Whether you’re planning to exit your dental practice in the next two to five years or have not yet decided your exit time, it’s natural to wonder what your business is worth. It is likely your largest asset, regardless of your financial and life situation. Knowing the true value of your practice today will help you not only make better business decisions, but also plan for life after practicing.

Many industries accept rules of thumb, which are used to gain a quick understanding of what businesses might be worth, and the dental industry is no exception. If, like many dentists, you believe the value of your practice is based on a rule of thumb, you’re likely underestimating its value. Rules of thumb are broad guides or principles based on experience or practice rather than theory. Rule of thumb calculations likely do not reflect the true value of a practice. The value is better determined using business valuation best practices.

We found this to be true when our company, Windham Brannon LLC, completed 46 valuations for dental practices in 2019. During the three-year period, an anomaly became evident when comparing the valuations performed by our company to implied values from rules of thumb. In most cases, using a rule of thumb undercut the real value by as little as 64% and as much as 207%.

Articles related to this topic

Understanding EBITDA

Dental practice valuation 101

One of the most frequently referenced rules of thumb for dental practices is 0.6 to 0.8 times (0.6x to 0.8x) revenue. Other commonly cited rules of thumb include 1.0x to 2.0x net income, 3.0x to 4.0x EBIT (earnings before interest and taxes), and 3.0x to 4.0x EBITDA.

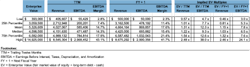

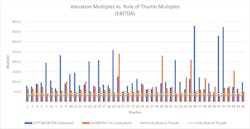

During these valuation assignments, with our method we calculated various multiples based on the independent valuations performed for all 46 practices. We considered each practice’s revenue and EBITDA at two points in time: the most recent trailing 12 months (TTM), since many buyers consider the most recent operations when valuing a business; and the next fiscal year (FY+1), since value is based on future operations and performance. A summary of the valuation multiples and data is included in table 1.

Money left on the table: examining multiples

Revenue multiples: One of the most cited rules of thumb for dental practices is 0.6x to 0.8x revenue, which is where we discovered the greatest discrepancy with the rule of thumb. Of the 46 practices valued, 41 were valued above the 0.8x revenue multiple and 44 above the 0.6x revenue multiple—only two practices fell below the 0.6x revenue multiple. Table 2 compares each practice’s TTM and FY+1 revenue multiples to the 0.6x and 0.8x revenue rule of thumb.

Twenty-seven of the 46 practices had a value of $1 million or greater than the implied value from the 0.8x revenue multiple, resulting in a difference greater than $9.4 million. On average, the value of a dental practice was approximately $2.1 million, or 62% higher using a business appraisal versus the value using the 0.8x rule of thumb multiple. The median difference in value was approximately $1.4 million, or 52% higher. That is quite a bit of money to leave on the table!

EBITDA multiples: Another common valuation multiple is the EBITDA multiple. Many acquisitions of companies, especially in the private equity community, are consummated based on EBITDA multiples. For acquisitions of dental practices, particularly by dental service organizations, it is common to find acquisition multiples ranging from 8.0x to 12.0x EBITDA. These multiples are significantly higher than the rule of thumb of 3.0x to 4.0x EBITDA. Just like the revenue rule of thumb multiples, data from our 46 valuations suggests that the 3.0x to 4.0x EBITDA rule of thumb is likely to undervalue practices. Table 3 compares each practice’s TTM and FY+1 EBITDA multiples to the 3.0x and 4.0x EBITDA rule of thumb.

None of the practice valuations fell below the rule of thumb EBITDA multiple of 4.0x (high end of the rule of thumb range). In fact, the low TTM EBITDA multiple was 4.7x, and 41 practices had a value $1 million or greater than the implied value from the 4.0x EBITDA multiple. The average and median differences in value were approximately $3 million (207%) and $2.8 million (131%), respectively.

True knowledge is true power

Sophisticated buyers of dental practices will rely mostly on multiples as part of their valuation process, which may or may not be based on some rules of thumb, since the buyer is seeking the best deal possible (i.e., pay the lowest price and multiples). The bottom line is that rules of thumb attempt to derive a quick assessment of value, but likely do not capture a true picture of a practice’s value.

Dental practice owners could be leaving millions of dollars on the table if they solely rely on a rule of thumb. That’s why understanding the true value of your practice can help you plan confidently for your retirement and potential sale of your practice. If you have questions about the value of your dental practice, reach out to me, Tom Brooks, Principal at Windham Brannon LLC.

Editor's note: This article appeared in the February 2023 print edition of Dental Economics magazine. Dentists in North America are eligible for a complimentary print subscription. Sign up here.

About the Author

Tom Brooks

For more than 25 years, Tom Brooks has handled valuation and litigation support matters for businesses of all sizes, from start-up companies to companies with more than $1 billion in revenues. He specializes in guiding clients with the valuation of their business, business interests, and intangible assets for mergers and acquisitions, estate planning, strategic planning, shareholder disputes, and commercial litigation. If you are interested in learning more about the potential value of your dental practice, email Tom at [email protected].

Updated October 3, 2023