The scoop on the new tax package

By Joe Blaes

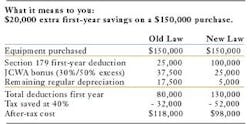

A very recent economic headline is the new tax package that President Bush signed into law. The new business tax breaks in this law are significant, and you should act to take advantage of them. Dental Economics columnist Rick Willeford, CPA, has summarized the dramatic parts of this new tax law, and I am including them in my column so you will have the best information. He will cover the entire law at a later date.

I felt that the material in this summary is very timely and could save you significant tax dollars over the next couple of years, if you plan correctly.

Section 179 "first year" deduction — Under the old law, you could immediately deduct the first $25,000 of equipment bought each year. An immediate deduction is more valuable than having to take the deduction over five to seven years in the form of depreciation. The new law raises this to $100,000 for items purchased in tax years beginning in 2003, 2004, and 2005. (For calendar-year practices, this means for purchases after January 1, 2003 and through December 31, 2005.) By the way, this applies to large SUVs (over 6,000 pounds), too! It only applies to the business-use percentage, and you must prove more than 50 percent business use.

Phase-out Increased — Under the old law, the $25,000 deduction was phased out if you spent more than $200,000 on equipment in one year. So a practice start-up or a major renovation might be caught in this trap. The new law raises the phase-out figure to $400,000! This also applies for 2003 through 2005.

9/11 Job Creation and Worker's Assistance (JCWA) bonus — Under the old law, you could take a first-year 30 percent depreciation deduction for purchases in excess of the Section 179 deduction above. The new law raises this to 50 percent for new equipment and certain leasehold improvements purchased after May 5, 2003 and by December 31, 2004. (The old law was to expire September 10, 2004.)

A note of caution: It is not clear if the states will follow the new federal law. If they do not, then the calculations become more complex, especially for a C corporation. For more information, feel free to contact Rick Willeford at rickw@willefordc pa.com.

Be sure to check out this month's cover story on page 18 Dr. Michael Gradeless outlines his practice's journey and how relationships have helped him to build the practice of his dreams. He has built a beautiful, functional office in Fishers, Ind., and, with careful planning, he has managed to stay within his budget. This is an office that I am sure we can all relate to.

Joe Blaes, DDS, Editor — e-mail: [email protected]Toll-free phone number: (866) 274-4500