Adjusting your strategies can improve your investments

Harris Gignilliat, CIMA, CRPS

H. Heath Henderson, CFP

“To invest successfully over a lifetime does not require a stratospheric IQ, unusual business insight, or inside information. What’s needed is a sound intellectual framework for decisions and the ability to keep emotions from corroding that framework.” — Warren Buffett1

Why do smart people make dumb decisions with their money? This question, whether spoken or simply thought, is a relative constant in the lives of financial advisors.

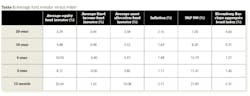

Numerous studies support the prevalence of dumb decision-making. In the 2018 Dalbar Quantitative Analysis of Investor Behavior,2 we learn that during the last 10 years (ending December 31, 2017), the average equity fund investor achieved a 4.88% per annum return, while the S&P 500 index returned 8.5% per annum—a difference of 3.67%. When the time period is extended to 20 years, the gap narrows somewhat to 1.91% (5.29% for average investor versus 7.2% for the S&P 500).2 However, the data continues to support the fact that investors are, on average, “costing” themselves money as opposed to simply holding the index (table 1).

Why is there a disparity in results? Why do we too often act inconsistently with our desired outcome? There are many factors that influence our ability to make decisions, including emotions, experiences, and internal behavioral biases. As investor Warren Buffett states in the introduction quote, if you do not have sound framework for making decisions and keeping your emotions in check, then finding success in investing appears to be reserved for the brilliant or lucky.

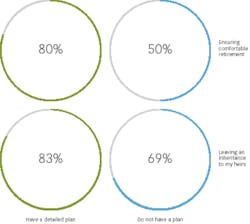

What we’ve learned through the years, and put into practice with numerous dentists across the southeastern United States, is that having an appropriate framework for evaluating investments and making financial decisions can provide clarity and purpose in your financial life. One study conducted by UBS Wealth Management Americas determined that because many millionaires are typically experts in their fields, they are likely to seek experts in other fields, including investing, for help.3 The same report demonstrated that setting specific goals, developing a detailed plan, and mitigating the emotional biases that are present in the markets may lead to a more confident outlook with regard to their financial life (figure 1).

Figure 1: Confidence in ability to achieve goals

The framework in which we subscribe and implement for our clients involves segmenting resources into three strategies: liquidity, longevity, and legacy. Adding this structure to your financial life can help you invest with a greater sense of purpose and reduce your reliance on your emotions when making decisions.

One byproduct of this strategy is that you change your view of risk. Risk is difficult for many in this industry to define, but most often risk refers to the volatility present in a portfolio. When you reframe your resources into the three segments, your management of risk becomes based on your ability to achieve your purposes and goals, not on your performance relative to some arbitrary benchmark.

This framework is not a cure-all for overcoming your emotions, experiences, or behaviors; however, it can provide the support you need during times of stress and uncertainty. By approaching your financial decisions through this lens as opposed to chasing market returns through timing and other behavioral tricks, you optimize your financial decision-making and align your resources with your purpose. This strategy should result in greater confidence in your financial life.

Harris Gignilliat, CIMA, CRPS, is a senior vice president of wealth management and senior institutional consultant at UBS Financial Services Inc., Atlanta, Georgia.

H. Heath Henderson, CFP, is a wealth advisor at UBS Financial Services Inc. Mr. Henderson and Mr. Gignilliat provide wealth management services for the Georgia Dental Association and the Alabama Dental Association.

Author’s note: UBS Financial Services Inc. is not affiliated with the Georgia Dental Association or the Alabama Dental Association. Certified Financial Planner Board of Standards Inc. owns the certification mark CFP, Certified Financial Planner, in the US. CIMA is a registered certification mark of the Investment Management Consultants Association Inc. in the US and worldwide.

For designation disclosures, visit ubs.com/us/en/designation-disclosures. Timeframes may vary. Strategies are subject to individual client goals, objectives, and suitability. This approach is not a promise or guarantee that wealth, or any financial results, can or will be achieved. Any information presented is general in nature and not intended to provide individually tailored investment advice. Investing involves risks and there is always the potential of losing money when you invest. The views expressed herein are those of the authors and may not necessarily reflect the views of UBS Financial Services Inc. In providing wealth management services to clients, we offer both investment advisory and brokerage services, which are separate and distinct and differ in material ways. For information, including the different laws and contracts that govern, visit ubs.com/workingwithus. UBS Financial Services Inc. is a subsidiary of UBS AG. Member FINRA/SIPC.

References

1. Sunder S. Warran Buffett says sell your IQ points; they are of no use in stock market. Financial Express website. https://www.financialexpress.com/market/warren-buffett-says-sell-your-iq-points-they-are-of-no-use-in-stock-market/947022/. Published November 25, 2017. Accessed September 14, 2018.

2. Quantitative Analysis of Investor Behavior. Dalbar website. https://www.dalbar.com/QAIB. Accessed August 29, 2018.

3. UBS Wealth Management, UBS Investor Watch, February 2015.