The case for Roth contributions

Tripp Yates, CPA/PFS, CFP

WITH THE IMPLEMENTATION of the new tax law in 2018, most tax brackets will decrease by approximately 3%.1 While there are many other factors that affect your total taxable income, such as deductions, we are currently in a more favorable tax environment for many dental practitioners. Additionally, the new tax law includes the 20% qualified business income deduction for practice owners with income below certain thresholds. Because these favorable tax rates are expected to expire at the end of 2025, we may be in a period where contributions to Roth IRAs and Roth 401(k)s will be of even greater benefit in the future.

What is a Roth IRA or Roth 401(k)?

Contributions to a Roth account are after-tax. This means your contribution is income earned that has been taxed. You do not receive a tax deduction for your contributions, but under current law you will never pay tax again when you withdraw the money (after you reach age 59 ½).

Another benefit to a Roth account is that you can withdraw your contributions any time tax- and penalty-free. For example, if you contributed $5,500 to a Roth IRA and it grew to $7,000, you could withdraw the $5,500 tax- and penalty-free at any time. This feature is somewhat of a safety net as far as access to your contributions.

Keep in mind that Roth account contribution limits are combined limits between the traditional account and the Roth account. Let’s look at the five different ways you can participate in Roth contributions: Roth 401(k), Roth IRA, backdoor Roth IRA, mega backdoor Roth, and Roth conversion.

How to participate in Roth contributions

Roth 401(k)—Today, most employers offer not only a traditional 401(k) option, but also a Roth 401(k). You can contribute $18,500 (for those under age 50) or $24,500 (50 and older) annually.1 The biggest advantage of a Roth 401(k) is there is no income limit in order to make contributions.

Roth IRA—You can contribute $5,500 (under age 50) or $6,500 (50 and older) annually.1 Your spouse can also contribute up to the same amount as long as your combined earned income is at or above your contribution amounts. The catch with making direct Roth IRA contributions is there is an income limit that you must meet to be allowed to contribute. Once your income is above the phase-out limit, you cannot contribute to a Roth IRA.

Modified Adjusted Gross Income Phase-out for Roth IRA contributions are as follows:1

• Single: $120,000–$135,000

• Married filing jointly: $189,000–$199,000

Backdoor Roth IRA—This is a strategy for those whose income is higher than the limits allowed in order to contribute to a Roth IRA directly. You would make a nondeductible contribution to an IRA and then convert it to a Roth IRA. There would be no tax effect as long as you do not have an IRA balance other than the nondeductible contribution you made. If you have IRA balances, you would not want to use this strategy because you would be taxed proportionately on the conversion as to what percentage of your total IRA balances you received a tax deduction in the past.

Mega backdoor Roth—This is an advanced strategy for dentist employees and independent contractors. Here’s what to look for in your 401(k) plan document:

• After-tax contributions are allowed.

• In-service withdrawals or rollovers are allowed before age 59½.

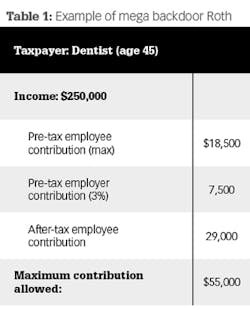

An example is provided in Table 1.

The idea is that the total contribution limit to a 401(k) plan for a specific person annually is $55,000 ($61,000 for those age 50 and older).1 The contribution is usually made up of employee contributions and employer contributions, such as a company match. However, if total contributions to your 401(k) do not reach the maximum amount, there would still be room for more after-tax contributions.

If your plan allows in-service withdrawals, you would roll the after-tax contributions ($29,000 in our example) into a Roth IRA each year. This would allow the contributions and earnings to build in a tax-free Roth IRA. If your plan does not allow in-service withdrawals, the after-tax contributions would stay in your 401(k) and only the contributions would be able to be rolled into a Roth IRA tax-free when you retire.

Roth conversion—There is no income limit for anyone to convert IRA or 401(k) balances to a Roth account. This strategy works well in a low-income year because you will pay tax on the amount converted. One example would be the year following the sale of your practice. You would have plenty of cash to support your lifestyle without having earned income from the practice. You would want to work with your CPA or tax preparer to decide how much to convert based on your current and future expected tax rates.

Other benefits of a Roth account

Two additional benefits of Roth accounts are as follows:

• There are no required minimum distributions at age 70½ as there are with traditional IRAs.

• Your heirs will be pleased to inherit accounts that are tax-free and would be able to take the withdrawals stretched out over their lifetimes.

The 20% qualified business income (QBI) deduction for practice owners makes the Roth option very appealing for those with taxable income below $157,500 (single) and $315,000 (married filing jointly). The marginal or highest federal tax rate for these groups is 24% or lower, while the QBI deduction is 20%.1 Therefore, a contribution to a traditional IRA or 401(k) lowers a person’s tax and also lowers their QBI deduction. By contributing to a Roth account, they would maintain the maximum QBI deduction while also building a tax-free retirement account.

While tax laws can change any time, we believe it is important to diversify your account types and tax structures of your retirement funds. Utilizing a Roth account will give you withdrawal flexibility in the future.

Further reading

Mega Backdoor Roth. Mad Fientist website. https://www.madfientist.com/after-tax-contributions/.

References

1. 2018 Key Numbers. Broadridge Investor Communications Solutions Inc. Published 2018.

Tripp Yates, CPA/PFS, CFP, is the founder of Memphis-based Registered Investment Advisor Eaglestrong Financial. He works with dentists to organize their finances, reduce taxes, and invest wisely. For more information, visit eaglestrong.com or email [email protected].

Disclaimer

Eaglestrong Financial is a Registered Investment Advisor (RIA) with the state of Tennessee. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities.