A 10-minute retirement plan

by Brian Hufford, CPA, CFP

How do you ensure you won’t run out of money during your planned retirement? This column will assess the dangers and opportunities associated with planning successful retirement investment and withdrawal strategies.

The first question to answer is, “How long are you going to live?” The most recent IRS life expectancy tables say the average life expectancy for a 60-year-old is 25 years. During a 25-year retirement, retirees tend to underestimate their actual income needs and the effects of inflation. They also tend to overestimate the amount that can be withdrawn anually from their investments. Historically, stock investment returns have been about 10 percent. Does this mean you could withdraw 10 percent of your investment portfolio annually? Historically, since inflation has averaged 3 percent, what impact does this have on a retiree’s income needs during a 25-year period and the appropriate withdrawal rate?

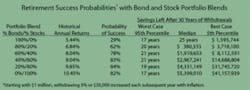

Recently, I prepared a Retirement Success Probabilities table (above) to assist with decisions about appropriate withdrawal rates, inflation, and investment allocation during retirement. It was developed using a Monte Carlo simulator with 10,000 “flips of the coin” for possible outcomes from worst-case to best-case scenarios. I think it reveals much about the important issues related to retirement.

Suppose you wish to be safe, plan for a 30-year retirement, and have a portfolio blend of bonds and stocks. You want to know your probability of success and how best to create a portfolio for 30 years while factoring in inflation. For this table, I have used long-term U.S. Treasury Bonds and the S&P 500 Index to calculate historical investment returns.

First, let’s assume you wish to decrease investment risk related to stocks. So you want to determine your probability of success with a portfolio consisting of 100 percent bonds. From the table, you see the historical investment return of bonds is 5.44 percent; however, inflation historically has been 3.05 percent. Thus, the returns for bonds, net of inflation, is only 2.39 percent (5.44 percent - 3.05 percent).

If you withdraw 5 percent from a $1 million portfolio, and increase withdrawals by inflation annually for 30 years with a 100 percent bonds portfolio, you would only have a 29 percent success probability. In the worst case, you could run out of money in just 17 years. With the median result, you could expect to run out of money in 25 years. In the best case, you would have $1,593,744 remaining after 30 years.

Let’s suppose stock volatility does not bother you and you invest your portfolio 100 percent in stocks. The historical return of stocks has been 10.45 percent. Adjusted by inflation of 3.05 percent, the net-of-inflation return is 7.4 percent. The probability of a successful retirement increases to 82 percent. You could still run out of money in 17 years in the worst case due to stock market volatility; however, the assets remaining after 30 years have increased dramatically to more than $5 million in the median case and more than $41 million in the best case. Based upon a retiree’s situation, the appropriate portfolio blend greatly can increase the likelihood or probability of success.

Longer periods of retirement dictate lesser percentage withdrawal rates and possibly a higher proportion of stock investments in a retiree’s portfolio to increase the probability of success. Anyone considering retirement must carefully consider his or her retirement time frame, withdrawal rate, inflation, and portfolio allocation to have the highest probability of success. Small changes can have big implications.

The simulation table models outcomes based upon historical results. Future investment performance may be significantly different than the performance assumptions used to create the simulation.

Brian Hufford, CPA, CFP®, is CEO of Hufford Financial Advisors, LLC, an independent, fee-only planning firm that helps dentists achieve financial peace of mind. Contact Hufford at (888) 470-3064, or at [email protected].