What financial planners are getting wrong about inflation, credit contraction, overvalued equities, and the next 10 years

Investors are seeking clues about where the markets are headed. Will there be a soft landing? Will the headwinds of inflation, rising national debt, and a burgeoning credit crisis push the economy into a recession? Or perhaps neither of those scenarios entirely?

For investors who want to step away from practice (and reduce their reliance on practice income), it is vital to have a financial plan that does not rely on accurately predicting the future.

What if markets don’t grow over the next decade?

Investors should beware of linear extrapolation, or the temptation to believe that the future will follow the recent past. The last 40 years have been an era of declining interest rates and market growth, ending in the historic lows of 2020–2021. Our national response to the pandemic (unprecedented stimulus) has triggered a wave of inflation and rising interest rates, the effect of which remains to be seen.

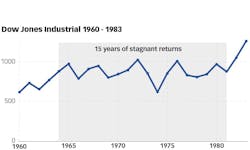

What happens to your future plans if the coming decade becomes an era of nominal growth (unlike the dramatic growth we’ve become accustomed to)? There have been numerous periods of stagnation and limited growth in the history of the US equity markets. The period from 1960–1982 saw a significant period of volatility with very limited growth. Significant inflation combined with an anemic economy led to a period of stagnation that became known as “stagflation” (figure 1).

There are numerous indicators that today’s markets are facing a tough road in the days ahead.1

Economic mirage: Things aren’t as stable as they seem

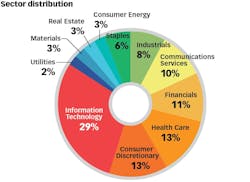

The composition of the S&P is limited to only a handful of companies and industries—just 20 companies represent 36.04% of the entire index. The technology, finance, and health-care sectors account for 53.5% of the index. Can we really claim that the well-being of the entire economy is represented solely by the prices of 20 companies or just by three sectors (figure 2)?

Growing reliance on credit despite rising rates

These points fly right in the face of the Fed’s ongoing war against inflation:

- Consumer revolving loan debt, like credit cards, hit an all-time high just shy of $1 trillion.3

- Consumers are assuming massive debt loads; their personal savings rate fell to just 4.3%, almost 30% lower than the midpandemic high.4

- Home cancellation rates (an oft-overlooked economic indicator) remain shockingly elevated, with KB Home’s recent 38% cancellation report considered “better than expected.”5

Inflation: Defeated or hiding in plain sight?

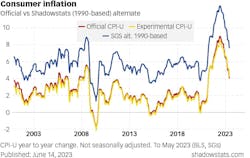

One way inflation might be “hidden” is in the way many official statistics are calculated. Data provider Shadowstats6 calculates inflation with official methodologies that were used until 1990. This reduces the impact of factors such as technological advancements and their weighting in the inflation calculation, both of which tend to lower headline inflation. On the other hand, it increases the influence of education and/or food prices.

If we consider the methodology used until 1990, the real inflation in 2022 was above double digits and currently stands close to 8%, approximately twice the figure declared by the Bureau of Labor Statistics. Do you still think prices have only increased 3% in the last 12 months (figure 3)?

Efficient markets = economic vulnerability

The Wall Street markets are an efficient marketplace with millions buying and selling in seconds, making it very difficult to “beat” the market. Without sophisticated technology or insider knowledge, individual traders have zero market advantage.

The markets are also vulnerable to global factors beyond our control. The news cycle can send shockwaves in minutes, and fear, greed, and crowd mentality can cause dramatic market swings with little basis in investment fundamentals.

Do you really want your future tied to something you have such little control over?

Most advisors encourage practitioners to follow the same path as they did 50 years ago, even though market realities have dramatically changed. We have seen the results of this approach; an increasing number of dentists are faced with economic uncertainty, the possibility of inflation reducing their real yields and threatening the purchasing power of their dollars in retirement.

A change in strategy is necessary. This involves a different plan that prioritizes translating equity into cash flow (insulated from market volatility with capital preservation), cash flow generation, and buying back time.

A return to merit-based investing

In a growth market, the rising tide lifts all boats. Many have invested according to the greater fool theory—i.e., buying in the hope that someone will be willing to pay even more in the future. But what happens in an era of limited growth, stagnation, or correction? When markets correct, they fall hard.

It’s time to return to merit-based investing, or investing in assets that have fundamental value, generate real profit, and are thus insulated from financial market volatility. It requires skill, effort, and intention. Start by identifying assets that turn your equity into reliable, sustainable, and sufficient cash flow. Divest your performance from indices and invest in real, tangible assets for a sustainable cash flow that frees you from the constraints of typical investment advice.

The case for real (hard) assets

Owning a business as an asset offers the highest degree of control. Rely on real, concrete profits that your business generates. You can adapt to changing economic conditions, pivot your strategies, and seek new opportunities, providing a resilience that’s hard to match with other investment forms. At some point, however, the next stage in the progression of economic freedom is to take the profits from your business and redeploy them into assets that produce cash flow and require less time to operate (such as real estate).

Invest in cash flow-producing assets that produce consistent cash flow streams and a hedge against inflation. It isn’t necessary to become a landlord or build a rental property portfolio (a second job) to enjoy the benefits of investing in tangible assets. It is critical to select a method that aligns with where we are in the market cycle and one that minimizes your commitment of time (trading one job for another). Now is a hazardous stage of the cycle in which to invest in traditional equity forms of real estate (rental properties, most multifamily or commercial syndications, etc.—all are susceptible to reduced profits in an overvalued and high-interest rate environment). However, investing in private credit secured by real estate (i.e., “being the bank”) can reduce investor risk exposure and provide more predictability in cash flow.

The key = relationships and access

Investing in real estate is about people, where building and maintaining strong relationships can be the difference between success and failure. Being a successful, passive investor involves meticulous planning, understanding your financial goals, risk tolerance and investment criteria, and working with trusted partners. These partners can provide insider knowledge, access to off-market deals, and firsthand advice on specific markets or property types, helping you navigate potential pitfalls and significantly reducing the time and money required to succeed. Remember, your network is your net worth.

Find guides

Sustainable success as a full-cycle investor comes from shifting and adapting through all market-cycle stages. Beware of relying on one model. Just because an operator is skilled in a particular expertise (multifamily, commercial, private lending/notes, etc.) doesn’t mean that asset is the right one for where the markets are headed.

Passive investors must develop a network of relationships that allows them to shift their investments as needed through each stage of the market cycle. This requires specific skill sets and an understanding of the market’s direction.

Be a contrarian

This advice is at odds with financial advisors who have a financial interest in maintaining the status quo and are slow to adapt to the realities of this new era. The result will be fewer choices, less peace of mind, and increased dependence on trading time for dollars for longer than desired.

With the right skill sets and strategy, it is possible to sustain and grow your wealth in every stage of the market cycle. High-income professionals should invest the effort to educate themselves and become knowledgeable about their options for controlling their financial future, and then act accordingly.

Editor's note: This article appeared in the February 2024 print edition of Dental Economics magazine. Dentists in North America are eligible for a complimentary print subscription. Sign up here.

References

- Burnick M. 1970s flashback: history is starting to rhyme, offering a road map of how to profit. Nasdaq. BofA Research Investment Committee, Bloomberg. November 15, 2022. https://www.nasdaq.com/articles/1970s-flashback%3A-history-is-starting-to-rhyme-offering-a-road-map-of-how-to-profit

- S&P 500 sector break-down fact sheet. S&P Dow Jones Indices. October 4, 2023. https://www.spglobal.com/spdji/en/indices/equity/sp-500/#overview

- Consumer loans: credit cards and other revolving plans, all commercial banks. FRED Economic Data. Updated August 11, 2023. https://fred.stlouisfed.org/series/CCLACBW027SBOG

- Personal saving rate. FRED Economic Data. Updated July 28, 2023. https://fred.stlouisfed.org/series/PSAVERT

- KB Home Reports 2023 first quarter results. KB Home Reports. March 22, 2023. https://investor.kbhome.com/company-news/news-releases/press-release-details/2023/KB-Home-Reports-2023-First-Quarter-Results/default.aspx

- Williams J. Alternate inflation charts. Shadow Government Statistics. May 2023. https://www.shadowstats.com/alternate_data/inflation-charts

When his young daughter was hospitalized with leukemia, David Phelps, DDS, founder of Freedom Founders, was able to turn to his alternative investments, step away from his dental practice, and be by her side. He created the Freedom Founders community in 2012 to help dentists and other professionals take control of their retirement investments to produce passive cash flow, security, and live life on their terms. To contact Dr. Phelps, visit freedomfounders.com.

About the Author

David Phelps, DDS

David Phelps, DDS, founder of Freedom Founders, was able to turn to his alternative investments, step away from his dental practice, and be by the side of his young daughter when she was hospitalized with leukemia. He created the Freedom Founders community in 2012 to help dentists and other professionals take control of their retirement investments to produce passive cash flow, security, and live life on their terms. To contact Dr. Phelps, visit freedomfounders.com.