Turning the dental mirror to disability insurance

A close-up look for clearer understanding

A well-developed plan for disability is essential for a sound dental practice. Whether you’re a sole practitioner or working in a large dental practice, prudent planning requires that you address the unknown and unexpected. The Council of Disability Awareness says that freak accidents are not the primary reason for disabilities; more often back injuries, cancer, heart disease, and other illnesses cause the majority of long-term disabilities.

We wanted to take a closer look at our readers’ views on own-occupation disability income insurance, and wanted to gauge the level of understanding and preferences among dentists in terms of their disability coverage. In December 2010, we surveyed nearly 400 readers who provided meaningful insight into this very important topic.

This article looks at the key findings of the survey and what can be learned from them.

“It won’t happen to me”

Dentists seem to have an “it won’t happen to me” attitude when it comes to becoming disabled, and therefore underestimate their likelihood of becoming disabled. In the survey, only about one in 10 felt there was a high likelihood, despite the fact that according to the Social Security

Administration, three out of 10 people entering the workforce today will become disabled and have to stop working prematurely. And, as Dental Economics® reported in February 2010, dentists may be even more susceptible than the general population. The simple fact is that no one can control whether they become disabled, so the best thing to do is be prepared for all scenarios.

Despite underestimating the likelihood, dentists have taken steps to address this need. The research showed that 8 in 10 own some kind of policy, and three-quarters agree it is important to be protected. Respondents who did not own a policy most often stated that it was because they could not afford it, or that they were willing to risk the possibility of becoming disabled without any coverage.

But perhaps another way to look at this is to ask yourself: Can you afford NOT to have DI? Not everyone has a six-figure income or a six-figure investment account. But everyone can benefit from the protection afforded by a disability income policy.

Understanding partial vs. total disability

One of the most fundamental components of any disability policy is the definition of “total” and “partial” disability. These definitions are used to determine the benefits you receive if you go on to make a claim and the requirements to receive those benefits. Our research revealed a startling misconception; less than half of the respondents could correctly identify the typical definition of total disability.

There was slightly greater understanding in terms of partial disability (69%), but it still paints a concerning picture. It is important that the policy owner understands what it means to be totally disabled and partially disabled. It is not something to be learned later, when the policy owner could be surprised at the time of claim.

Consider the possibility of developing a “tremor,” identified as a specific disability in the research. Fifty percent said this condition would result in a partial disability, and 48% percent thought it would result in a total disability. Which is correct?

The reality is that it depends on the duties of the dentist at the time prior to a disability. If a dentist suffered from a tremor of the hand, for instance, he or she may be prevented from performing dental surgery or certain other procedures; however, it is not likely to prevent the practitioner from doing other usual duties, such as patient consultation, administration, or supervision of other dental staff or hygienists.

If the dentist can still perform these other duties, there is a good chance he or she would be considered partially disabled, despite the fact that the dentist can no longer perform procedures. One might say that the likelihood of being partially disabled increases with the number of duties performed as part of the job.

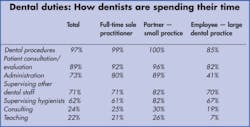

In fact, the research shows that most dentists perform a range of duties as part of their day-to-day job. For example, nearly 97% of our practitioners are performing procedures. In addition, 89% also conduct patient consultation/evaluation, 72% spend time on administration, and 70% supervise other dental staff.

What is important to note here is that each individual situation is unique. It is not necessarily true that if a dental professional has a hand tremor, he or she would be totally disabled. It depends on many factors about the individual and his or her specific employment and duties prior to a disability.

“Own occupation” and “medical occupation”

Research conducted in 2008 revealed misperceptions among medical professionals about how the own occupation disability insurance product works and what it means to be “totally disabled.” In addition, it was clear from the findings that medical professionals are most interested in protecting the “duties that matter most,” as in earn the most income.

Based on this feedback, one company, the Northwestern Mutual Life Insurance Company in Milwaukee, Wisconsin, has developed the Medical Occupation Definition of total disability. The only definition of its kind in the industry, it was designed specifically for — and with input from — the medical professionals it impacts.

The Medical Occupation Definition differs from typical “own occupation” and “own specialty” definitions because it provides medical professionals, in certain situations, the flexibility to choose between continuing to work and receiving a partial benefit, or not working at all and receiving full benefits.

This is an important difference because “own occupation” and “own specialty” policies being sold today require someone who is partially disabled to continue working in order to receive any benefits.

“What does this mean for me?”

The most important thing is to educate yourself about disability income insurance. Know your options, and take the time to find a disability policy that fits your needs. Be sure that you understand the implications of the policy you choose to purchase.

We know it’s important to you. Our research found that nearly all (95%) believe it is important to be financially protected in the event of a disability; yet only 72% are confident of their protection. This number drops to 48% for those who do not own disability insurance. You have invested much time, energy, and money into a career. A DI policy purchase is protection on that investment to help guard financially if an injury or illness out of your control were to make it impossible for you to earn a living in that career.

Working with an insurance company

If you don’t own a DI policy or would like to learn more, one of the first steps is determining from which carrier you would like to make a purchase. But there are many choices, so how do you narrow them down? We found in our research that the most important aspects that dentists seek in a DI carrier are the highest possible financial strength ratings (89%), well-known reputation among dentists (78%), and local representatives that work with other dentists (69%).

For those of you who already own this coverage, it is important to re-evaluate your policy regularly to ensure that you have the coverage you need, and that you understand the details of your policy.

Particularly as things change in your career — for instance, if your duties change, your income increases, or you move from a sole practitioner to an employee of a large dental practice — take a second look at that policy to ensure you are not surprised at the time of claim.

And perhaps the best advice is to decide you are not going to make these important decisions without the help of an expert on the matter, someone you can trust. Your financial professional is there to help you down the road to long-term financial security, and will also soften the bumps along the way.

For more on this topic, go to www.dentaleconomics.com and search using the following key words: DE Special Report, disability insurance, freak accident, partial vs. total disability.