balance not included on an income statement.

Accounts Receivable

The accounts receivable (AR) balance represents outstanding collections and should be routinely monitored. A cash basis balance sheet will not record the outstanding AR balance; therefore, detailed information can be obtained through practice management reports. The amount within AR will vary based upon the type of practice or specialty and composition of the patient base (in-network, Medicaid, or fee-for-service).

An increase in AR can reduce the collection percentage in one period, while a decrease in AR has the opposite impact on the collection percentage. Figure 2 illustrates an increase in the AR balance of $66,500 for the year. Refunds and NSF items account for a 1.10% reduction in collections. The remaining decrease in collection percentage from 98.9% to 91.3% is due to an increase in the AR balance.

The aging accounts receivable report disaggregates the total balance into the number of days outstanding. Reviewing the aging AR report should be part of the monthly financial analysis. Figure 3 provides an example of an aging report. Specifically, balances between 90 and 180 days are important to review and take action upon in order to ensure collection. Balances over 365 days are usually not collectable and could be considered for bad-debt write-off. The caveat to a write-off is the patient's balance will be zero if the patient returns in the future. Below are steps to reduce AR and increase collections:

• Collecting copays upfront prior to service ensures collection and alleviates increasing the AR balance. In large treatment cases, ensure prepayment in advance. This also helps reduce cancellations that can leave openings in the schedule.

• Bill patients with outstanding balances in a timely manner. Many companies and practice software options provide this service without utilizing practice staff.

• Train the front desk to collect outstanding balances at the beginning of the next visit. As long as the balance is associated with an active patient, this can be effective in collecting AR.

• Utilize a collection agency for debts deemed uncollectable by the practice.

Once collections are deposited, practice expenses, principal repayments, and capital expenditures are a few items that impact cash available to the owner. Practitioners working with an accountant should develop a cash requirement budget. This budget will provide the required monthly cash outlays and develop a bare minimum of collections needed to break even each month.

A common question we encounter is, "Why is net income a certain number but cash available is significantly less?" A traditional income statement provides net income but does not capture the full cash flow cycle. A cash flow statement should also be included with monthly financials to provide insight on how cash resources are used upon collection. This statement includes all receipts and outlays including nondeductible items. Working with a CPA who provides dental-specific financials will aid practice owners in managing the business. Practice management reports combined with properly built financial statements are vital to managing the practice for success and maximizing collections.

Jonathan W. White, CPA, operates a dental-specific CPA firm, Jonathan W. White, CPA, PLLC, that provides accounting and tax services in the Southeast. He works with practices at all stages, including startups and transitions. View jonathanwhitecpa.com for more information.

T. Lynn Coward, CPA, CFP, owned a CPA firm focusing on dentists for 30 years prior to retirement.