Third-party financing

Are you aware of all the hidden payoffs?

Dental consultants, practice-management articles, and third-party financing advertisements often encourage practices to outsource patient financing. Practices that do this can focus on superior customer service and clinical dentistry. But for doctors, the discount fees paid is the big issue.

There are advantages to not running credit reports, setting up and enforcing payment plans, and making collection calls while avoiding bad-debt write-offs. Few offices efficiently handle payment-plan receivables. Typically, collections take a backseat in the front office and are avoided.

At first a doctor might ask, “Why should I give up a 3 percent, 5 percent, or 10 percent discount (depending on the length of zero-interest payments chosen by the patient) to my regular fee, when my practice can finance and bill patients without paying any discount?”

Practice-management software can handle accounts-receivable billing efficiently while filing electronic insurance claims. Nevertheless, it takes time to set up payment plans, run credit reports, send statements, write past-due notices, and make collection calls. To be effective, the last resort must be small claims court (which would require a practice employee to attend) or a collection service (which would receive a high percentage).

In addition, let’s remember sizable write-offs for dead accounts. These collection efforts cost money, require a motivated and non-procrastinating business assistant, and involve negative patient-practice interactivity. A typical dentist views the payoff as a result of avoiding these expenses and hassles vs. the third party’s discount fee (3 to 10 percent of the transaction). While the aforementioned arguments are typical and important, they do not complete the puzzle.

Third-party financing extends beyond trading staff hassles, billing, and collection costs. Many doctors don’t recognize hidden payoffs or consider them when making decisions.

Quadrant or multi-procedure visits

Include high dollars-per-hour and high dollars-per-visit in your practice goals. Three crowns per visit differ dramatically in efficiency from three crowns in six visits. Think of the administrative cost of booking extra visits, turning the operatories, and dealing with the patient six times vs. twice.

Also, performing three crowns per visit requires substantially less time per crown than performing them separately. Most patients with good jobs can’t even afford that up front. Often, the result is a pay-as-you-go approach - six appointments. Sure, dentists will pay a discount, but look at the decrease of total clinical time, which more than offsets the discount fee. Meanwhile, patients may lose motivation, interest, and even defer treatment if financing is unavailable.

Reduce reschedules, short-notice cancellations, and broken appointments

When patients pay cash as they go, events can change their finances even when they have the best intentions. If an unforeseen financial circumstance pops up, a dental patient will delay the appointment, reschedule with short notice, or become a no-show. Each is an administrative hassle that burns time and stresses business assistants. If an open time results, the practice suffers substantial financial loss. Open time is an economic disaster to a practice. Many lose $25,000 to $50,000 a year in open time.

Patient wants treatment, is motivated, but doesn’t have money up front

Many patients are motivated early, but lose their enthusiasm and follow-through if offices delay or stagger treatment. In addition, they might reject more comprehensive treatment. With up-front financing, dentists can perform treatment early in a clinically efficient manner. Regarding upper-level, comprehensive dentistry acceptance, monthly payment affordability - not sticker shock - rules.

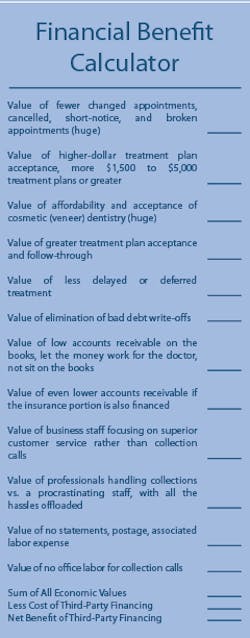

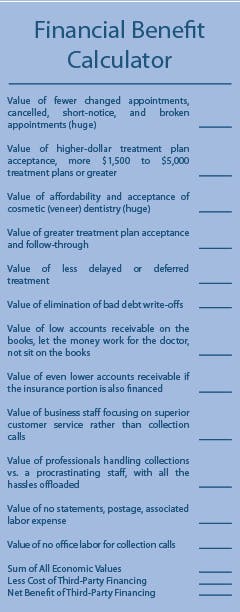

If a doctor doesn’t participate in certain managed-care plans or drops a plan, then the patient receives the insurance check - not the doctor. Then the practice must get the money from the patient. With third-party financing, the doctor gets paid up front, the insurance check goes to the patient, and the patient makes payments to the third party. The practice gets paid and is out of the loop. It’s difficult, if not impossible, to quantify the concrete savings, increased cash flow, and greater profitability of third-party financing. Outlined on page 18 is a financial benefit calculator for third-party financing. Although no specific dollar amounts are assigned for the typical practice, the overall benefits outweigh any associated cost.

Unfortunately, many dentists are cost-based vs. revenue-savvy. The positive economic values in the financial benefit calculator exceed any related cost. With third-party financing, consider the big picture in determining whether to participate. It’s a no-brainer for an analytical dentist.

Charles Blair, DDS, is a contributing editor for Dental Economics®. He is a former practicing dentist who provides consulting services full time to the dental industry with Dr. Charles Blair & Associates, Inc. in Mt. Holly, N.C. A graduate of Erskine College, he earned a doctorate degree at the University of North Carolina at Chapel Hill. Dr. Blair has degrees in accounting, business administration, mathematics, and dental surgery. Order his recently released dental insurance handbook, “Coding with Confidence: The Go-To Guide for CDT-2005,” toll free at (866) 858-7596.