Hiring a spouse to work for your dental practice: A cost/benefit analysis

Your spouse may be pitching in to help run your dental practice—from the occasional trip to the warehouse club to buy supplies, to answering calls when another staff member is out, to maintaining your computers and countless other tasks—so why not make it official and put your spouse on the payroll?

The argument against having a spouse on the payroll tends to be: why should we lose out on about 16% of FICA and payroll taxes when the compensation added to the doctor’s pay will likely cost only 3.8% in the Medicare portion of the payroll tax? This may be a valid consideration, but it should not be the only consideration. The pros often outweigh the cons.

Business travel with your spouse

Does your spouse travel with you for continuing education courses and other business travel? If he/she is a bona fide employee of the practice and is going on the excursion for a valid business reason, then your spouse’s share of the travel costs would now be a tax-deductible expense. In 2022, that would not only include the cost of the continuing education course but also airfare, lodging, and 100% of the cost of meals.

Saving for retirement

Does your practice have a 401(k) or other qualified retirement plan? A spouse who works enough to be eligible to participate in the retirement plan could have substantial tax benefits, along with helping you save for retirement. For example, if your practice has a 401(k) plan, your spouse could elect to defer up to $20,500 in wages in 2022 ($27,000 if age 50 or over). If your practice has any type of matching contribution, your spouse could benefit from that as well. In turn, the contributions grow on a tax-deferred basis.

Pros and cons of setting a pay rate

If the practice has a match, profit sharing, or other retirement benefit, it only helps make the payroll that much more beneficial. Discussions with your retirement planning administrator can help determine if there are reasons where the pay should be even greater, perhaps, but still reasonable given the services being performed.

If your practice does not have a retirement plan, maybe a yearly pay of at least $6,000 or $7,000 to show that your spouse is a bona fide employee to help support business travel expense deductions would make sense and allow your spouse to make an IRA contribution ($6,000 in 2022, which becomes $7,000 at age 50 or older).

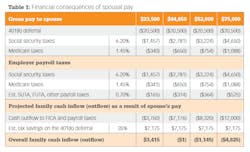

Determining a pay rate can also be a psychological issue. We all want to be appreciated and paid a fair wage, so it’s important to examine the issue as an overall family cost/benefit analysis. Table 1 illustrates the tax consequences of spousal pay at different pay rates and the negative impact of FICA and other payroll taxes, versus the positive benefits of tax savings assuming 35% tax rate and $20,500 elective deferral to a 401(k) and no other retirement plan benefits.

In this chart, we can see that an annual pay of $23,500 results in overall family cash inflow of $3,415, and the further out we go with a $75,000 annual pay, the tax savings on the 401(k) deferral alone is not enough to offset the FICA and payroll taxes (net being a family cash outflow of $4,825). The break-even pay in this case is about $44,850. Working with a retirement plan advisor to see if other tax savings opportunities can be created with your retirement plan could make a significant difference on the pay rate to set.

Ultimately, having your spouse on the payroll for work performed and services rendered could make a lot of financial sense and is something worth exploring.

Editor's note: This article appeared in the March 2022 print edition of Dental Economics. Dentists in North America are eligible for a complimentary print subscription. Sign up here.

About the Author

John Baffo, CPA, CFP

John Baffo, CPA, CFP, is a practicing CPA out of Boston, Massachusetts, who has been working with the dental community for more than 25 years. You can reach him at [email protected].

Updated February 9, 2022